Premium Only Content

How Early Filing for ISF Ensures Effortless Customs Clearance

ISF Solution | (832-904-9333)

[email protected] | www.isfsolution.com

The advantages of early filing for the Importer Security Filing (ISF) are numerous and can greatly benefit both customs brokers and importers. Firstly, early filing allows customs brokers to obtain crucial information well in advance, which helps them plan and prepare for the smooth clearance of the goods. This includes obtaining necessary customs bonds, which are integral to the importation process. By submitting the ISF early, customs brokers can avoid last-minute rushes and ensure that all necessary information is in order.

Secondly, early filing enables customs brokers to identify any potential issues or discrepancies related to the ISF well before the cargo arrives at the port. This gives them ample time to rectify any errors and ensure a seamless process when the shipment reaches the port. It also allows for better communication with importers, as any potential issues can be addressed proactively.

The process of early filing for ISF involves submitting the required information to US Customs and Border Protection (CBP) at least 24 hours prior to the vessel's departure from the foreign port of loading. This allows CBP to review and assess the submitted data in a timely manner. By filing early, customs brokers can avoid any potential delays or penalties that may arise from late filing.

When filing for ISF, it is important for customs brokers to have accurate and complete information about the shipment. This includes details such as the shipper's name and address, consignee's name and address, the manufacturer's name and address, and a description of the goods being imported. Additionally, customs brokers must also provide information regarding the container stuffing location, the consolidator's name and address, as well as the vessel and voyage details. It is imperative that all this information is correctly entered to avoid any delays or penalties.

Finally, once the ISF is filed, customs brokers must keep a record of it for at least five years from the date of filing. This is important for future reference and any potential audits by CBP. Having a record of the ISF ensures compliance with CBP regulations and provides evidence of proper filing procedures.

In conclusion, early filing for ISF provides numerous advantages for both customs brokers and importers. It allows for better planning, early identification of issues, and a smoother clearance process at the port. By ensuring the accurate and timely submission of required information, customs brokers can facilitate a hassle-free importing experience for their clients. #usimportbond #isfcustomsbroker #uscustomsclearing #isfentry

Video Disclaimer Here: For educational purposes - No affiliation with US government sectors.

-

LIVE

LIVE

iCkEdMeL

22 minutes ago🔴 BREAKING: Gunman Opens Fire at Tim Pool’s Home

3,566 watching -

LIVE

LIVE

Grant Cardone

2 hours agoHow to Find Your First $1million Profit In Real Estate

6,360 watching -

LIVE

LIVE

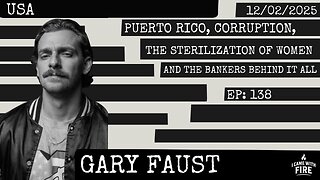

I_Came_With_Fire_Podcast

10 hours agoPuerto Rico, Corruption, Ther Sterilization of Women, and the Bankers Behind it All

636 watching -

![Mr & Mrs X - [DS] Pushing Division, Traitors Will Be Exposed, Hold The Line - EP 18](https://1a-1791.com/video/fwe2/96/s8/1/w/U/W/F/wUWFz.0kob-small-Mr-and-Mrs-X-DS-Pushing-Div.jpg) 54:40

54:40

X22 Report

4 hours agoMr & Mrs X - [DS] Pushing Division, Traitors Will Be Exposed, Hold The Line - EP 18

87.5K19 -

1:34:19

1:34:19

LumpyPotatoX2

1 hour agoDestiny Rising: Gameplay - Partnered Creator

8.81K -

1:10:32

1:10:32

Wendy Bell Radio

7 hours agoPet Talk With The Pet Doc

27.5K19 -

LIVE

LIVE

ttvglamourx

1 hour ago $0.51 earnedHAPPY SATURDAY !DISCORD

252 watching -

18:53

18:53

Wrestling Flashback

23 days ago $8.94 earned10 WWE Wrestlers Who Ruined Their Bodies Wrestling Too Long

21.7K4 -

LIVE

LIVE

Amarok_X

2 hours ago🟢LIVE WARZONE | LETS SQUAD UP | PREMIUM CREATOR | VETERAN GAMER

172 watching -

27:03

27:03

The Kevin Trudeau Show Limitless

3 days agoThey're Not Hiding Aliens. They're Hiding This.

55.6K76