Premium Only Content

Basemoney: MASSIVE BTC Pump in 2025: Low Rates & Money Printing

Matthew Mežinskis explains how 2025 could be the perfect Bull run coinciding with low interest rates and huge money printing!

Where to store your Bitcoin? I personally use a BitBox!

- Get a 5% Discount with code "ROBIN"

- & visit: https://bitbox.swiss/robin

Contact the CyberSecurity & Self Custody Experts from the Bitcoin Way:

- 30 mins free call with my link: https://www.thebitcoinway.com/partners/robin

Get the Best Bitcoin Watches ever:

- Here: https://www.coinvigilante.com/?ref=robinseyr

Guest's contact: https://x.com/1basemoney

!!! Disclaimer: This content is for educational purposes only. The views expressed by Robin Seyr and guests are their own and do not reflect any responsibility or liability on our part.

Summary

In this conversation, Robin Seyr and Matthew (@1basemoney) discuss the evolving landscape of Bitcoin adoption, particularly by nation-states, and its implications for the global economy. They explore the concept of base money, the significance of Bitcoin in comparison to traditional currencies, and the potential for hyperinflation. The discussion also touches on the future of fiat money, the role of central banks, and the impact of Bitcoin on financial systems and individual investments. Matthew shares insights on the four-year cycle of Bitcoin's growth and the challenges of predicting economic trends, emphasizing the importance of understanding monetary policy and the value proposition of Bitcoin as a store of financial energy.

Takeaways

Nation states are increasingly adopting Bitcoin as a strategic reserve asset.

Base money refers to the physical currency and bank reserves in the economy.

The four-year cycle of Bitcoin's growth may diminish over time.

Hyperinflation is unpredictable and can have severe economic consequences.

Bitcoin is now the fifth strongest financial asset globally.

Bitcoin's adoption could lead to better decision-making in governance and finance.

The value of Bitcoin lies in its ability to hold financial energy over time.

Borrowing against Bitcoin can be a viable strategy if done cautiously.

The future of fiat money remains uncertain amidst rising debt levels.

Bitcoin's impact on the economy could lead to more productive investments.

Chapters

00:00 Nation State Adoption of Bitcoin

02:49 Understanding Base Money

06:20 Bitcoin vs. Other Assets

09:22 The Four-Year Cycle and Its Future

15:23 Hyperinflation and Its Implications

20:11 Correlation Between Money Printing and Bitcoin Price

26:25 Central Banks and Gold Holdings

29:07 The Future of Fiat Money

37:05 Bitcoin's Position Among Currencies

42:08 The Role of Debt in a Bitcoin Standard

49:34 The Impact of Bitcoin on the World

57:10 Conclusion and Final Thoughts

-

2:57

2:57

EvenOut

1 day agoTHE TELEPORTING PORTA POTTY TWIN RPANK!

145 -

1:02:55

1:02:55

In The Litter Box w/ Jewels & Catturd

21 hours agoAmerica Is Under Attack! | In the Litter Box w/ Jewels & Catturd – Ep. 711 – 1/02/2025

57.1K30 -

1:45:25

1:45:25

The Quartering

5 hours agoHuge Update In Cybertruck Attack & Dark New Details From New Orleans Attacker & More!

90.5K45 -

16:04

16:04

Tundra Tactical

2 days ago $1.38 earnedHow Palmetto State Armory got so BIG!

27K3 -

13:41

13:41

MichaelBisping

8 hours agoBISPING: Jamahal Hill is BEEFING with EVERYONE before UFC 311?! | Hill vs Prochazka

1931 -

12:57

12:57

BlackDiamondGunsandGear

1 day agoSingle stack that takes a Double Stack Mag?

27 -

3:21:21

3:21:21

DemolitionDx

5 hours agochecking out multiple games

33K -

2:14:38

2:14:38

Conspiracy Pilled

1 day agoPortal to Hell: The Elisa Lam/Cecil Hotel Case (S5 Ep 12)

40.3K5 -

14:31

14:31

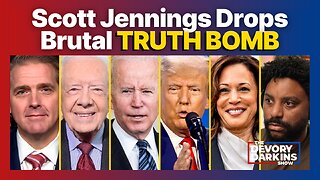

DeVory Darkins

2 days ago $8.73 earnedScott Jennings Drops Brutal TRUTH BOMB

38.3K153 -

LIVE

LIVE

cbsking757

6 hours ago★TANKING RIVALS RANKED! GIFTED SUBS ARE LIVE! #marvel #marvelrivals

159 watching