Premium Only Content

Mastering ISF Filing for Women's Knit Tops: Choosing the Right Path

ISF Filer || isf@isffiler.com || 858-280-9374 || www.isffiler.com

In this video, we discuss the important topic of where to file an Importer Security Filing (ISF) for women's knit tops. An ISF is a mandatory filing requirement enforced by US Customs and Border Protection (CBP) to enhance security and facilitate risk assessment of imported cargo. The responsibility for filing an ISF lies with the importer of record or their authorized agent, such as a licensed customs broker. There are two options for filing an ISF: independently using the Automated Broker Interface (ABI) system or hiring the services of a licensed customs broker. When choosing a customs broker, it is important to consider their expertise in the specific product category, and they can assist with other customs-related matters such as tariff classification and duty calculation. Additionally, a customs bond may also be required, and your customs broker can guide you on this matter. Accurate and timely filings are crucial to avoid penalties and delays in the importation process.

#usimportbond #isfcustomsbroker #uscustomsclearing #isfentry

Video Disclaimer Here: This video is intended for educational purposes and has no affiliation with US government entities.

00:26 - Understanding ISF Requirements: An Importer Security Filing (ISF), also known as 10+2, is mandatory for importers to enhance cargo security and facilitate risk assessment by U.S. Customs and Border Protection. It must be filed at least 24 hours before a vessel's departure to the U.S.

01:05 - Filing Options: Importers can file the ISF independently using the Automated Broker Interface (ABI) system, but it's often more efficient to hire a licensed customs broker who specializes in ISF filings for women's knit tops, ensuring compliance and timely submissions.

01:27 - Additional Support: Customs brokers not only assist with ISF filing but also provide guidance on tariff classification, duty calculation, and compliance with trade regulations. They can also advise on the need for a customs bond to guarantee payment of duties and taxes.

-

59:21

59:21

Adam Does Movies

6 hours ago $1.24 earnedMore Reboots + A Good Netflix Movie + Disney Live-Action Rant - LIVE

29.6K1 -

36:28

36:28

TheTapeLibrary

15 hours ago $7.86 earnedThe Disturbing True Horror of the Hexham Heads

57.8K5 -

6:08:00

6:08:00

JdaDelete

1 day ago $1.22 earnedHalo MCC with the Rumble Spartans 💥

37.3K7 -

3:52:22

3:52:22

Edge of Wonder

9 hours agoChristmas Mandela Effects, UFO Drone Updates & Holiday Government Shake-Ups

33.8K8 -

1:37:36

1:37:36

Mally_Mouse

8 hours agoLet's Play!! -- Friends Friday!

39.3K1 -

57:45

57:45

LFA TV

1 day agoObama’s Fake World Comes Crashing Down | Trumpet Daily 12.20.24 7PM EST

35K15 -

1:27:17

1:27:17

2 MIKES LIVE

7 hours ago2 MIKES LIVE #158 Government Shutdown Looms and Games!

30.9K10 -

1:07:34

1:07:34

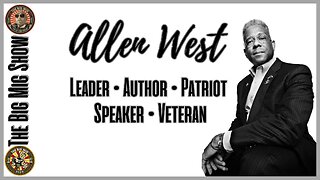

The Big Mig™

11 hours agoVeteran, Patriot, Leader, Author Allen West joins The Big Mig Show

30.3K8 -

1:06:47

1:06:47

The Amber May Show

1 day ago $1.18 earnedBloated CR Failed | What Did The View Say Now? | Who Kept Their Job At ABC| Isaac Hayes

18.5K2 -

59:29

59:29

State of the Second Podcast

4 days agoAre We Losing the Fight for Gun Rights? (ft. XTech)

32.8K3