Premium Only Content

LIC Insurance Policy Vs LIC SIP Mutual Fund For Long Time Money Making Wealth Gain 36.76% Return

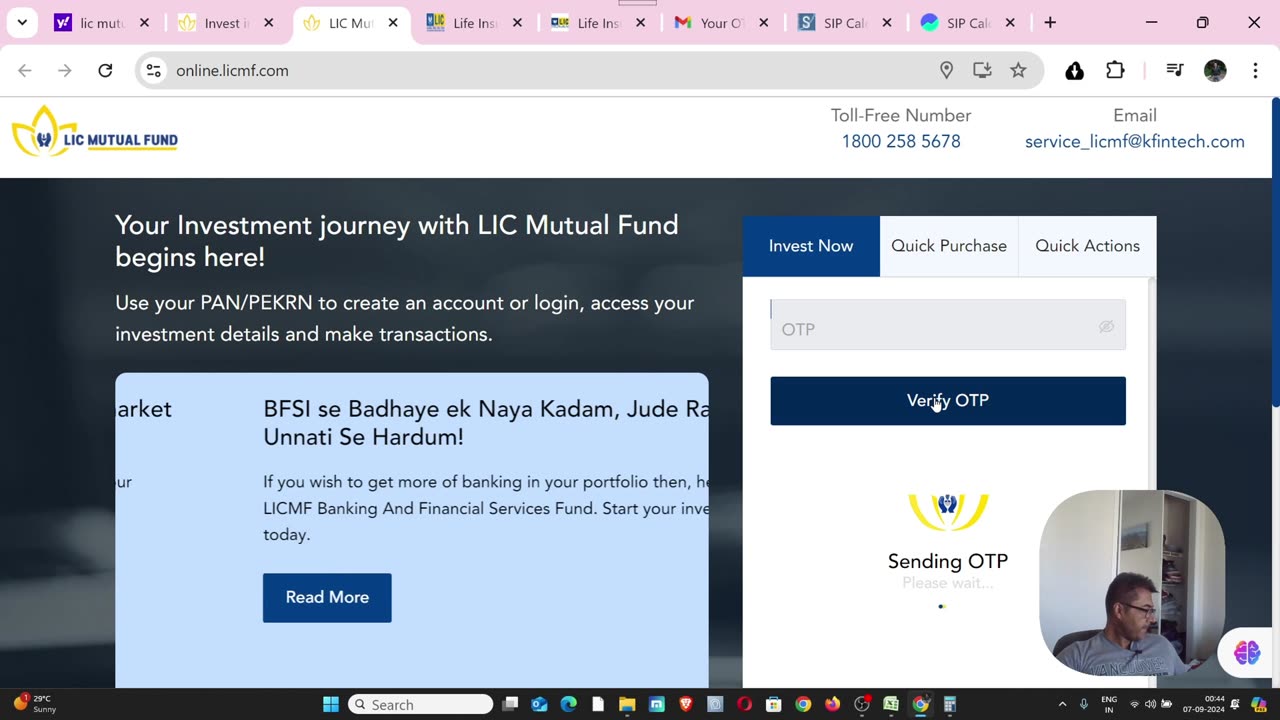

here in this video i am going to show you step by step all results , and can see and think which is better LIC Insurance ( Life Insurance Policy ) Or LIC SIP Mutual Fund investing for wealth gain and money making

I myself invested in both money making tools to earn money from my investment i brought 700000 lic policy Jeevan Annand and another 100000 lumpsum endowment policy for 21 years terms and my yearly premium 34809/- and 5156 /- Rs. i paid yearly premium but i divided my combined premium to monthly which is 3330 ,

now on other side i am contumely investing 500 rs. monthly in LIC Mutual FUND ELSS Fund as SIP , you can see i am getting 36.76% Returns on that

so if i did not invested in LIC insurance and same amount i invested in LIC mutual fund or any other equity mutual fund and almost same yearly gain i got and then my invested amount after 21 years around 9.85 Crores ,

So India growth story day by day gaining now the time is where China was around

#licinsurance

#licmutualfund

#mutualfundsindia

#howtoinvestinmutualfund

#bestwaystoinvestinmutualfund

#sipinvestment

#bestmoneymakingtips

#howtoinvestinmutualfund

#longtimemutualfundinvesting

so you can see how you can invest and gain money in SIP as long time investor

how to earn monthly income from sip , how to invest 500 rupees per month , money investment tips , how to increase saving money, how to grow financially in life , best lumpsum investment for monthly income , this week in money , bestversionus- finances bestversionus , my lead gen secret, grow your money by investing in long terms SIPs and stock investment, see stock analysis

-

LIVE

LIVE

Welcome to the Rebellion Podcast

19 hours agoMonday Funday - WTTR Podcast Live 8/25

308 watching -

1:21:24

1:21:24

Game On!

15 hours ago $0.02 earnedTom Brady And The Las Vegas Raiders ARE BACK! 2025 NFL Preview!

23.9K1 -

LIVE

LIVE

The Bubba Army

2 days agoShould RaJa Jackson Be Arrested? - Bubba the Love Sponge® Show | 8/25/25

1,928 watching -

LIVE

LIVE

FyrBorne

14 hours ago🔴Warzone M&K Sniping: Builds So Strong They Think I'm Hacking

272 watching -

2:01:48

2:01:48

BEK TV

3 days agoTrent Loos in the Morning - 8/25/2025

19.9K -

4:23

4:23

Blackstone Griddles

17 hours agoEasy Salmon Dinner on the Blackstone Griddle

36K2 -

8:10

8:10

WhaddoYouMeme

1 day ago $0.08 earnedChristians, Before You See “Testament”, Watch this!

13.5K5 -

8:42

8:42

Freedom Frontline

15 hours agoDurbin’s Trump Smear Video Just HUMILIATED Him in the Senate

20K8 -

10:56

10:56

ariellescarcella

13 hours agoThe Shocking Divide Among College Voters Sparks Worry For America

14.6K8 -

13:09

13:09

Forrest Galante

12 hours agoWildlife Expert Reacts To Deadly Australian Animal TikToks

64.7K10