Premium Only Content

Add Asset Filtering, Normalized Log Returns (y), and Advanced Technical Analysis Indicators

This updated Python script now applies a refined filtering process to remove unstable or unwanted crypto assets before conducting any price analysis. It then calculates a normalized y value using the logarithmic percentage change of closing prices, allowing for a more nuanced representation of market movements. On top of that, it integrates advanced technical indicators—such as moving average crosses, RSI, KDJ, and MACD structures—using talib and polars for efficient, CPU-parallelized computations. The careful handling of numeric conversions, data cleansing, and error avoidance (like preventing division-by-zero) ensures that the resulting dataset is both high-quality and analysis-ready for deeper quantitative strategies.

https://github.com/PythonCryptoDev369/trade/blob/1c1ce9f058eb81e7cccb24b34873d7f3f9f96906/trade.py

BTC -> bc1qm9f4qt0fvmf08x9fq7kaw0jm9p470cvhvv9amj

ETH -> 0x168973848BC0f159f0cac1313564176002e4d93D

XRP -> rsCmjwyXKg4QjLFwKcNUnyc7nCr6m6ti22

-

LIVE

LIVE

2 MIKES LIVE

1 hour ago2 MIKES LIVE #158 Government Shutdown Looms and Games!

261 watching -

LIVE

LIVE

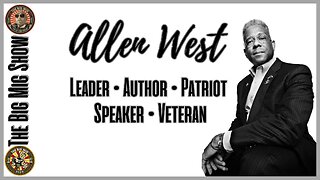

The Big Mig™

5 hours agoVeteran, Patriot, Leader, Author Allen West joins The Big Mig Show

1,248 watching -

LIVE

LIVE

The Amber May Show

21 hours agoBloated CR Failed | What Did The View Say Now? | Who Kept Their Job At ABC| Isaac Hayes

123 watching -

59:29

59:29

State of the Second Podcast

4 days agoAre We Losing the Fight for Gun Rights? (ft. XTech)

6.03K3 -

1:00:10

1:00:10

The Nima Yamini Show

2 hours agoTragedy in Germany 🇩🇪 Suspected Terror Attack at Christmas Market – LIVE Updates from Germany

15K18 -

10:52

10:52

Evenout

2 hours ago $0.45 earnedTIME TRAVELLING ON THE ESCALATOR TWIN PRANK!

6.31K2 -

5:43:44

5:43:44

Scammer Payback

7 hours agoCalling Scammers Live

78.4K12 -

LIVE

LIVE

Barry Cunningham

4 hours agoWATCH LIVE: James O'Keefe, Gen. Michael Flynn,, Byron Donalds, PBD & More At AmericaFest!

844 watching -

2:00:10

2:00:10

Twins Pod

7 hours agoYouth Pastor Confronts People Possessed By DEMONS! | Twins Pod - Episode 44 - Drew Hernandez

44.5K12 -

1:37:40

1:37:40

The Quartering

7 hours agoShutdown Watch, Biden Dementia Bombshell, Madison Shooter Had An Accomplice & Much More!

83.5K36