Premium Only Content

Bret Baier Examines the Problems of Crime & Taxes in Illinois

The problems of crime and taxes in Illinois, as of 2024, present a multifaceted issue that intertwines economic policy, public safety, and social justice. Here's an examination based on the latest information:

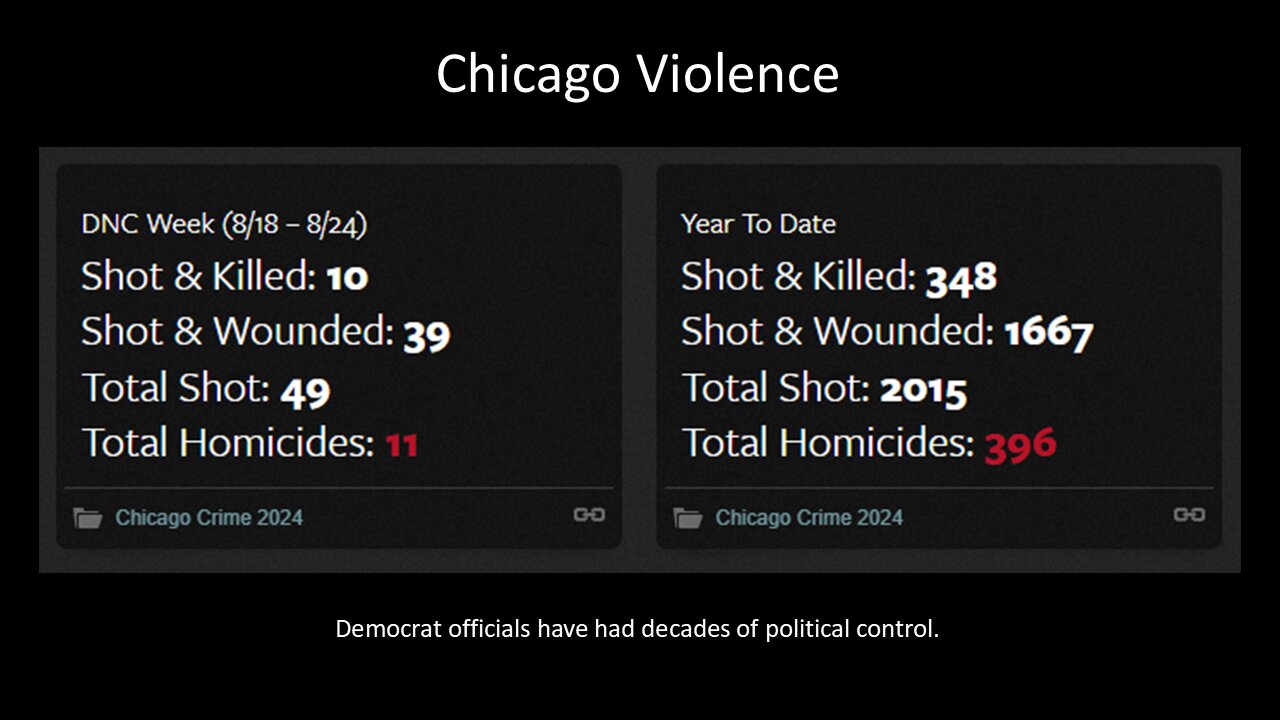

Increase in Violent Crime: There's been an 18% rise in violent crime over the last decade in Chicago, with a notable 11.5% increase in 2023 alone. Despite a decrease in homicides, other violent crimes like vehicle thefts and assaults have surged, indicating a shift in crime patterns rather than an overall reduction in violence.

Arrest Rates: Concurrently, there's been a significant drop in arrest rates, down by 43% over ten years. This decline suggests either a change in law enforcement strategies, policy impacts like the SAFE-T Act's cash bail reform, or both, potentially leading to fewer apprehensions for violent crimes.

High Tax Burden: Illinois has one of the highest tax burdens in the U.S., particularly with property taxes, which are the highest in the nation. This burden is exacerbated by the state's need to fund public pensions, which are significantly underfunded, leading to increased taxation to cover these obligations.

Revenue and Spending: Despite high taxes, Illinois faces revenue shortfalls. The state's spending has outpaced revenue growth, with significant portions of property taxes going towards pension funds, which are only 20% funded. This has led to a scenario where despite high taxation, there's still a need for more revenue, often leading to further tax increases or new taxes.

Interplay Between Crime and Taxes:

Public Safety vs. Economic Stability: The rise in crime, potentially influenced by policies like the SAFE-T Act, alongside high taxes, creates a narrative where public safety and economic stability are seen as inversely related. High taxes might fund more police or social programs, but if crime continues to rise, it undermines the economic stability that taxes are supposed to support.

Community and Business Exodus: The combination of these factors has led to a sentiment of dissatisfaction, with some posts indicating that businesses and individuals are leaving Illinois due to these pressures, which in turn reduces the tax base, leading to a vicious cycle.

In summary, Illinois faces a complex scenario where crime and taxes are not isolated issues but are deeply interconnected with economic policy, social justice reforms, and public safety. The state's approach to these problems, as reflected in public discourse and policy changes, shows a struggle between maintaining fiscal responsibility, ensuring public safety, and addressing social equity, with no easy solutions in sight.

-

22:57

22:57

Illinois Family Action

4 months agoFreedom Caucus Members Lament IL Budget Process & Possible Tax Hikes

172 -

LIVE

LIVE

Side Scrollers Podcast

3 days ago🔴FIRST EVER RUMBLE SUB-A-THON🔴DAY 3🔴PLAYING MIKE TYSON'S PUNCH OUT TILL I WIN!

1,256 watching -

17:14

17:14

Mrgunsngear

2 hours ago $1.73 earnedUpdate: Current Glocks Discontinued & Glock V Series Is Coming!

1.26K16 -

2:52:54

2:52:54

Barry Cunningham

3 hours agoMUST SEE: PRESIDENT TRUMP NATO PRESSER! AND NEW YORK CITY MAYORAL DEBATE!

18.6K32 -

13:15

13:15

Cash Jordan

5 hours ago"INVASION" Mob STRIKES Chicago Jail… FRONTLINE Marines IGNORE Judge, SMASH Illegals

2.34K13 -

LIVE

LIVE

SpartakusLIVE

2 hours ago#1 Solo Challenge CHAMPION entertains HERDS of NERDS

107 watching -

LIVE

LIVE

Alex Zedra

1 hour agoLIVE! New Game | DeathWatchers

91 watching -

LIVE

LIVE

Nikko Ortiz

2 hours agoShotguns With A Magazine... |Rumble Live

59 watching -

23:18

23:18

Lady Decade

7 hours agoThe Diversity Lie Gaming Refuses To Talk About

1.1K4 -

LIVE

LIVE

Geeks + Gamers

2 hours agoGeeks+Gamers Play- MARIO KART WORLD

137 watching