Premium Only Content

PROTECT Your Investments: Navigate Market Volatility with Confidence - Andy Tanner

In this episode of the Cashflow Academy podcast, host Andy Tanner, alongside financial experts Noah Davidson and Corey Halliday, dives deep into navigating market volatility and effective risk management strategies. If you want to learn how to make informed decisions in unpredictable financial markets, this episode offers valuable insights into understanding key market indicators, including the VIX, often called the "fear gauge." By the end of this episode, you'll gain practical strategies to protect your investments and maximize opportunities during periods of uncertainty.

Get FREE Training with Andy Tanner: https://bit.ly/3U3HAPY

Risk Management and the Four Pillars of Investing

Andy and his guests stress the importance of risk management as a core component of investing. They outline the four pillars of investing:

1. Understanding Fundamentals

2. Evaluating Technicals

3. Gauging Market Sentiment

4. Prioritizing Risk Management

These pillars serve as a roadmap for investors looking to navigate market volatility with confidence.

Understanding the VIX: The Fear Gauge

Corey Halliday breaks down the importance of the VIX, a key market indicator that signals fear and potential market downturns. The discussion delves into how investors can capitalize on periods of elevated fear to hedge against losses and find opportunities during market distress.

Investment Strategies for Volatile Markets

The episode offers practical strategies for managing investments during volatile market conditions. Key techniques include:

Using spreads on the VIX to manage risk

Leveraging options as hedging tools to minimize potential losses while maximizing potential gains

00:00 - Introduction

01:52 - The Four Pillars of Investing

04:18 - Understanding the VIX: The Fear Gauge

07:31 - Technical Analysis and Market Movements

10:33 - Insurance and Risk Management

17:52 - Market Sentiment and Predictions

24:22 - High Prices and Economic Concerns

24:42 - Understanding the PMI Report

25:10 - Jobs Reports and Economic Indicators

25:57 - Inflation and Market Dynamics

27:20 - Tax Policies and Market Reactions

28:55 - Investment Strategies and Economic Insights

32:37 - Market Trends and Predictions

32:59 - The Role of the Federal Reserve

36:23 - VIX Trade Strategies

-----

Disclaimer: The information provided in this video is for educational and informational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any financial instrument or engage in any financial activity.

The content presented here is based on the speaker's personal opinions and research, which may not always be accurate or up-to-date. Financial markets and investments carry inherent risks, and individuals should conduct their own research and seek professional advice before making any financial decisions.

-

20:16

20:16

The Rich Dad Channel

4 days agoHow to Avoid Real Estate Disasters

2.27K3 -

2:24:17

2:24:17

Barry Cunningham

4 hours agoFOR PRESIDENT TRUMP WILL TAKE NO PRISONERS AND THE LIBS SHOULD EXPECT NO MERCY!

69.1K40 -

1:08:41

1:08:41

Savanah Hernandez

4 hours agoCharlie Kirk Was Our Bridge And The Left Burned It

10.2K28 -

DVR

DVR

Flyover Conservatives

7 hours agoFinancial Web Behind Charlie Kirk's Murder with Mel K | Silver On It's Way to $50 | FOC Show

22.3K2 -

LIVE

LIVE

We Like Shooting

15 hours ago $0.08 earnedWe Like Shooting 628 (Gun Podcast)

148 watching -

1:09:26

1:09:26

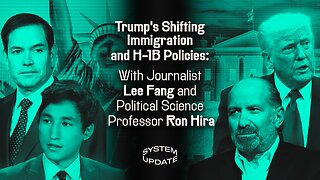

Glenn Greenwald

6 hours agoTrump's Shifting Immigration and H-1B Policies: With Journalist Lee Fang and Political Science Professor Ron Hira | SYSTEM UPDATE #515

164K33 -

13:09:23

13:09:23

LFA TV

1 day agoLFA TV ALL DAY STREAM - MONDAY 9/15/25

253K60 -

54:12

54:12

Donald Trump Jr.

5 hours agoCharlie's Vision. Our Future. | TRIGGERED Ep274

197K120 -

1:03:35

1:03:35

BonginoReport

6 hours agoKirk’s Alleged Killer Dating Hateful Transgender??? - Nightly Scroll w/ Hayley Caronia (Ep.134)

126K140 -

1:01:12

1:01:12

The Nick DiPaolo Show Channel

8 hours agoKirk Assassination Exposes Insane Left | The Nick Di Paolo Show #1793

94.7K25