Premium Only Content

CBDCs and Digital Payments: The Future of Finance or a Threat to Freedom

India is leading the way in digitalization, particularly in the areas of digital payments and public digital infrastructure. Central Bank Digital Currencies (CBDCs) are seen as the future of global currencies, and countries are encouraged to work towards their development and implementation. At the same time, traditional paper currency is expected to remain as a backup in case of technological failures or crises.

India has already achieved remarkable progress in digital payments, processing over 10 billion transactions per month through its Unified Payments Interface (UPI) system. CBDCs are regarded as essential tools to enhance financial inclusion, promote innovation, and improve economic efficiency.

However, concerns have been raised about emerging forms of digital currencies, such as stablecoins and cryptocurrencies. These technologies pose potential threats to domestic and global financial stability, risk undermining central banks' control over monetary systems, and may facilitate illegal activities like money laundering and terrorism financing.

While acknowledging the innovations brought by these technologies, caution is advised. A thorough understanding of the risks and consequences is considered crucial before granting legitimacy to such financial products.

-

3:18

3:18

FIGHT FOR FREEDOM AND TRUTH!

16 days agoLISTA EPSTEIN: UNA BOMBA TERMONUCLEARE

24 -

LIVE

LIVE

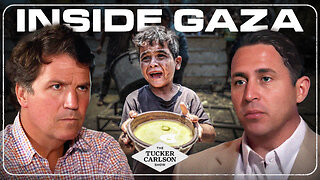

Tucker Carlson

1 hour agoTony Aguilar Details the War Crimes He’s Witnessing in Gaza

4,644 watching -

LIVE

LIVE

Badlands Media

4 hours agoBadlands Daily: July 31, 2025

2,958 watching -

LIVE

LIVE

Matt Kohrs

11 hours agoHUGE Earnings Beat, Inflation Data & New Record Highs || Live Trading Options & Futures

634 watching -

19:44

19:44

Bearing

2 hours agoWorld’s CRAZIEST Feminist Wants AMERICANS to WAKE THE F*** UP 🦅💥

44120 -

LIVE

LIVE

Randi Hipper

38 minutes agoUNITED STATES BITCOIN RESERVE IS COMING! WHITE HOUSE CRYPTO REPORT EXPLAINED

100 watching -

LIVE

LIVE

Wendy Bell Radio

6 hours agoBurn Baby Burn

8,059 watching -

LIVE

LIVE

JuicyJohns

2 hours ago $0.63 earned🟢#1 REBIRTH PLAYER 10.2+ KD🟢$500 GIVEAWAY SATURDAY!

144 watching -

LIVE

LIVE

LFA TV

12 hours agoLFA TV ALL DAY STREAM - THURSDAY 7/31/25

4,150 watching -

1:02:45

1:02:45

Game On!

18 hours ago $2.56 earnedFootball is BACK! NFL Hall of Fame Game 2025

17.3K2