Premium Only Content

ETF Ideas

Claim your Moomoo welcome rewards https://j.moomoo.com/01Iik6

Gate.io Crypto exchange, Web3, NFT, Defi

https://www.gate.io/ref/X1NDAVk?ref_type=102

OKX Crypto exchange and Wallet

https://okx.com/join/9458250

Bridget, enjoy the crypto trading joiner together.

https://bit.ly/3Bx99Mn

Enjoy the sharing ideas and earning

https://rumble.com/register/themarkets

Check out https://linktr.ee/thecapmarkets for complete coverage along with all the latest financial news and data!

#etf #bitcoin #trump #tesls

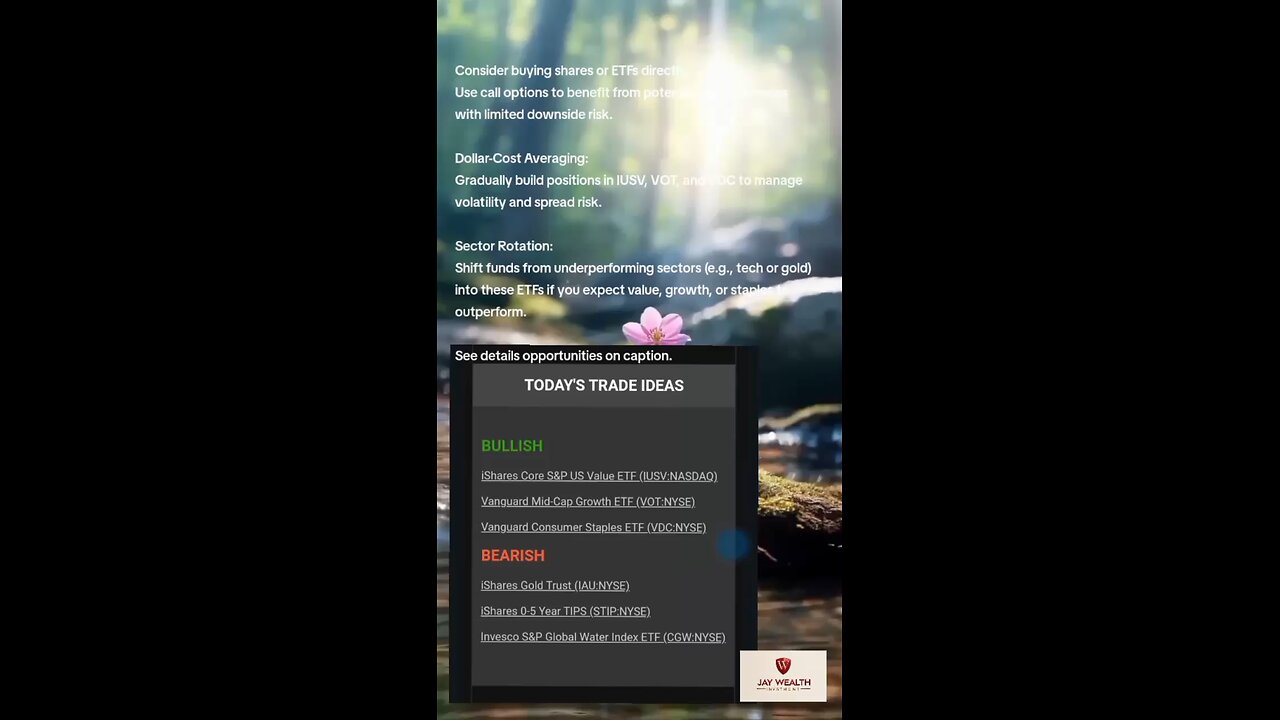

The list divides bullish and bearish trade ideas, reflecting market sentiment or expectations for these ETFs. Here's an analysis and potential strategies:

---

Analysis

Bullish ETFs:

1. iShares Core S&P US Value ETF (IUSV:NASDAQ)

Focused on large-cap U.S. value stocks, likely benefiting from a rotation into value over growth. These stocks may perform well in an environment of moderate inflation or improving economic conditions.

2. Vanguard Mid-Cap Growth ETF (VOT:NYSE)

Targets mid-cap growth stocks, which can excel during periods of innovation, strong earnings growth, or positive investor sentiment.

3. Vanguard Consumer Staples ETF (VDC:NYSE)

A defensive sector, suggesting optimism about consistent consumer demand even during uncertain times (e.g., inflation or economic slowdown).

Bearish ETFs:

1. iShares Gold Trust (IAU:NYSE)

Bearish sentiment could suggest rising interest rates, reducing gold’s appeal (as it doesn’t generate yield). A strong dollar could also put pressure on gold prices.

2. iShares 0-5 Year TIPS (STIP:NYSE)

TIPS (Treasury Inflation-Protected Securities) are defensive and inflation-linked. A bearish outlook here suggests expectations for moderating inflation or better performance in equities/bonds.

3. Invesco S&P Global Water Index ETF (CGW:NYSE)

Focused on water-related industries, bearish sentiment could reflect concerns about valuation, demand shifts, or interest rate pressures on infrastructure investments.

---

Recommended Strategy

For Bullish ETFs:

Long Positions:

Consider buying shares or ETFs directly.

Use call options to benefit from potential price increases with limited downside risk.

Dollar-Cost Averaging:

Gradually build positions in IUSV, VOT, and VDC to manage volatility and spread risk.

Sector Rotation:

Shift funds from underperforming sectors (e.g., tech or gold) into these ETFs if you expect value, growth, or staples to outperform.

---

For Bearish ETFs:

Short Selling:

Consider shorting IAU, STIP, and CGW if you’re confident in the bearish sentiment.

Use put options to hedge risk while betting on price declines.

Hedge Portfolio Risks:

If you hold positions in these ETFs, use stop-loss orders or protective puts to limit downside.

Rotate Funds:

Reallocate funds into higher-yielding assets or bullish opportunities to take advantage of the expected decline in these ETFs.

---

Risk Management Tips:

1. Diversify: Avoid concentrating your portfolio in one sector or theme.

2. Monitor: Keep track of economic indicators (inflation, interest rates, and GDP growth) to validate assumptions.

3. Adjust: Be ready to revise strategies if market sentiment shifts unexpectedly.

-

LIVE

LIVE

Boxin

1 hour agoGrounded! Part 6

73 watching -

LIVE

LIVE

TheBoyDevv

7 hours agoSNAKE BEATER?!🐍 | METAL GEAR SOLID Δ: SNAKE EATER GAMEPLAY ❗| I APPRECIATE YOU💙

433 watching -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

319 watching -

4:30:47

4:30:47

BigN1ck

4 hours agoPhasmo and chill

33 -

10:03

10:03

The Pascal Show

21 hours ago $6.01 earnedNEW STATEMENT! D.A. Breaks Silence Since Emmanuel Haro Presser... Trying To Shut Up Social Media?!

20.3K5 -

LIVE

LIVE

LethalPnda

1 hour ago🔫 "Bullets, Bad Decisions & Farlight 84" I @Mystivis

49 watching -

21:22

21:22

GritsGG

16 hours agoPlugged in MnK on Warzone & We Hit Shots!

171K5 -

1:23:30

1:23:30

TruthStream with Joe and Scott

2 days agoJaime Harlow is back! #483

16.8K21 -

1:32

1:32

Gaming on Rumble

2 days agoWhat is the Rumble Creator Program?!?! | Lvl UP

65.8K4 -

10:34:09

10:34:09

Rallied

16 hours ago $20.89 earnedSolo Challenges ALL DAY

266K9