Premium Only Content

Fed on the Brink: Breaking Down Critical Moves That Could Impact You

🔒 SHOW YOUR SUPPORT.

➤ Gain Access to our independent network.

🌐 https://www.thecomission.com

📺 BROWSE OUR CHANNELS

➤ Watch our content channels.

🌐 https://www.thecomissionnetwork.com

📱 NEED CUSTOM SERVICES?

➤ Build YOUR brand. Build with us and remain independent.

🌐 https://www.thecomissionsystem.com

📼 VIDEO DESCRIPTION

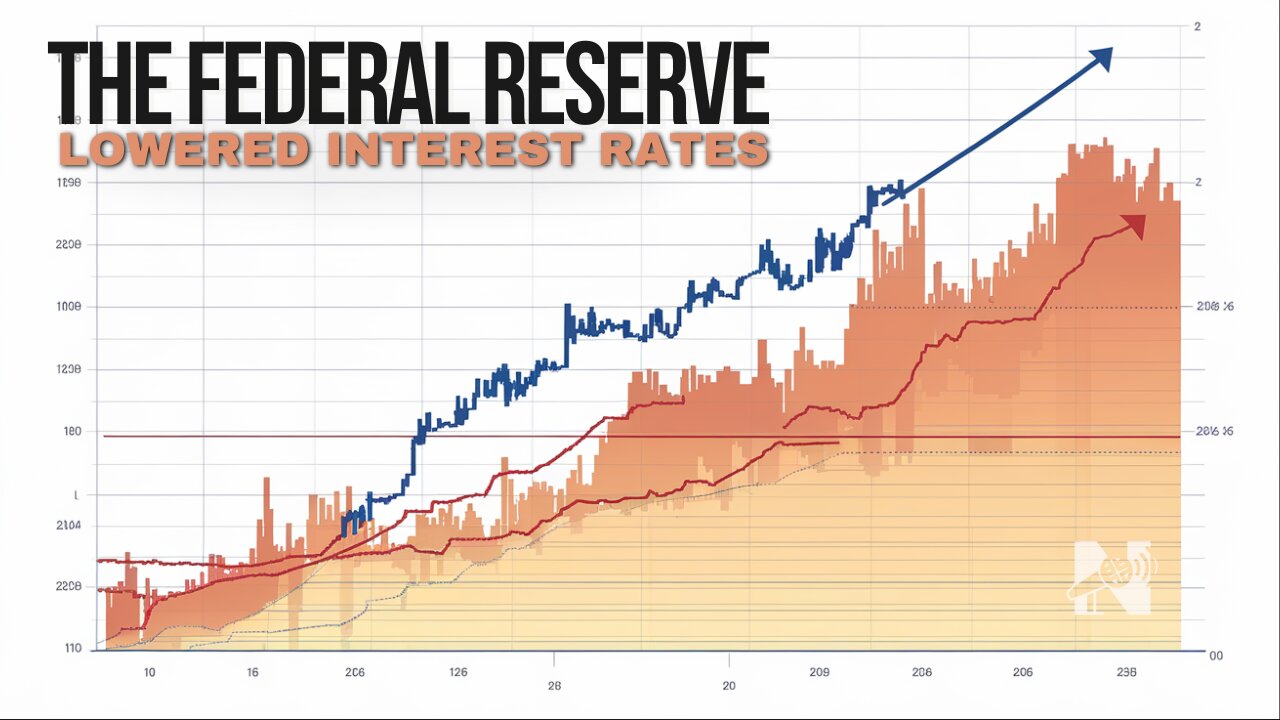

In this video, we take a deep dive into the evolving economic landscape and compare how the US Federal Reserve and the European Central Bank (ECB) are navigating cooling inflation and economic uncertainty. As inflation moderates, both central banks are recalibrating their monetary policies to stabilize their economies.

Key Points Covered:

1. Federal Reserve's Response: The Federal Reserve recently cut interest rates by 50 basis points in response to slower economic growth and cooling inflation. With inflation nearing the Fed's 2% target, there's growing speculation about further rate cuts in 2024. We explore the factors driving these decisions, including inflation trends, GDP growth, labor market conditions, and global economic influences.

2. Cooling Inflation in the US: Inflation in the US has significantly decreased from a high of 9.1% in June 2022 to 3.1% in January 2024. Contributing factors include stabilizing energy prices, improved supply chains, and the Fed's tighter monetary policies, all of which signal a shift in economic momentum.

3. European Central Bank's Anticipated Moves: We also examine how the ECB is likely to respond. While expected to follow the Fed’s lead with interest rate cuts, the ECB's approach is more cautious. With inflation in Europe expected to remain above target into 2025, analysts predict the ECB will carefully balance monetary easing with inflation control, stabilizing rates between 3.0% and 3.75% by mid-2025.

Tune in to understand how these monetary policies could impact global economic trends, mortgage rates, and the overall financial landscape in the coming years.

#FederalReserve #EuropeanCentralBank #MonetaryPolicy #Inflation #EconomicOutlook #InterestRates #GlobalEconomy #ECB #Fed #EconomicAnalysis

-

10:56

10:56

ariellescarcella

11 hours agoThe Shocking Divide Among College Voters Sparks Worry For America

2.66K5 -

13:09

13:09

Forrest Galante

9 hours agoWildlife Expert Reacts To Deadly Australian Animal TikToks

47K4 -

12:08

12:08

Zoufry

1 day agoThe Mystery of Gaddafi's Final 24 Hours

8.67K7 -

18:25

18:25

Liberty Hangout

13 days agoAnti-Ice Demonstrators Love Poop!

44.4K64 -

9:39

9:39

MattMorseTV

16 hours ago $1.05 earnedVance just DROPPED a BOMBSHELL.

40.2K63 -

23:47

23:47

GritsGG

1 day agoThe Forgotten Best Sniper Support AR!

15.5K3 -

1:15:48

1:15:48

The Pascal Show

17 hours ago $0.10 earnedMUGSHOTS RELEASED! Emmanuel Haro's Parents Mugshot Released To The Public

12.2K1 -

14:45

14:45

BlabberingCollector

20 hours agoKings Cross Station SET LEAKS! | Harry Potter HBO Show Update & News

11.8K1 -

33:20

33:20

SB Mowing

9 days agoHealth Struggles + Endless Rain = A Yard Out of Control

20K19 -

1:09:42

1:09:42

Mike Rowe

4 days agoHow Did THIS Dirty Job Make Tommy Mello A Billionaire?! | #447 | The Way I Heard It

79.6K20