Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

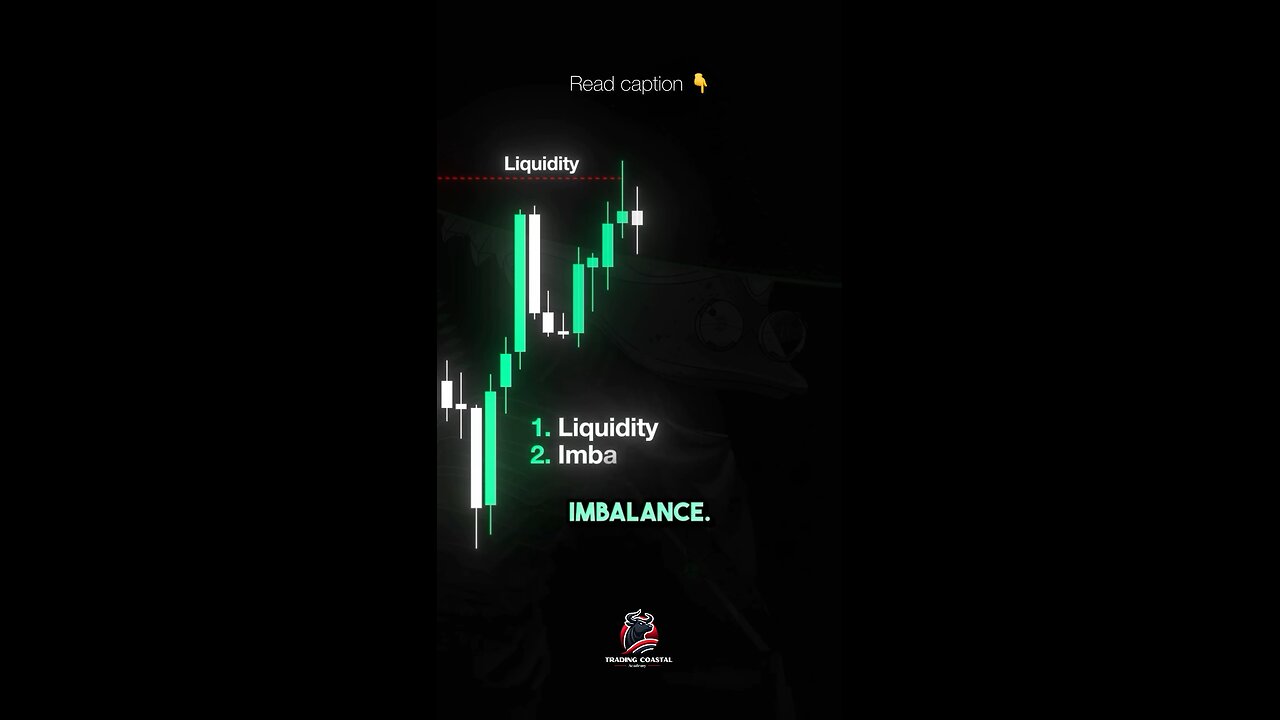

“Master Liquidity & FVG Strategy for Bearish Setups 📉💡 | #TradingTips #Forex #SmartMoney”

10 months ago

18

1. Liquidity Sweep and Price Shift: The initial liquidity sweep occurs when the market clears stop orders, often triggering a shift in market sentiment. In this case, the sweep shifts the sentiment to bearish, indicating that sellers are gaining control.

2. Fair Value Gap (FVG) as Entry Point: The price leaves behind an FVG after the shift, which acts as a point of imbalance. When the price retraces to fill this gap, it offers a prime opportunity to enter a sell position.

3. Targeting Nearest Liquidity: After the retracement and entry at the FVG, the sell position can target the nearest liquidity pool, typically located at a support level or previous low, where stop orders are likely to reside.

Loading comments...

-

LIVE

LIVE

Geeks + Gamers

2 hours agoGeeks+Gamers Play- MARIO KART WORLD

238 watching -

![(8/27/2025) | SG Sits Down Again w/ Sam Anthony of [Your]News: Progress Reports on Securing "We The People" Citizen Journalism](https://1a-1791.com/video/fww1/d1/s8/6/G/L/3/c/GL3cz.0kob.1.jpg) 29:34

29:34

QNewsPatriot

3 hours ago(8/27/2025) | SG Sits Down Again w/ Sam Anthony of [Your]News: Progress Reports on Securing "We The People" Citizen Journalism

3.08K1 -

25:12

25:12

Jasmin Laine

7 hours agoDanielle Smith’s EPIC Mic Drop Fact Check Leaves Crowd FROZEN—Poilievre FINISHES the Job

3.68K16 -

ZWOGs

11 hours ago🔴LIVE IN 1440p! - SoT w/ Pudge & SBL, Ranch Sim w/ Maam & MadHouse, Warzone & More - Come Hang Out!

826 -

LIVE

LIVE

This is the Ray Gaming

59 minutes agoI'm Coming Home Coming Home Tell The World... | Rumble Premium Creator

33 watching -

LIVE

LIVE

GrimmHollywood

10 hours ago🔴LIVE • GRIMM HOLLYWOOD • GEARS OF WAR RELOADED CUSTOMS • BRRRAP PACK •

45 watching -

1:13:28

1:13:28

Glenn Greenwald

4 hours agoGlenn Takes Your Questions on the Minneapolis School Shooting, MTG & Thomas Massie VS AIPAC, and More | SYSTEM UPDATE #506

99.4K46 -

LIVE

LIVE

RCAM

1 hour agoLIVE | Trans Shooter Who Targeted Christians | Premium Creator

37 watching -

LIVE

LIVE

Spartan

5 hours agoMaybe finishing Expedition 33, then back to Halo Grind

14 watching -

DVR

DVR

Armadillofather

3 hours ago $0.52 earnedEspionage Action in the Den! | Metal Gear Solid Delta | You being here means so much!

12.5K