Premium Only Content

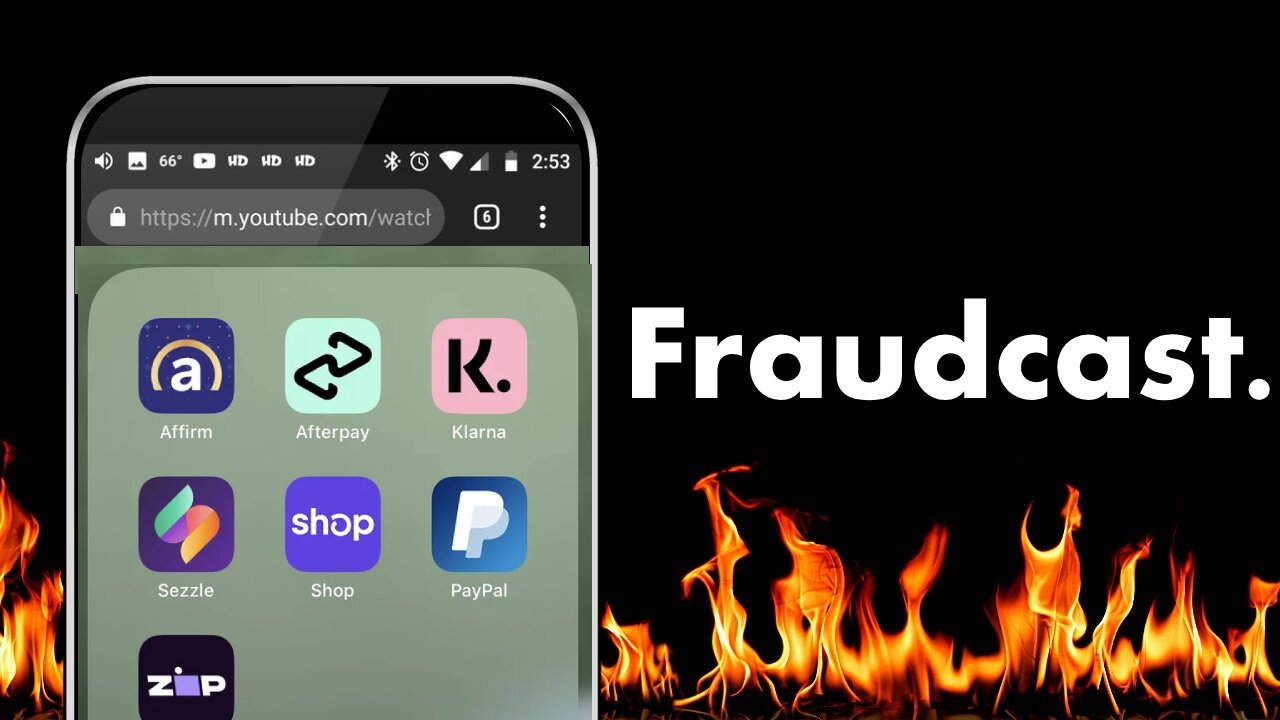

Buy Now Pay Later Is A Joke

Buy Now, Pay Later (BNPL) services like Affirm, Klarna, and Afterpay are taking over the way we shop, but they are also fueling a hidden debt crisis that could soon bring the global economy to its knees. While BNPL promises zero-interest loans and the ability to buy now and pay later, it’s rapidly becoming one of the largest unregulated debt bubbles in history. Consumers—especially young shoppers—are being lured into a false sense of financial security, unaware that these loans are quietly destroying their credit and contributing to a massive financial time bomb.

In this video, we dive deep into the alarming rise of BNPL, exploring how its rapid expansion mimics the dangerous subprime mortgage crisis that led to the 2008 financial collapse. With BNPL loans soaring from $2 billion in 2019 to a staggering $24.2 billion in 2021, more and more consumers are falling into the trap of hidden debt. Unlike traditional credit cards, BNPL doesn’t report to credit agencies, meaning people can rack up loans without realizing the severe consequences until it’s too late.

The worst part? Many BNPL users are relying on these loans for essential items like groceries and utility bills—necessities, not luxuries. This growing dependency on BNPL is leading to widespread financial insecurity, and missed payments are becoming increasingly common, threatening to derail consumers’ credit scores. What’s even more concerning is that BNPL is becoming a major player in the retail world, with merchants happily paying higher fees because BNPL services increase sales. But these services don’t just put consumers at risk—they also pose a serious threat to the broader economy.

As delinquencies rise, especially among younger borrowers, experts are warning that BNPL’s unchecked growth could soon push the global economy into another financial meltdown. Just like the subprime mortgage crisis, BNPL’s lack of regulation and oversight makes it a ticking time bomb, one that could lead to mass defaults and widespread economic damage. This video explores how BNPL is becoming the next financial disaster we’re all overlooking—one that could endanger not just consumers but the entire financial system.

Stay tuned to find out why BNPL isn’t just a harmless shopping trend—it’s a debt crisis in disguise that could bring the global economy to its breaking point.

0:00 Gen Z No BNPL Guilt

0:40 Subprime Mortgage Parallel

1:25 BNPL’s Hidden Consumer Risks

1:38 What is a BNPL?

2:14 The Rise of BNPL

3:23 BNPL vs Credit Cards

4:07 Why Gen Z Finds BNPL Safer

4:20 BNPL's Rise on Social Media

5:38 How do BNPL’s Make Money?

6:22 BNPL Risks in Detail

7:41 Untracked BNPL Debt Data

9:07 BNPL Phantom Debt Crisis

10:45 BNPL Default Problem

-

7:32

7:32

Mini Money Docs™

4 months agoWhat Killed Quiznos? (It Wasn’t Subway)

15 -

UPCOMING

UPCOMING

FreshandFit

7 hours agoLas Vegas Takeover!

5.62K7 -

LIVE

LIVE

Badlands Media

7 hours agoDevolution Power Hour Ep. 404

7,945 watching -

LIVE

LIVE

Drew Hernandez

20 hours agoGOP COOKED INTO DENIAL & 12 ISRAELI-LINKED PHONES DETECTED AT UVU DAY OF CK EXECUTION?

960 watching -

2:46:08

2:46:08

TimcastIRL

3 hours agoFAA To STOP Flights Over Shutdown, May CLOSE Airspace, Thanksgiving Travel APOCALYPSE | Timcast IRL

144K73 -

1:56:20

1:56:20

Tucker Carlson

3 hours agoIt’s Time to Decide: America First or Lindsey Graham’s Psychosexual Death Cult?

26.2K192 -

LIVE

LIVE

SpartakusLIVE

5 hours agoBattlefield 6 - REDSEC || ARC Raiders Later? || Anybody Want Warzone???

617 watching -

LIVE

LIVE

Alex Zedra

2 hours agoLIVE! Spooky Games tn

186 watching -

LIVE

LIVE

I_Came_With_Fire_Podcast

12 hours agoThe Normalization of Political Violence | Right Wing In-Fighting | China Chooses China

186 watching -

LIVE

LIVE

PandaSub2000

7 hours agoLIVE 10:30pm ET | BUZZ TRIVIA with Chat!

146 watching