Premium Only Content

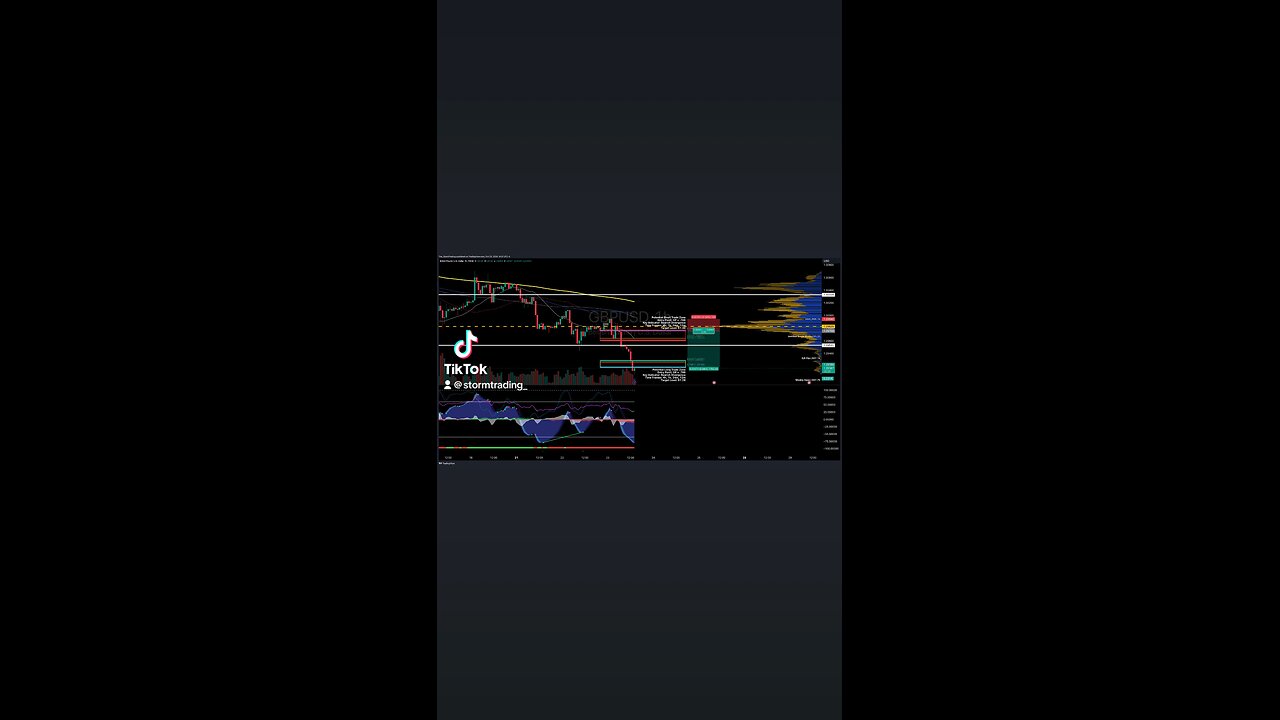

$GBPUSD | 1H Trade Setup Update Position: 🔴 Short

$GBPUSD | 1H Trade Setup Update

Position: 🔴 Short

Trade Details: • Entry: 1.2975 • Stop Loss: 1.2994 • Take Profit: 1.2918

● Current Analysis: GBP/USD has broken down through key support and is heading into a potential short trade zone. Price is moving below the 200-period Moving Average (MA) and approaching a key Fibonacci retracement zone (0.786). The bearish divergence in momentum suggests further downside potential, while the price action is hovering near low-volume areas on the profile, indicating a lack of buyer support at these levels.

● Technical Indicators:

• Momentum: Declining, signaling bearish pressure is building.

• Volume Profile: Thin above current levels, meaning there’s minimal resistance for continued downside.

• Stochastic RSI: Still in oversold territory, but no sign of reversal yet, signaling the continuation of bearish momentum.

● Outlook: With a clean break below 1.2982, GBP/USD could continue toward the target of 1.2875. However, traders should keep an eye on the Fibonacci and MA levels for any signs of consolidation or reversal. If 1.3035 is breached, it may invalidate the short setup, and a re-test of higher levels could occur. For now, the trend looks bearish.

-

29:18

29:18

ArynneWexler

23 hours agoHas The Online Right Lost Its Mind?

1351 -

23:07

23:07

marcushouse

1 day ago $0.40 earnedSpaceX is Rushing Toward Starship Flight 11 – Already!?

5572 -

13:52

13:52

True Crime | Unsolved Cases | Mysterious Stories

8 days ago $0.29 earned7 Real Life Heroes Caught on Camera

2841 -

![Welcome to The Finals [OPEN PARTY] - #RumbleGaming](https://1a-1791.com/video/fww1/3e/s8/1/4/H/W/f/4HWfz.0kob.1-small-Welcome-to-The-Finals-OPEN-.jpg) LIVE

LIVE

LumpyPotatoX2

3 hours agoWelcome to The Finals [OPEN PARTY] - #RumbleGaming

1,639 watching -

13:05

13:05

Mike Rowe

2 days agoIs College DEAD? Inside America’s #1 Trade School | Sheree Utash From #448 | The Way I Heard It

12.3K6 -

8:49

8:49

Truly

1 day agoMy Body Feels Like It’s On Fire | BORN DIFFERENT

7 -

13:43

13:43

The Kevin Trudeau Show Limitless

4 days agoClassified File 3 | Kevin Trudeau EXPOSES Secret Society Brainwave Training

100K19 -

2:51

2:51

Memology 101

9 hours ago $0.19 earnedJD VANCE just NUKED a top Democrat influencer defending NARCOTERRORISTS 💥

63711 -

10:00

10:00

GBGunsRumble

21 hours agoGBGuns Range Report 06SEP25

82 -

LIVE

LIVE

Times Now World

2 days agoWorld News LIVE | Maduro Dares Trump, Says China Is Now World’s Top Power Not US

153 watching