Premium Only Content

How Export Factoring Can Improve Your Business Cash Flow

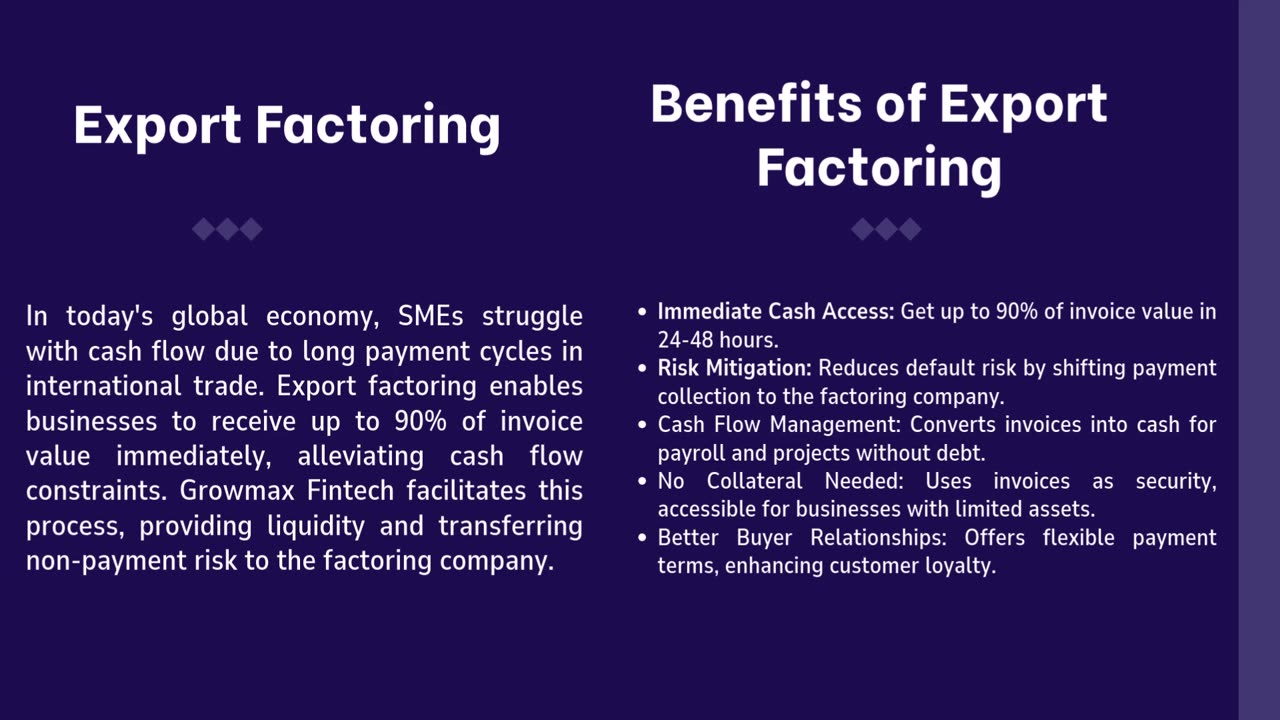

In today’s global economy, SMEs face cash flow challenges due to long payment cycles in international trade. Export factoring offers immediate access to up to 90% of invoice value, providing cash within 24-48 hours instead of waiting up to 120 days. This solution ensures instant working capital and reduces credit risk by shifting payment collection to the factoring company.

Growmax Fintech simplifies the process by connecting exporters with multiple factoring providers for quick comparisons and approvals, requiring no collateral. Additionally, export factoring fosters better buyer relationships through flexible payment terms.With tailored solutions, Growmax Fintech helps SMEs effectively manage cash flow, reduce risks, and focus on growth.

To know more : https://growmaxfintech.com/how-export-factoring-can-improve-your-business-cash-flow/

-

1:12:00

1:12:00

The Car Guy Online

13 hours ago $0.80 earnedAutomakers EXPOSED, Whistleblowers SILENCED! NextGen Engineer Speaks Out!

12.5K5 -

1:17

1:17

The Lou Holtz Show

14 hours agoThe Lou Holtz Show S2 EP16 | Hugh Freeze on Faith, Football & Restoring American Values #podcast

11.5K2 -

LIVE

LIVE

BEK TV

23 hours agoTrent Loos in the Morning - 8/22/2025

236 watching -

LIVE

LIVE

The Bubba Army

22 hours agoHogan's Death: Bubba Called it FIRST AGAIN! - Bubba the Love Sponge® Show | 8/22/25

2,536 watching -

38:40

38:40

ZeeeMedia

17 hours agoMax Pace’s Crypto Revolution Story: Four Strategies to Win | Daily Pulse Ep 93

28.5K14 -

2:16:46

2:16:46

"What Is Money?" Show

2 days agoBitcoin vs War, Violence, & Corruption w/ Gary Mahmoud

18.6K -

28:33

28:33

DeVory Darkins

1 day ago $9.57 earnedNewsom suffers stunning EMBARRASSMENT as MAJOR retailer makes devastating announcement

33K62 -

32:46

32:46

Coin Stories with Natalie Brunell

2 days agoInside Look at Strategy’s $70+ Billion Bitcoin Treasury

19.7K1 -

8:21

8:21

MattMorseTV

18 hours ago $9.01 earnedTrump just SCORED a $500,000,000 LEGAL WIN.

121K47 -

2:11:05

2:11:05

Side Scrollers Podcast

22 hours agoDISASTROUS Cracker Barrel Rebrand + Destiny PDF Allegations + More | Side Scrollers Live

78.6K30