Premium Only Content

Choosing the Right Lender Key Tips for Home Loans

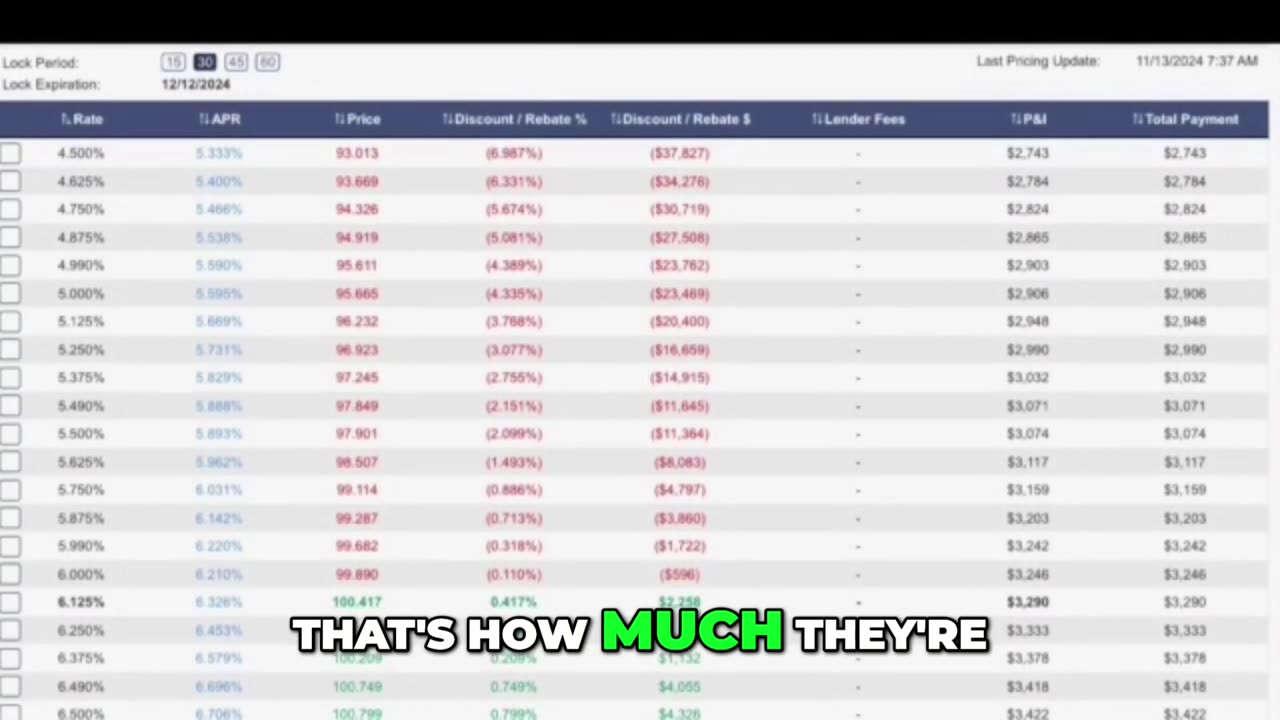

I get this question a lot as a realtor When I'm shopping for a loan What is it that I'm looking for in a lender first things first they're a 247 lender That means that they'll return your text messages and phone calls and emails no matter what time of day or no matter what day of the week it is as long as they're awake and not helping somebody else at that moment right So you want a good responsive relationship You want somebody who doesn't put their phone away and put it in the bedside table for a certain day every week second You want the best product at the best price Well what is the product The product is like everybody else sees and I'm gonna bring up a par sheet here in a minute but the product is the interest rate that is going to be locked in for that 30 year loan right The price is how much money out of pocket do I have to come to closing with So if you're dealing with a company that you're going 0 down VA And they're saying that your cash out of pocket cash to close is going to be 5 or 6 percent of your purchase price That's a red flag Anything over 3 percent of your purchase price is a red flag You can find certain deals at certain times where it's as low as 2 percent out of pocket And can you have the seller pay that Yes if you have the right realtor and they get you the right deal Can you have the lender pay that And that's where the par sheet comes up They bring up this par sheet here So in this part sheet what you can see is that there's green and there's red Where you see the green is the lender the bank the mortgage company They're gonna pay you to take that higher rate Where you see it in red or negative that's how much they're asking for you to pay for that better rate So where you see the 2 right you're looking for the best deal You're looking for that rate with the best credit or that rate with the lowest points Then you can say wait a minute If I take that higher rate and you're going to apply X amount to my to my closing costs let's call it 0 8 percent or one percent right Now that lender is saying if you pay us a higher monthly payment And lock in this 30 year note for the higher monthly payment Then we'll pay that one percent or 0 8 percent or 0 6 percent of your 2 to 3 percent closing cost It's a brilliant way to without even asking the seller and getting their consensus on it it's a brilliant way to get your closing cost paid and it's not even a negotiation tactic

-

34:12

34:12

inspirePlay

1 day ago $5.55 earned🏆 The Grid Championship 2024 – Cass Meyer vs. Kelly Rudney | Epic Battle for Long Drive Glory!

84K8 -

17:50

17:50

BlackDiamondGunsandGear

14 hours ago $2.84 earnedTeach Me How to Build an AR-15

58.3K6 -

9:11

9:11

Space Ice

1 day agoFatman - Greatest Santa Claus Fighting Hitmen Movie Of Mel Gibson's Career - Best Movie Ever

116K47 -

42:38

42:38

Brewzle

1 day agoI Spent Too Much Money Bourbon Hunting In Kentucky

78.7K12 -

1:15:30

1:15:30

World Nomac

22 hours agoMY FIRST DAY BACK in Manila Philippines 🇵🇭

60.9K9 -

13:19

13:19

Dr David Jockers

1 day ago $11.59 earned5 Dangerous Food Ingredients That Drive Inflammation

79.9K17 -

1:05:13

1:05:13

FamilyFriendlyGaming

1 day ago $15.88 earnedCat Quest III Episode 8

130K3 -

10:39

10:39

Cooking with Gruel

2 days agoMastering a Succulent London Broil

83.8K5 -

22:15

22:15

barstoolsports

1 day agoWhite Elephant Sends Barstool Office into Chaos | VIVA TV

59.1K1 -

3:30:40

3:30:40

MrNellyGB

19 hours ago🔴LIVE - GRINDING MARVEL RIVALS RANKED! | #RumbleTakeover #RumblePremium

40.6K1