Premium Only Content

My Thoughts on the Market

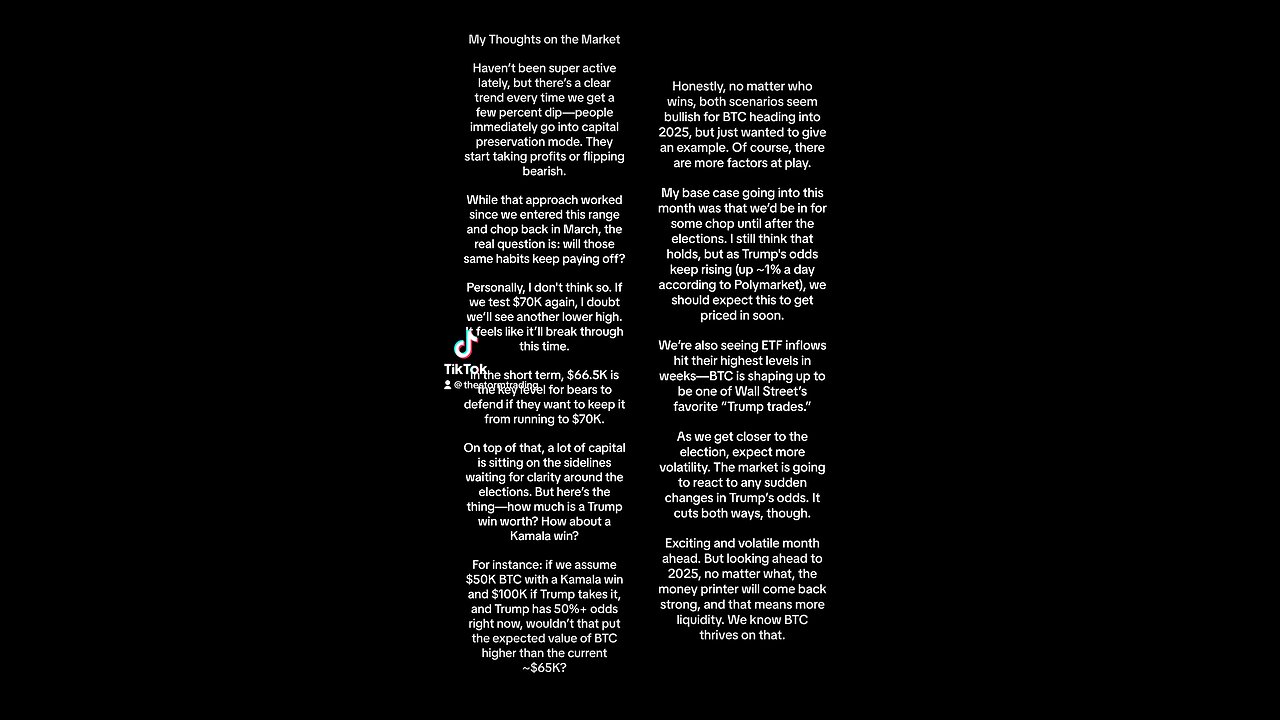

My Thoughts on the Market

Haven’t been super active lately, but there’s a clear trend every time we get a few percent dip—people immediately go into capital preservation mode. They start taking profits or flipping bearish.

While that approach worked since we entered this range and chop back in March, the real question is: will those same habits keep paying off?

Personally, I don't think so. If we test $70K again, I doubt we’ll see another lower high. It feels like it’ll break through this time.

In the short term, $66.5K is the key level for bears to defend if they want to keep it from running to $70K.

On top of that, a lot of capital is sitting on the sidelines waiting for clarity around the elections. But here’s the thing—how much is a Trump win worth? How about a Kamala win?

For instance: if we assume $50K BTC with a Kamala win and $100K if Trump takes it, and Trump has 50%+ odds right now, wouldn’t that put the expected value of BTC higher than the current ~$65K?

Honestly, no matter who wins, both scenarios seem bullish for BTC heading into 2025, but just wanted to give an example. Of course, there are more factors at play.

My base case going into this month was that we’d be in for some chop until after the elections. I still think that holds, but as Trump's odds keep rising (up ~1% a day according to Polymarket), we should expect this to get priced in soon.

We’re also seeing ETF inflows hit their highest levels in weeks—BTC is shaping up to be one of Wall Street’s favorite “Trump trades.”

As we get closer to the election, expect more volatility. The market is going to react to any sudden changes in Trump’s odds. It cuts both ways, though.

Exciting and volatile month ahead. But looking ahead to 2025, no matter what, the money printer will come back strong, and that means more liquidity. We know BTC thrives on that.

-

LIVE

LIVE

Dr Disrespect

5 hours ago🔴LIVE - DR DISRESPECT - CRONOS: The New Dawn - FIRST IMPRESSIONS

1,525 watching -

![MAHA News [9.5] RFK Lights Up Congress, CDC House Cleaning, Fight Over Vax Mandates For School Children](https://1a-1791.com/video/fww1/b9/s8/1/i/h/m/f/ihmfz.0kob-small-MAHA-News-9.5.jpg) LIVE

LIVE

Badlands Media

12 hours agoMAHA News [9.5] RFK Lights Up Congress, CDC House Cleaning, Fight Over Vax Mandates For School Children

517 watching -

LIVE

LIVE

The Tom Renz Show

1 hour agoWho Is Undermining Trump?

164 watching -

1:00:55

1:00:55

Mark Kaye

4 hours ago🔴 Trump Tells Tech Tycoons It's Time To Pay Up!

19.7K4 -

LIVE

LIVE

Right Side Broadcasting Network

6 hours agoLIVE: President Trump Makes an Announcement - 9/5/25

5,330 watching -

LIVE

LIVE

SportsPicks

3 hours agoCrick's Corner: Episode 77

228 watching -

1:06:02

1:06:02

LindellTV

2 hours agoBREAKING: FBI Returns Mike Lindell’s Cellphone

20.2K9 -

1:04:31

1:04:31

Jeff Ahern

2 hours ago $0.51 earnedFriday Freak out with Jeff Ahern

8.37K -

7:33

7:33

Talk Nerdy Sports - The Ultimate Sports Betting Podcast

5 hours agoFriday Night Lights in BRAZIL 🇧🇷🔥🏈

8.06K -

LIVE

LIVE

Reidboyy

2 hours ago $0.64 earned$20 Billion Dollar Warzone Tournament! Protect The President

50 watching