Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

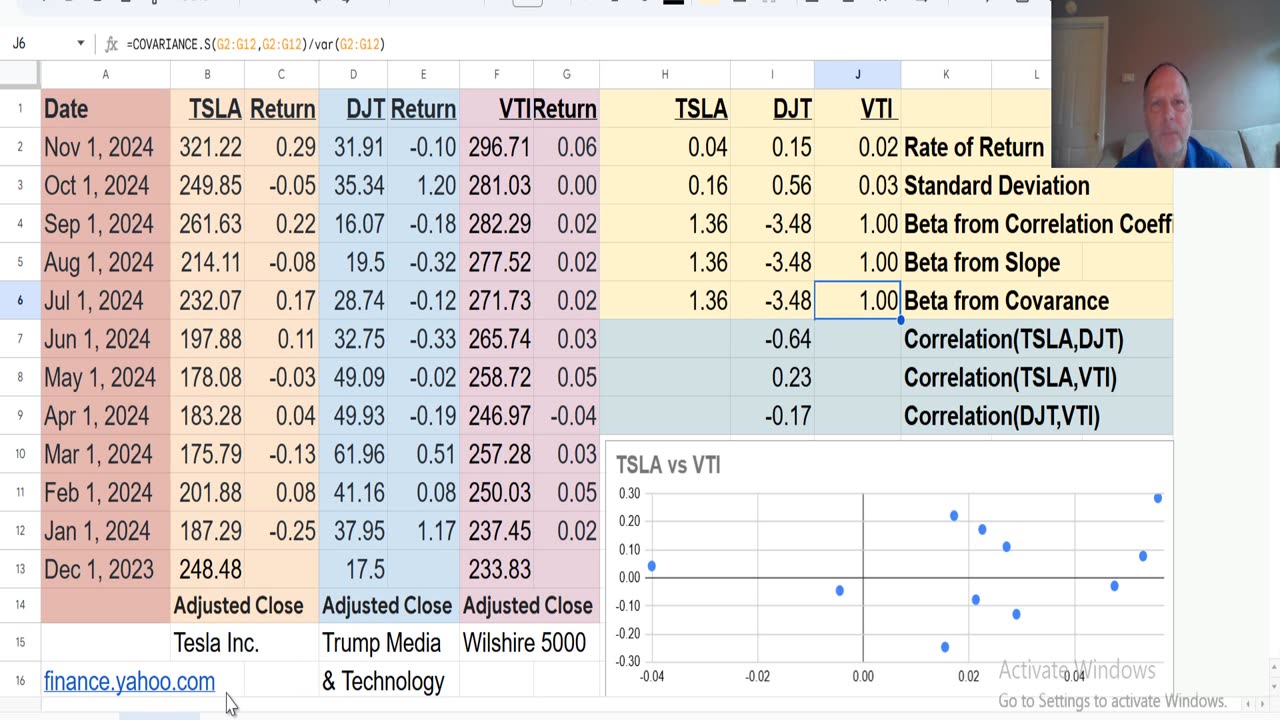

TSLA, DJT, VTI (Standard Deviation, Variance, Correlation, Covariance, and Beta)

10 months ago

27

Finance & Crypto

Brigham

Financial Management

Corporate Finance

Risk and Return

Beta

Covarance

Correlation

Variance

Standard Deviation

VTI

This video uses historic stock data from finance.yahoo.com for Tesla Inc. (TSLA), Trump Media

& Technology Group Corp (DJT), and Vanguard Total Stock Market Index Fund ETF Shares (VTI) to show how to use Excel function to calculate Rate of Return, Variance, Standard Deviation, Correlation, Covariance, and Beta. The Vanguard Total Stock Market Index is a proxy for the Wilshire 5000 which is a broader US stock index than the S&P 500.

The problem is a supplement to the Brigham, Financial Management text chapter on Risk and Return Part 1.

Loading 1 comment...

-

2:52:28

2:52:28

TimcastIRL

6 hours agoSTATE OF EMERGENCY Declared Over Food Stamp CRISIS, Judge Says Trump MUST FUND SNAP | Timcast IRL

221K119 -

3:22:45

3:22:45

Tundra Tactical

12 hours ago $18.00 earned🚨Gun News and Game Night🚨 ATF Form 1 Changes, BRN-180 Gen 3 Issues??, and Battlefield 6 Tonight!

34K2 -

1:45:13

1:45:13

Glenn Greenwald

9 hours agoJD Vance Confronted at Turning Point about Israel and Massie; Stephen Miller’s Wife Screams “Racist” and Threatens Cenk Uygur with Deportation; Rio's Police Massacre: 120 Dead | SYSTEM UPDATE #540

111K154 -

LIVE

LIVE

SpartakusLIVE

6 hours agoSpart Flintstone brings PREHISTORIC DOMINION to REDSEC

419 watching -

1:05:02

1:05:02

BonginoReport

9 hours agoKamala CALLED OUT for “World Class” Deflection - Nightly Scroll w/ Hayley Caronia (Ep.167)

131K75 -

54:36

54:36

MattMorseTV

7 hours ago $25.51 earned🔴The Democrats just SEALED their FATE.🔴

61.2K98 -

8:07:01

8:07:01

Dr Disrespect

14 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - SOLO RAIDING THE GALAXY

145K13 -

1:32:00

1:32:00

Kim Iversen

10 hours agoThe World’s Most “Moral” Army — Kills 40 Kids During "Ceasefire" | Socialism's Coming: The Zohran Mamdani Agenda

114K205 -

1:04:50

1:04:50

TheCrucible

8 hours agoThe Extravaganza! EP: 63 with Guest Co-Host: Rob Noerr (10/30/25)

93.2K8 -

6:36:45

6:36:45

GritsGG

8 hours agoQuads! #1 Most Wins 3880+!

43.2K4