Premium Only Content

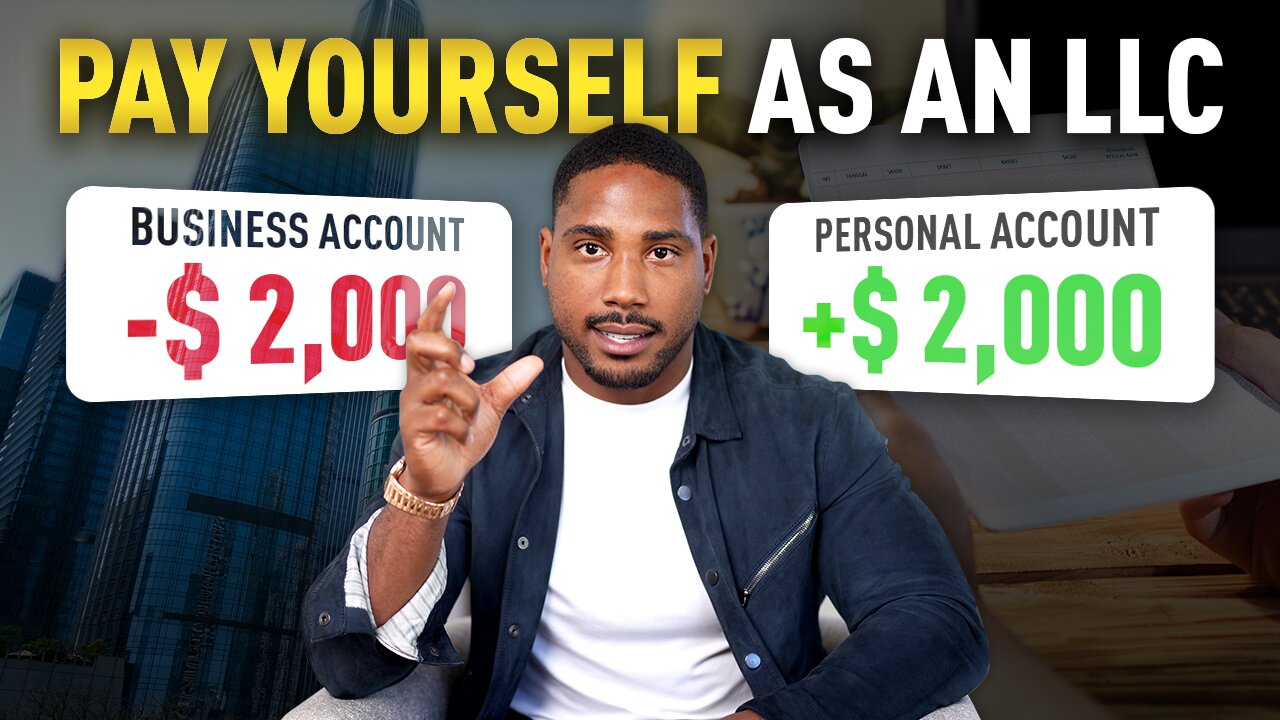

How to Pay Yourself as an LLC in 2025

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube

Cost Segregation Tax Savings Calculator ▶ https://taxalchemy.com/cost-segregation-calculator/

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

It’s one thing to form an LLC and to start making money from a new business; it’s another thing entirely to make sure that you pay yourself correctly from your business. A failure to pay yourself correctly as an LLC can create massive problems for your business. For this reason, all LLC owners need to know how to pay themselves as LLCs in 2025.

In this video, tax expert Karlton Dennis walks you through the process of paying yourself as an LLC. This information is extremely helpful for all LLC owners who want to make sure that they don’t accidentally commingle their personal and business funds. There are a number of key steps that business owners need to know for transferring funds from an LLC.

Karlton walks you through every single step of the process of transferring funds out of an LLC into a personal account after an LLC starts making money. Following all of these steps correctly is critical for making sure that mistakes are not made that get LLCs in trouble with the law. This video is relevant for all LLC owners in 2025.

CHAPTERS:

0:00 Intro

0:39 How to Take Owner's Draws to Pay Yourself as an LLC in 2025

1:54 Step #1: Get an EIN

2:23 Step #2: Set Up Your Business Bank Account

3:11 Step #3: Make Your Owner's Draw

6:09 Case Study for Paying Yourself as an LLC

6:37 Other Tax Information for LLC Owners

7:51 Limited Liability in LLCs

9:30 Subscriber Question!

12:08 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#llc #ownersdraw #taxstrategy

-

9:59

9:59

Karlton Dennis

1 month agoTrump's "Big, Beautiful Bill" | MASSIVE Tax Changes Coming Soon?

461 -

LIVE

LIVE

The Quartering

2 hours agoImminent Threat On US Bases From Iran, Unhinged Mom, Protein Craze In America Guest Marc Lobliner

10,378 watching -

LIVE

LIVE

Right Side Broadcasting Network

2 hours agoLIVE: Iran Fires Missiles at U.S. Bases: Breaking News - 6/23/25

6,847 watching -

1:34:14

1:34:14

Russell Brand

4 hours ago"MIGA!!!" Trump Endorses REGIME CHANGE, as The World BRACES For Iran Response - SF601

129K46 -

LIVE

LIVE

Barry Cunningham

3 hours agoTHE BIGGEST PRESIDENT TRUMP STORY NO ONE IS TALKING ABOUT | PAM BONDI TESTIFIES!

2,058 watching -

LIVE

LIVE

Jeff Ahern

49 minutes agoMonday Madness with Jeff Ahern

130 watching -

2:24:11

2:24:11

The Charlie Kirk Show

3 hours agoIRAN FIRES MISSILES AT U.S. BASE IN QATAR

180K113 -

1:02:30

1:02:30

Sean Unpaved

3 hours agoDurant to H-Town, New Champions Crowned & Operation Midnight Hammer

36.6K -

19:14

19:14

Clownfish TV

10 hours agoCNN is in Hospice! Mainstream Media BEATEN by Social Media!

1.43K3 -

LIVE

LIVE

ROSE UNPLUGGED

32 minutes agoWorld On Edge: Eyes on Iran, China, & Russia

65 watching