Premium Only Content

Self-Employed?

I'm not sure if you've come across this tax credit for self-employed individuals including insurance agents, brokers, advisors, etc.

Visit https://bit.ly/3NOZGmg

Plus you can receive your funds in 15-20 days.

This is HUGE for ALL self-employed, 1099, independent contractors, sole proprietors, single person LLC, gig workers, and free-lancers.

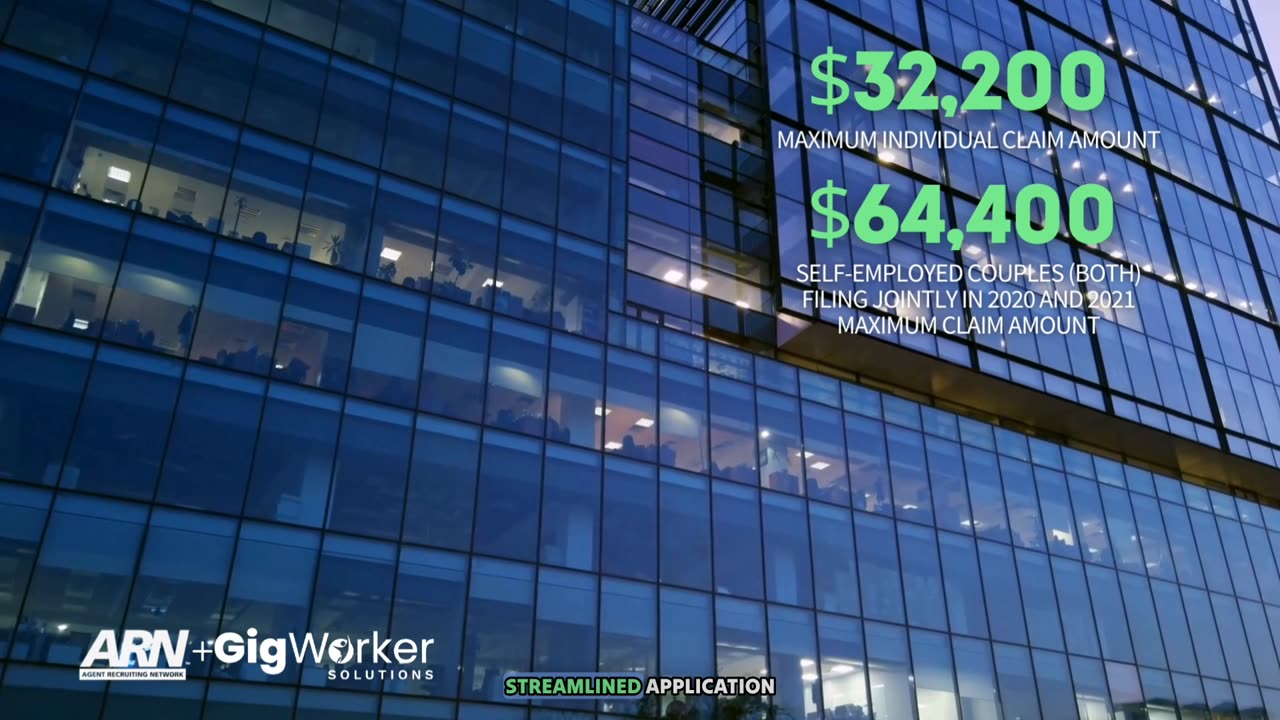

Under the Families First Corona Virus Response Act (FFCRA) and the American Rescue Plan Act (ARPA), the Sick Leave and Family Leave Credit is a specialized tax credit designed to support ALL self-employed individuals from 2020 and/or 2021 who were impacted during the COVID-19 pandemic. The government has set aside hundreds and hundreds of millions in tax credits for self-employed individuals affected by the pandemic. The credit acknowledges that there were unique challenges faced by all those who work for themselves, especially during illness, caregiving responsibilities, quarantine, and related circumstances. The government funded tax-free rebates can be from around $2,000 to a maximum rebate of $32,220 per person. And up to $64,400 for couples both self-employed filing their taxes jointly.

This Online Tax Credit Calculator quickly shows people if they might be eligible. There's an explainer video and additional information as well. Then people can apply online in like 15 minutes to request the refund and receive in 15-20 days.

Don’t let this one get away.

Feel free to share with every self-employed individual you know.

Good luck,

Rob Jeffries

Agent Recruiting Network

#self-employed

-

34:12

34:12

inspirePlay

1 day ago $4.66 earned🏆 The Grid Championship 2024 – Cass Meyer vs. Kelly Rudney | Epic Battle for Long Drive Glory!

65.6K8 -

17:50

17:50

BlackDiamondGunsandGear

10 hours ago $0.24 earnedTeach Me How to Build an AR-15

41.3K4 -

9:11

9:11

Space Ice

1 day agoFatman - Greatest Santa Claus Fighting Hitmen Movie Of Mel Gibson's Career - Best Movie Ever

103K45 -

42:38

42:38

Brewzle

1 day agoI Spent Too Much Money Bourbon Hunting In Kentucky

68.3K12 -

1:15:30

1:15:30

World Nomac

19 hours agoMY FIRST DAY BACK in Manila Philippines 🇵🇭

52K9 -

13:19

13:19

Dr David Jockers

1 day ago $2.14 earned5 Dangerous Food Ingredients That Drive Inflammation

72.2K17 -

1:05:13

1:05:13

FamilyFriendlyGaming

1 day ago $0.46 earnedCat Quest III Episode 8

126K3 -

10:39

10:39

Cooking with Gruel

2 days agoMastering a Succulent London Broil

81.7K5 -

22:15

22:15

barstoolsports

1 day agoWhite Elephant Sends Barstool Office into Chaos | VIVA TV

57.4K1 -

3:30:40

3:30:40

MrNellyGB

16 hours ago🔴LIVE - GRINDING MARVEL RIVALS RANKED! | #RumbleTakeover #RumblePremium

39.4K1