Premium Only Content

Understanding the Different Types of Surety Bonds

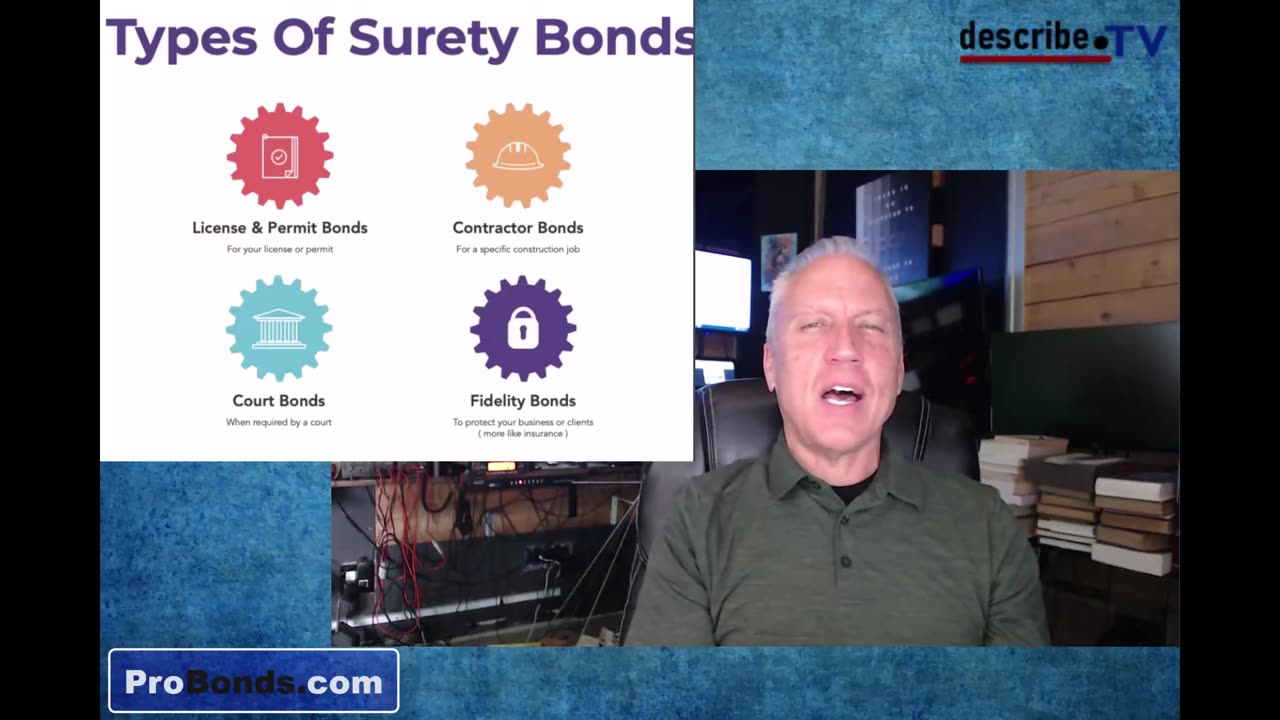

If you’re wondering about the different types of surety bonds, you’re not alone. Many businesses and professionals need to understand which type of bond they might need. Here are the four general types of surety bonds (excluding bail bonds) and how they work:

License and Permit Bonds: These are required by state licensing authorities to ensure that professionals, like accountants or contractors, comply with regulations and protect consumers. If they fail to meet the standards or harm a consumer, the bond helps remedy the situation.

Contractor Bonds: These bonds guarantee that a business or individual will fulfill the terms of a contract. For example, if a company bids to build a bridge and fails to complete the project, the bond helps cover the financial loss for the other party involved in the contract. It applies to all kinds of contractual obligations, including manufacturing, services, or consulting projects.

Court Bonds: If you lose a lawsuit and want to appeal the verdict, the court may require you to post a bond. This bond ensures that the funds for the judgment will be available if the appeal doesn’t succeed.

Fidelity Bonds: These are used to protect against theft, embezzlement, or fraud. Businesses purchase these bonds to assure clients that their employees won’t misuse funds entrusted to them, such as in trust accounts held by attorneys.

Common Thread: All of these bonds serve to protect third parties from potential harm or loss due to your failure to meet your obligations. They guarantee that you will act in good faith, and if not, the bond can be used to cover any damages.

Key Considerations: The cost of a surety bond is typically between 1-3% of the bond amount. For example, securing a $100,000 bond may cost between $1,000-$3,000. The bonding company will evaluate your business history, experience, and background to determine the price and ensure you are trustworthy.

Get a Quote: You can get fast quotes for almost any type of bond on our website at probonds.com.

Remember, surety bonds can sometimes be a requirement, but they are also a great way to build trust and credibility with clients and contractors.

Need Expert Advice? If you have questions about surety bonds or need help navigating the process, you can access live one-on-one consultations with experts in various fields, including private investigators, commercial insurance brokers, real estate title examiners, civil court mediators, and general contractors.

-

4:00:19

4:00:19

The Bubba Army

1 day agoAnother LopSided Jake Paul Fight? - Bubba the Love Sponge® Show | 8/21/25

88.1K1 -

1:02:42

1:02:42

Dialogue works

1 day ago $4.43 earnedJohn Helmer: Trump Ditches Ceasefire? Despite EU & Zelensky Pressure

62.4K22 -

10:48

10:48

Nikko Ortiz

21 hours agoDont Watch These TikToks

94.6K14 -

10:17

10:17

MattMorseTV

20 hours ago $16.59 earnedTrump's DOJ just DROPPED a NUKE.

96.9K103 -

2:09:32

2:09:32

Side Scrollers Podcast

23 hours agoStreamer DIES Live On Air + Your Food is Poison + Xbox Announces $900 Handheld | Side Scrollers Live

51K19 -

15:32

15:32

GritsGG

19 hours agoFull Auto ABR Sniper Support! Most Winning Quad Win Streaking!

36.1K4 -

7:42

7:42

The Pascal Show

18 hours ago $2.39 earnedBREAKING! Police Provide UPDATE In Emmanuel Haro's Case! Is Jake's Lawyer Lying To Us?!

42.5K2 -

2:29:46

2:29:46

FreshandFit

11 hours agoAfter Hours w/ Girls

147K95 -

5:28

5:28

Zach Humphries

17 hours ago $2.84 earnedNEAR PROTCOL AND STELLAR TEAM UP!

42.5K4 -

1:09:57

1:09:57

Brandon Gentile

1 day ago10,000 Hour BITCOIN Expert Reveals Why $13.5M Is Just The Start

40.2K7