Premium Only Content

Maximize Your Savings: Essential IRS Deductions for Lower Taxes

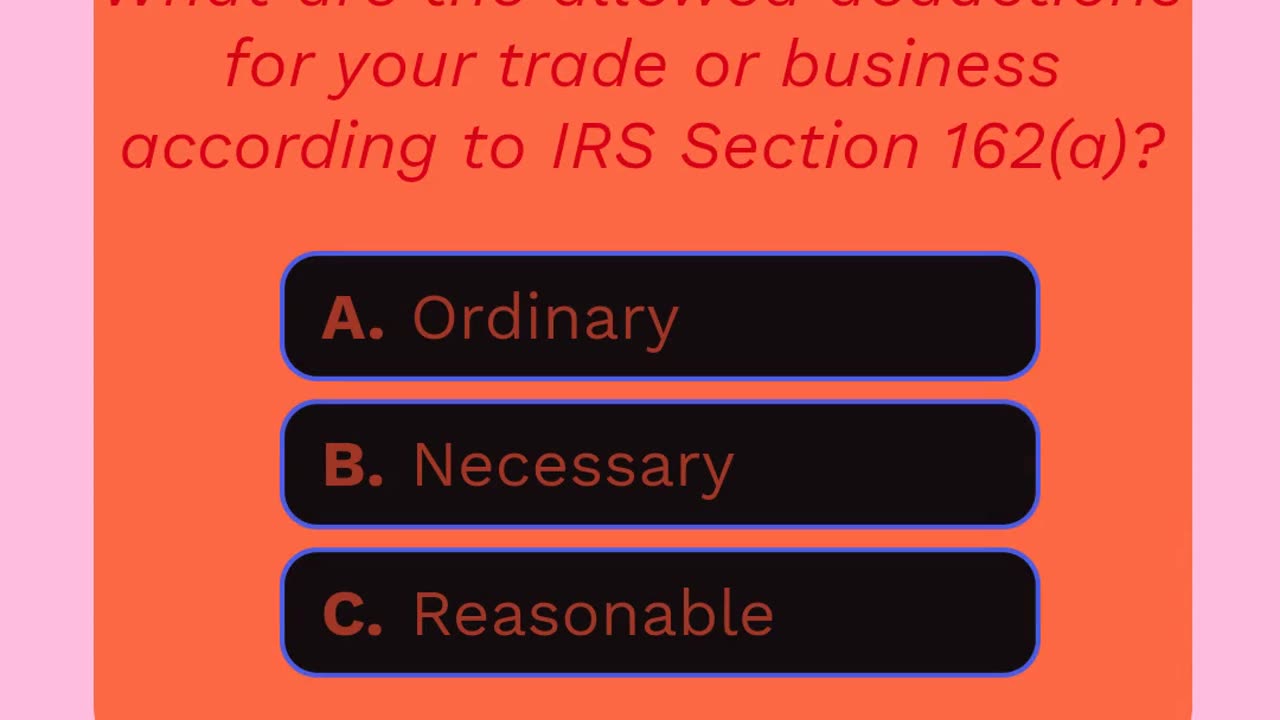

🚨All of the above🚨🎄Dear Hustler🫰🏾💰,

Dive into the benefits:

✔️Itemize expenses to lower your taxable income

✍️Request a tax plan consultation AND get your tax return prepared with Hearth Business📎Click here: linktr.ee/HearthBusiness #TaxTips #BusinessSuccess #HearthBusiness #CreativeSolutions

Alt-Text: linkr.ee/HearthBusiness A visually engaging quiz graphic with vibrant colors and dynamic animations The title "Quiz Time" is displayed in bold pastel pink text at the top center Below that a centered question reads: "What are the allowed deductions for your trade or business according to IRS Section 162(a)?" in italicized red text with three response options labeled "A. Ordinary B. Necessary C. Reasonable" 2nd frame The title "All of the above." is prominently displayed in large bold red font at the top center Below it two smaller sections of text in dark gray font explain tax-related benefits The first reads "You can itemize the expenses you incur for your trade or business and lower your taxable income." The second states "Get a tax plan consultation with Hearth Business and you can request for your tax return to be prepared also." At the bottom the link "linktr.ee/HearthBusiness" appears in bold red font below the link there is a logo for Hearth Business.

#HBFinancial #30DaysofContent #SummerComeBack #TaxPlanning #TaxSeason #HearthBusiness #IRSUpdates #shorts🎄🫰🏾💰💸 🤔💡💪✨💼🚨 All of the above Maximize Your Savings Essential IRS Deductions for Lower Taxes All of the above Maximize Savings Essential IRS Deductions Lower Taxes Itemize Expenses Taxable Income Tax Plan Consultation Return Preparation Hearth Business Tips Success Creative Solutions Quiz Time Section 162 Ordinary Necessary Reasonable Benefits Planning Financial Strategies Small Support Freelancers Contractors Dynamic Timeless Inquisitive Nature Trusted Advice ROI Efficient Growth Personalized Simplified Finance Expert Guidance Entrepreneur Expertise Linktree link tree Optimization Deduction Assistance Smart Investments Wellness Reduction Wealth Building Clarity Cost Efficiency Expense Management Client Professional Help Relief EITC Your with Earned Credit 2024 Credits Claim Child No Kids Reserve Spot Refund Filing Eligibility Made Easy Secure Online Earn Money Back Optimize Guidelines Calculator Boost Single Filers Deadline Experts Refunds Dependents Claims Prep Maximized Incentives Dear Hustler Top Losing Cash Shocking Truth About Empowerment Leaving On Table Freedom Coins Falling Flowing Growing Do You Leave Take Control Get Holiday Hustlers Goals Coaching Fiscal Responsibility Bag Year-End Owners Side Hustles www Earning Threshold Documents Rules Taxation Code Insights Year-Round Book Now Consult Opportunities Personal Monday Motivation Effortless Plans Accurate Advisors Freelancer Breaks Quick focused Streamlined Health Check 7 2 6 3 9 5 4 Year new happy merry christmas 2025 eve free simple twitch. Linktr.ee/HearthBusiness

-

14:37

14:37

Michael Button

3 days ago $0.44 earnedEvidence For LOST Ancient Civilization is Growing 🤯

4922 -

LIVE

LIVE

Bannons War Room

4 months agoWarRoom Live

15,519 watching -

LIVE

LIVE

The Big Mig™

2 hours agoThe Biden Mush Brain Cover-Up Saga Continues

7,065 watching -

LIVE

LIVE

Badlands Media

7 hours agoBadlands Daily - July 10, 2025

5,221 watching -

1:15:03

1:15:03

Dear America

3 hours agoWhy Is EVERYWHERE Flooding!! + I Am DONE With All Of The LIES!!!

99.8K227 -

2:18:22

2:18:22

Matt Kohrs

10 hours agoMARKETS ARE SET TO SKYROCKET 🚀🚀🚀 || Live Trading Options & Futures

13.9K1 -

LIVE

LIVE

Wendy Bell Radio

6 hours agoTiming Is Everything

8,854 watching -

36:33

36:33

Randi Hipper

1 hour agoBITCOIN HITS NEW ALL TIME HIGHS! LATEST PRICE ACTION

4.51K2 -

28:34

28:34

The Finance Hub

9 hours ago $0.74 earnedBREAKING: NEWT GINGRICH JUST DROPPED A MASSIVE BOMBSHELL!!!

5.54K5 -

1:02:33

1:02:33

The Mike Schwartz Show

2 hours agoTHE MIKE SCHWARTZ SHOW with DR. MICHAEL J SCHWARTZ 07-10-2025

4.1K2