Premium Only Content

The Hidden Reality of American Poverty: Trapped in the Illusion of Wealth

America, often hailed as the land of opportunity, masks a harsh reality for millions of its citizens: a system designed to keep them working endlessly while accumulating little to no real wealth. With 60% of Americans living paycheck to paycheck and even half of six-figure earners barely staying afloat, the promise of the “American Dream” has become, for many, an unattainable mirage.

This article delves deeper into the economic trap faced by Americans, exploring systemic flaws, cultural conditioning, and the steps individuals can take to break free from this cycle.

1. The Illusion of Wealth

Living Beyond Means

On the surface, many Americans appear prosperous, driving new cars, living in spacious apartments, and enjoying the latest technology. However, much of this “wealth” is financed by debt:

• Car loans: Americans owe over $1.5 trillion in auto loans, with many paying $500 or more per month for vehicles they don’t own.

• Credit card debt: The average household carries around $6,000 in credit card debt, often at exorbitant interest rates.

• Student loans: Over $1.6 trillion in student loan debt weighs on young professionals, preventing them from building true financial independence.

Consumerism as a Trap

American culture encourages relentless consumption. From the latest smartphones to designer clothes, people are conditioned to equate material possessions with success. The result? A nation of people living paycheck to paycheck, not because they don’t earn enough, but because they are locked in a cycle of earning and spending.

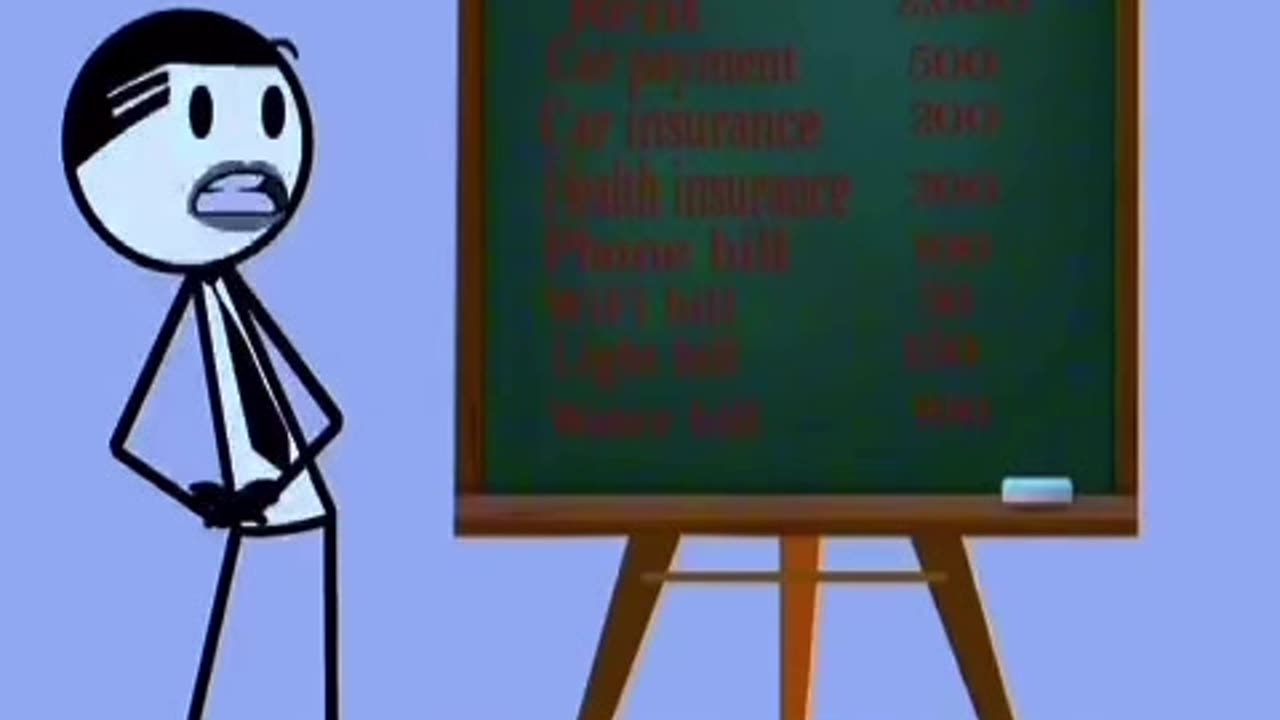

2. The Cost of Simply Existing

The basic cost of living in America is alarmingly high. Even with a seemingly decent salary, essential expenses eat away at most people’s income:

• Housing: In many cities, $2,000 a month for rent is the norm. Homeownership is increasingly out of reach, with median home prices exceeding $400,000.

• Healthcare: With health insurance averaging $200-$500 a month and unexpected medical bills a constant threat, healthcare costs are a significant burden.

• Utilities and Transportation: From $150 for electricity to $500 for car payments and insurance, the costs of maintaining a basic lifestyle are unsustainable for many.

By the time these bills are paid, little is left for savings, investments, or discretionary spending. This isn’t living—it’s survival.

3. Debt: The Modern Form of Servitude

A Lifetime of Indentured Labor

Debt has become a cornerstone of the American economic system. People are encouraged to borrow for education, cars, homes, and even everyday expenses. However, this debt often comes with crushing interest rates and long repayment periods that keep individuals tied to their jobs, unable to escape the cycle of work and repayment.

The Systemic Trap

The U.S. financial system benefits from keeping people in debt. Interest payments fuel banks, credit card companies, and lenders, creating a scenario where the average person spends decades paying into the system without accumulating meaningful wealth.

4. The Cultural Disconnect: Redefining Poverty

In America, poverty is often associated with extreme deprivation—homelessness, unemployment, or a lack of basic necessities. But this definition fails to account for the millions of people who work tirelessly, only to remain in perpetual financial insecurity.

Paycheck-to-Paycheck Living

Living paycheck to paycheck, as 60% of Americans do, means having no financial cushion. Any unexpected expense—a car repair, a medical emergency—can spiral into disaster. Yet, this reality is rarely labeled as poverty.

Comparisons to Other Countries

In countries like Mexico, many people own their homes outright, reducing monthly expenses significantly. The cultural emphasis on frugality and self-sufficiency contrasts sharply with America’s debt-driven consumerism.

5. Why the System Is Designed This Way

Economic Dependence

The U.S. economy relies on constant consumer spending. If Americans stopped buying on credit, the financial system would face collapse. Thus, the system incentivizes debt while discouraging financial independence.

Lack of Safety Nets

Unlike many developed nations, the U.S. offers minimal safety nets for its citizens. High healthcare costs, expensive childcare, and limited retirement options force individuals to work longer and harder just to stay afloat.

6. Breaking Free: Steps Toward Financial Independence

While the system may be stacked against the average person, individuals can take steps to reclaim control:

1. Live Below Your Means

• Reject the culture of overconsumption. Prioritize needs over wants and focus on building savings.

2. Eliminate Debt

• Pay off high-interest debt as quickly as possible. Avoid unnecessary loans and credit card balances.

3. Build an Emergency Fund

• Save at least three to six months’ worth of expenses to protect against unexpected financial shocks.

4. Invest Wisely

• Start small but invest in assets that grow over time, such as index funds or real estate.

5. Advocate for Change

• Push for systemic reforms, such as universal healthcare, affordable housing, and stronger consumer protections, to alleviate the financial burdens on individuals.

7. A Vision for a Better Future

Breaking free from this cycle requires not only individual effort but also systemic change. Imagine a society where:

• Basic needs like healthcare, education, and housing are affordable and accessible.

• Financial literacy is taught in schools, empowering people to make smarter decisions.

• Consumerism is replaced with sustainability, and success is redefined as financial stability and well-being.

This vision may seem distant, but it starts with awareness. By recognizing the traps of debt and consumerism, Americans can begin to reclaim their autonomy and build a more equitable economic future.

Conclusion: Time to Rethink the American Dream

The reality is clear: many Americans are not as wealthy as they believe. Trapped in a system that prioritizes debt and consumption over financial independence, they work tirelessly without ever truly getting ahead.

It’s time to redefine what it means to be “wealthy” in America. True wealth isn’t about owning the latest gadgets or driving the newest car—it’s about freedom: the freedom to live without debt, to save for the future, and to pursue happiness on one’s own terms.

Breaking free from the illusion of wealth requires courage, discipline, and a willingness to challenge societal norms. But for those who take the first step, the reward is a life of genuine security and independence—a dream worth striving for.

-

11:04:44

11:04:44

FusedAegisTV

1 day agoNYE Eve! - 2025 Incoming 🎉 - 12hr Variety Stream!

143K7 -

1:18:52

1:18:52

Awaken With JP

20 hours agoSomehow The World DIDN’T End This Year! - LIES Ep 72

177K93 -

1:19:34

1:19:34

Michael Franzese

18 hours agoWhat 2024 Taught Us About the Future?

139K34 -

1:48:09

1:48:09

The Quartering

19 hours agoBird Flu PANIC, Sam Hyde DESTROYS Elon Musk & Patrick Bet David & Woke Witcher?

144K105 -

4:47

4:47

SLS - Street League Skateboarding

3 days agoLiz Akama’s 2nd Place Finish at SLS Tokyo 2024 | Best Tricks

65.4K6 -

4:06:54

4:06:54

LumpyPotatoX2

18 hours agoHappy New Year Rumble ! - #RumbleGaming

47.9K1 -

10:37

10:37

One Bite Pizza Reviews

1 day agoBest of Barstool Pizza Reviews 2024

72.2K33 -

2:37

2:37

Tate Speech by Andrew Tate

20 hours ago2025 WILL BE YOUR YEAR

125K46 -

3:51:31

3:51:31

Sgtfinesse

21 hours agoRumble New Years Eve with Sarge

70.1K -

13:01:17

13:01:17

Sm0k3m

22 hours agoNew Years Eve | Good bye 2024

55.1K1