Premium Only Content

Land Value Mapping Training Part One

Land Value Mapping Training Part One with Joshua Vincent, Director, Center for the Study of Economics

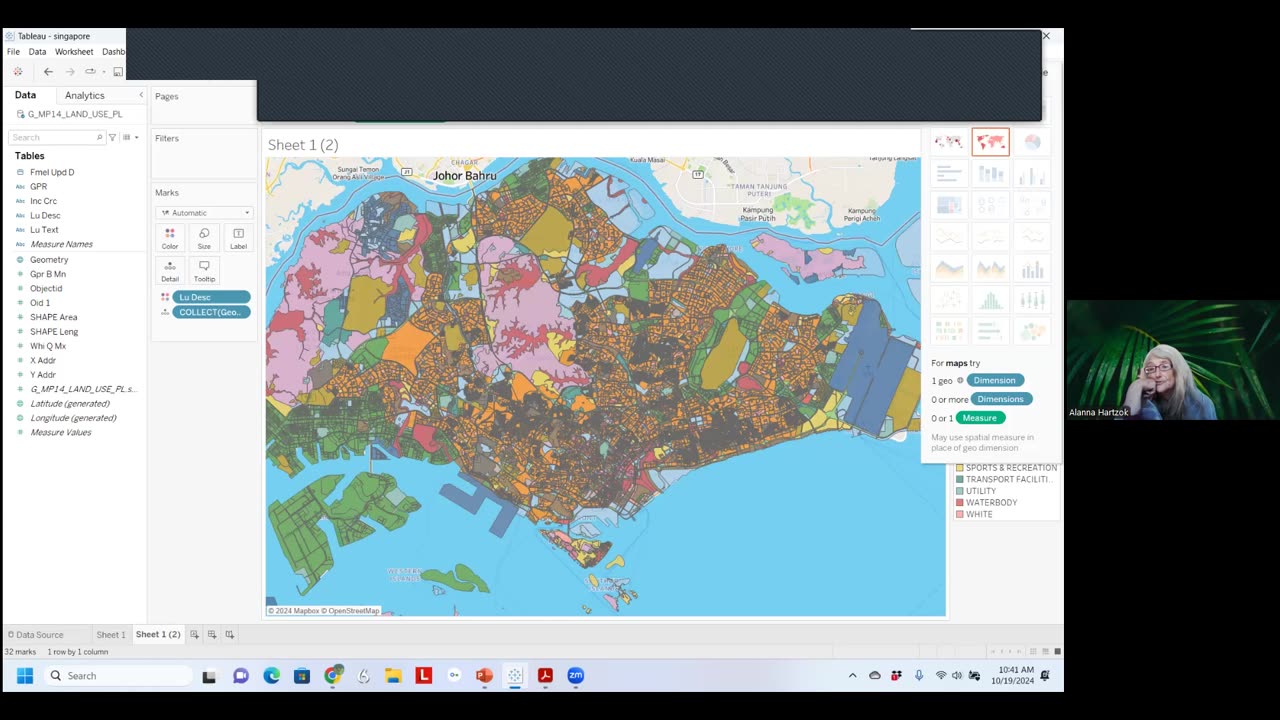

Show Notes: People from all five continents participated in this first of three training sessions about the principles, power and praxis of land value mapping - an essential tool for capturing land rent. First slide of the power point showed the first known map of the world, a cuneiform tablet from Babylon. This is a map about grain production. Ancient Greek map was later showed that region. Land value maps have evolved as technology has. With computers and easily available software, the technology of mapping has been democratized. Can help us think critically about what harms or helps a community. A way to engage with and empower your community. Land – find out what’s in it and what it’s worth

Domesday Book 1066 in Britain after William the Conqueror was a kind of land value mapping. 1901 detailed land value map of UK. 1940s Chicago’s Blue Book of land values. We value land now with assessment cards which can be very detailed. Showing assessed value of land and buildings for each parcel and particulars of the house. This is now the standard, to separate land and building value. All this detailed information gets turned into GIS maps.

Estonia has a national land value tax and every part of Estonia has been land value mapped. You can click on the map to get detailed information for each parcel. This information is in the hands of the citizens not just the government. If the citizens have a problem with what the value of their property is or about their taxes, they have a place to go. Singapore land value and land use maps.

Land Value Tax project steps to proceed. We will develop land value maps for LVT implementation projects. One way to get data is to ask realtors. We collect the data, digitalize it, and put an optimal tax rate into one of the fields, then we can figure out how much money can be raised to pay for the local government budget.

Compliance of tax payment numbers are good in Estonia, 95-98% at local level.

Challenge is that on level of national government there is the influence of power brokers and much less transparency about tax takes and expenditures.

Dr. Shyam (in India) mentioned day and night maps produced by NASA. Josh says that with most GIS programs it is possible to switch to NASA view. A lot of local characteristics can be observed from satellite view. Environmental degradation and pollution. Monitor soil loss worldwide. All mapped.

In Baltimore our land value maps clearly show how absentee land-owners pay more when shifting to land value taxes. For the most part those are the properties in worse shape, they make the community less valuable to live there but absentees don’t care, all they are doing is taking money out of the community.

You could say with the land value tax approach that we are socialists who love the free market. Why should people get penalized with taxes when they are providing socially needed goods and services?

Josh shows the land value map he made for each county of California. The data was available but no one had made it into a map previously. 865 billion dollars in land value, probably more, mostly in Los Angeles County.

Conversation about San Francisco where Henry George wrote his masterwork Progress and Poverty. Josh tells us that in the Tenderloin, a very poor area of the city, much of the land is owned by banks, Deutsche Bank and Black Rock. San Francisco land values similar to desert areas but this cannot be true. Josh “Public lies are as important as public truth because you can launch law cases to legislate for accuracy and transparency.”

Next session he will show details of a city like Philadelphia or Munich showing that a land value tax is progressive. Who owns the base of wealth which is land. People go to war over land. A land tax has to be paid even if you have your land registered on the Isle of Mann, you cannot hide your land. No matter where you are or who you have to pay a land tax, it cannot be avoided like other taxes You cannot hide it or put it in tax shelters. People who do not pay their land tax lose their land. Land it is held conditional just as with current property tax.

Re war and land grabbing. Prior to the war in Ukraine people outside of Ukraine could not buy and own land in Ukraine. Now Western agribusiness companies have been buying up much of the rich agricultural land of eastern Ukraine. US politician Lindsey Graham has stated that the war in Ukraine is over the 12 trillion dollars worth of mineral resources there.

Patricia told us that Restore.ecoeco is a good way to find out about environmental issues and projects around the world.

Conversation between Josh and Bruno about how they used land value maps in gaining support for the campaign for land value tax in Philadelphia several years ago.

Wendell - Once you have the land value maps you can compare major land owners with those who are paying / donating to the politicians. Josh – In Baltimore the Chamber of Commerce opposed the tax shift. Yet we were able to use this information and present it to the Apartment Owners Association showing that they would pay less (they provide housing) so they supported it after not doing so initially.

Discussion of “unholy alliance” that believes you are either left or you are right. This tax shift presents the possibility of a unified movement for fundamental economic and social reform. Are we capitalists or socialists? The answer is Yes! We are the radical middle.

Participants expressed appreciation for learning about this powerful tool of land information technology to enable us to claim the earth for the people as a whole.

Next session (November 16) will look at the indigenous land maps that the Maori of New Zealand are using and also go into details in a few city neighborhoods. Josh will find free software for us to begin land mapping our communities.

-

20:08

20:08

MYLUNCHBREAK CHANNEL PAGE

6 hours agoThe Field Museum is From Another Timeline

3.13K2 -

LIVE

LIVE

SpartakusLIVE

2 hours agoSOLOS on ARC Raiders || WZ Stream LATER

2,418 watching -

UPCOMING

UPCOMING

Side Scrollers Podcast

5 hours agoSide Scrollers Presents: QUEEN OF THE Wii

650 -

LIVE

LIVE

GritsGG

4 hours agoBO7 Warzone Is Here! Win Streaking! New Leaderboard?

385 watching -

1:00:55

1:00:55

Jeff Ahern

4 hours ago $6.55 earnedThe Saturday show with Jeff Ahern

37.8K15 -

LIVE

LIVE

Ouhel

6 hours agoSATURDAY | Battlefield 6 | Going for the Queen in Arc after | O'HELL LIVE |

43 watching -

LIVE

LIVE

ShivEmUp

4 hours ago🔴LIVE🔴🔵Battlefield 6🔵Game Changing Updates?🔵Grumpy Bird🔵

53 watching -

LIVE

LIVE

Grant Cardone

6 hours agoHow to Find Your First $1million Profit In Real Estate

1,022 watching -

![[ FF7 Remake] | Cloud doing what he does best [ PART 6 ]](https://1a-1791.com/video/fwe2/a6/s8/1/Y/8/Y/F/Y8YFz.0kob.1-small--FF7-Remake-Cloud-doing-wha.jpg) 5:00:59

5:00:59

CHiLi XDD

5 hours ago[ FF7 Remake] | Cloud doing what he does best [ PART 6 ]

144 -

![Mr & Mrs X - [DS] Pushing Division, Traitors Will Be Exposed, Hold The Line - EP 18](https://1a-1791.com/video/fwe2/96/s8/1/w/U/W/F/wUWFz.0kob-small-Mr-and-Mrs-X-DS-Pushing-Div.jpg) 54:40

54:40

X22 Report

8 hours agoMr & Mrs X - [DS] Pushing Division, Traitors Will Be Exposed, Hold The Line - EP 18

118K39