Premium Only Content

Planning Generational Wealth

To plan for generational wealth effectively, here are some structured tips, including banking and planning advice:

1. Establish Clear Financial Goals

Define what generational wealth means for your family.

Create both short-term and long-term financial plans.

2. Invest Wisely

Diversify investments in areas like real estate, stocks, bonds, and business ventures.

Focus on assets that appreciate over time and provide passive income.

3. Educate the Next Generation

Share financial literacy with family members to ensure the wealth is preserved.

Teach them about savings, investments, and responsible spending.

4. Set Up Trusts and Foundations

Consider trusts to manage and protect your assets for future generations.

Establish family foundations for philanthropic purposes, reinforcing family values.

5. Banking Strategies

Choose banks that offer wealth management services and a history of security.

Open separate accounts for personal savings, investments, and business activities.

Maintain records of all transactions to ensure transparency and accountability.

6. Tax Planning

Consult tax professionals to minimize tax burdens on inheritance.

Learn about tax-advantaged accounts and charitable deductions.

7. Prepare a Business Plan

If wealth is tied to a business, ensure it has a succession plan.

Leverage experts in the Seeds of Wisdom Team’s Planning Room for guidance.

8. Legal Safeguards

Draft wills, estate plans, and legal documents outlining your wishes.

Regularly review and update these documents with professional advice.

9. Emergency and Risk Management

Have insurance to protect assets against unforeseen events.

Keep a portion of wealth liquid for emergencies.

10. Engage with the Seeds of Wisdom Team

Visit the Seeds of Wisdom Team website for resources on planning.

Use the Telegram planning room to ask questions, exchange ideas, and get expert advice on business plans and generational wealth.

-

8:15

8:15

Currency Facts Seeds of Wisdom Team

2 days agoCurrency Fact You Need to Know

581 -

1:50:39

1:50:39

Kim Iversen

10 hours agoShocking Proposal: Elon Musk for Speaker of the House?! | IDF Soldiers Reveal Atrocities—'Everyone Is a Terrorist'

73.9K162 -

43:27

43:27

barstoolsports

13 hours agoOld Dog Bites Back | Surviving Barstool S4 Ep. 9

125K3 -

5:13:04

5:13:04

Right Side Broadcasting Network

7 days agoLIVE REPLAY: TPUSA's America Fest Conference: Day One - 12/19/24

178K28 -

1:06:01

1:06:01

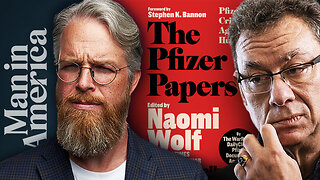

Man in America

1 day agoPfizer Has Been Caught RED HANDED w/ Dr. Chris Flowers

56.9K15 -

2:24:15

2:24:15

Slightly Offensive

11 hours ago $17.85 earnedAttempted ASSASSINATION of Nick J Fuentes LEAVES 1 DEAD! | Guest: Mel K & Breanna Morello

49.9K43 -

1:43:08

1:43:08

Roseanne Barr

10 hours ago $28.29 earned"Ain't Nobody Good" with Jesse Lee Peterson | The Roseanne Barr Podcast #79

81.8K49 -

The StoneZONE with Roger Stone

7 hours agoTrump Should Sue Billionaire Governor JB Pritzker for Calling Him a Rapist | The StoneZONE

51.6K5 -

1:36:58

1:36:58

Flyover Conservatives

1 day agoAmerica’s Psychiatrist Speaks Out: Are We Greenlighting Violence? - Dr. Carole Lieberman | FOC Show

34.9K6 -

6:44:54

6:44:54

LittleSaltyBear

9 hours ago $3.20 earnedNecromancing Path of Exile 2 4K

30.5K4