Premium Only Content

When Should You Set Up an LLC Management Company?

JOIN THE TAX-FREE WEALTH CHALLENGE NOW! OCTOBER 14-18, 2024!

https://join.taxalchemy.com/join-thechallenge?utm_source=youtube

TAKING THE NEXT STEP:

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_source=youtube

Book a Professional Tax Strategy Consultation ▶ https://taxalchemy.com/consultation?utm_source=youtube

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registration?utm_source=youtube

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink=&afftrack=

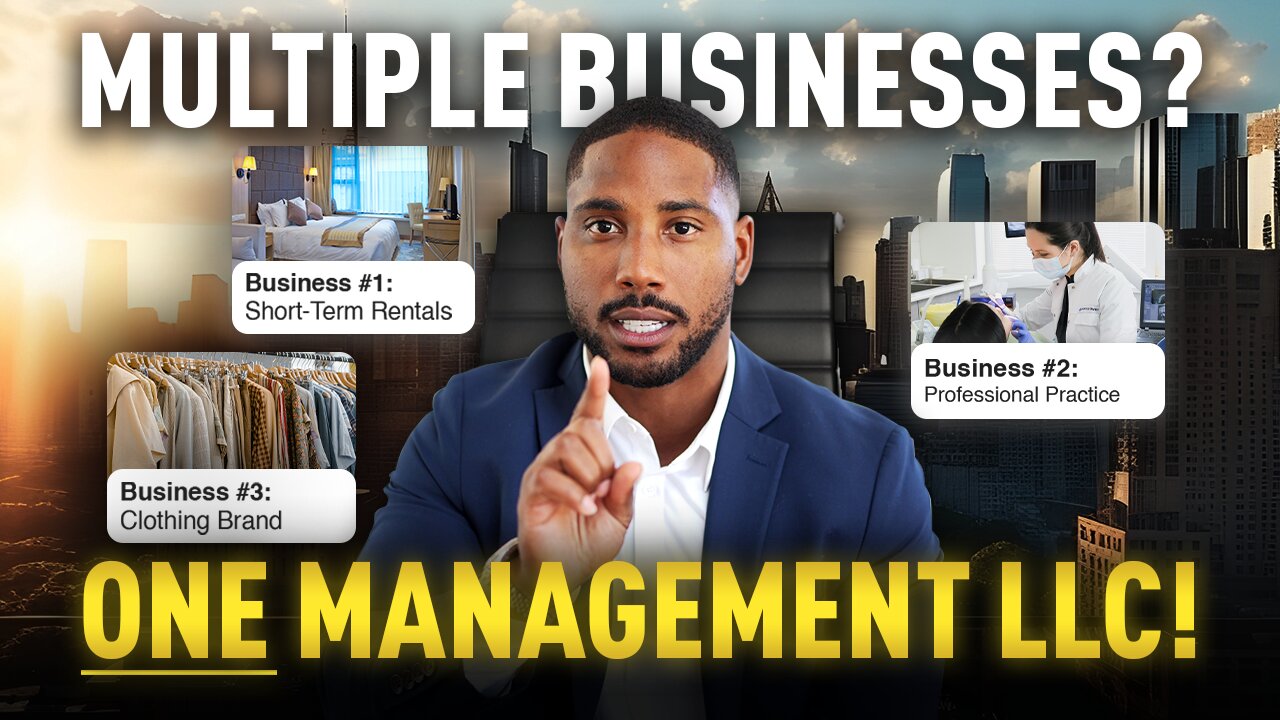

Many entrepreneurs and business owners have several, or even a large number of business entities that they either own or operate. If you are an entrepreneur, then the way that you structure your entities can have huge implications both for your taxes and the liabilities that your businesses are exposed to.

In this video, tax expert Karlton Dennis breaks explains the concept of LLC management companies. He discusses what they are, when entrepreneurs should consider forming them, and what their most important benefits are. He also explains how business owners can shift income from their operational companies to their management companies, and how management companies can be used by real estate investors.

A lot of people who own businesses also want to add either their spouses or their children to payroll. Karlton explains how LLC management companies can be extremely useful for this purpose as well. Due to the complexities of entity structuring, it is important to consult a tax professional to answer any questions you might have about setting up management companies.

CHAPTERS:

0:00 Intro

0:31 What is a Management Company?

2:30 How to Use Management Companies for Income Shifting

6:45 Tax Advantages of Placing Your Children on Payroll

7:20 Using the Home Office Deduction

7:43 Vehicle Write-Offs for Real Estate Investors

8:58 The Different Types of Management Companies

9:41 Study the Court Cases with a Tax Professional

9:59 Outro

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#realestateinvesting #managementcompany #entrepreneur

-

8:02

8:02

Karlton Dennis

1 month agoHow to Pay Yourself as an LLC in 2026

33 -

58:39

58:39

MattMorseTV

8 hours ago $14.24 earned🔴Rand Paul just made a BIG MISTAKE.🔴

14.4K123 -

37:25

37:25

Nikko Ortiz

12 hours agoTerrible Military Deaths and War Crimes

3.31K4 -

24:21

24:21

The Pascal Show

7 hours ago $0.72 earned'CHALLENGE ACCEPTED!' TPUSA Breaks Silence On Candace Owens Charlie Kirk Allegations! She Responds!

2.76K5 -

19:23

19:23

MetatronHistory

14 hours agoThe REAL Origins and Function of the PRETORIANS in Ancient Rome

1.39K -

2:03:59

2:03:59

Side Scrollers Podcast

17 hours agoKaceytron Publicly Humiliated by H3H3 + Sabrina Carpenter/White House FEUD + More | Side Scrollers

47.3K6 -

2:17:46

2:17:46

The Connect: With Johnny Mitchell

4 days ago $16.66 earnedA Sitdown With The Real Walter White: How An Honest Citizen Became A Synthetic Drug Kingpin

93.2K2 -

2:40:08

2:40:08

PandaSub2000

1 day agoDEATH BET | Solo Episode 01 (Edited Replay)

17.4K1 -

9:41

9:41

Blabbering Collector

2 days agoHarry Potter Vintage Christmas Merch By Realtec Canada!

1.65K -

LIVE

LIVE

Lofi Girl

2 years agoSynthwave Radio 🌌 - beats to chill/game to

865 watching