Premium Only Content

Bret Baier Examines the Problems of Crime & Taxes in Illinois

The problems of crime and taxes in Illinois, as of 2024, present a multifaceted issue that intertwines economic policy, public safety, and social justice. Here's an examination based on the latest information:

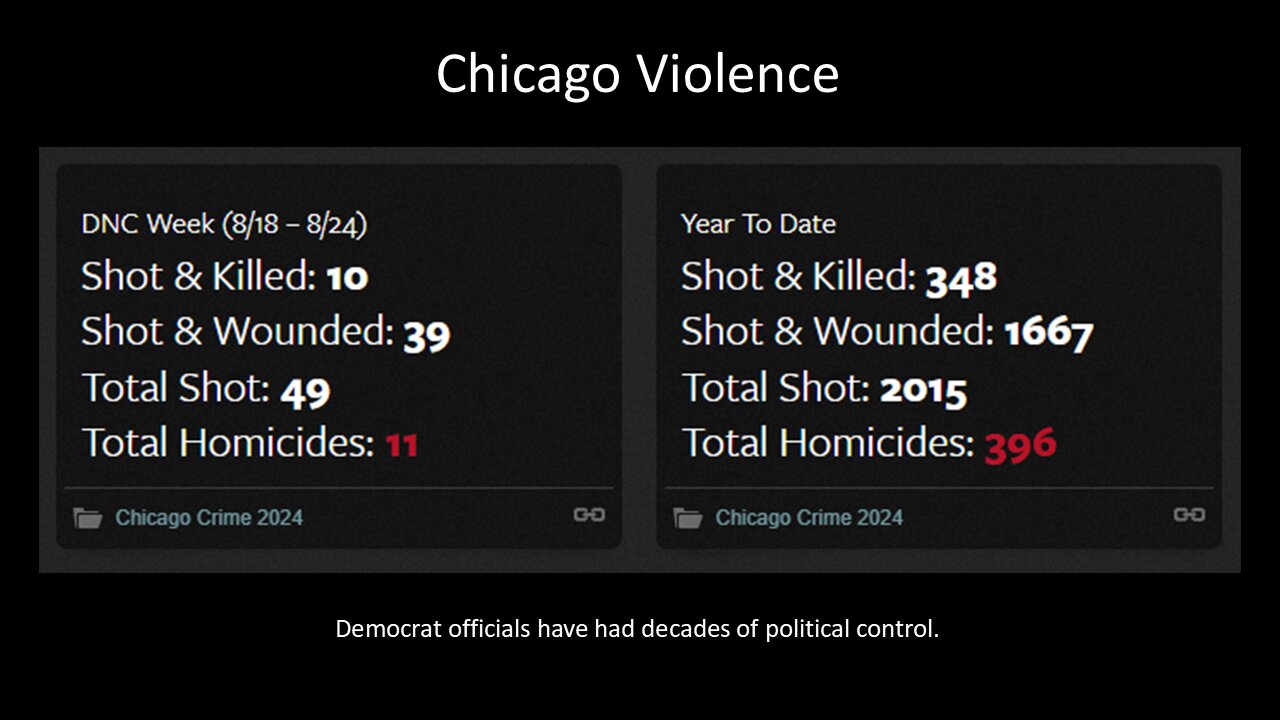

Increase in Violent Crime: There's been an 18% rise in violent crime over the last decade in Chicago, with a notable 11.5% increase in 2023 alone. Despite a decrease in homicides, other violent crimes like vehicle thefts and assaults have surged, indicating a shift in crime patterns rather than an overall reduction in violence.

Arrest Rates: Concurrently, there's been a significant drop in arrest rates, down by 43% over ten years. This decline suggests either a change in law enforcement strategies, policy impacts like the SAFE-T Act's cash bail reform, or both, potentially leading to fewer apprehensions for violent crimes.

High Tax Burden: Illinois has one of the highest tax burdens in the U.S., particularly with property taxes, which are the highest in the nation. This burden is exacerbated by the state's need to fund public pensions, which are significantly underfunded, leading to increased taxation to cover these obligations.

Revenue and Spending: Despite high taxes, Illinois faces revenue shortfalls. The state's spending has outpaced revenue growth, with significant portions of property taxes going towards pension funds, which are only 20% funded. This has led to a scenario where despite high taxation, there's still a need for more revenue, often leading to further tax increases or new taxes.

Interplay Between Crime and Taxes:

Public Safety vs. Economic Stability: The rise in crime, potentially influenced by policies like the SAFE-T Act, alongside high taxes, creates a narrative where public safety and economic stability are seen as inversely related. High taxes might fund more police or social programs, but if crime continues to rise, it undermines the economic stability that taxes are supposed to support.

Community and Business Exodus: The combination of these factors has led to a sentiment of dissatisfaction, with some posts indicating that businesses and individuals are leaving Illinois due to these pressures, which in turn reduces the tax base, leading to a vicious cycle.

In summary, Illinois faces a complex scenario where crime and taxes are not isolated issues but are deeply interconnected with economic policy, social justice reforms, and public safety. The state's approach to these problems, as reflected in public discourse and policy changes, shows a struggle between maintaining fiscal responsibility, ensuring public safety, and addressing social equity, with no easy solutions in sight.

-

22:57

22:57

Illinois Family Action

1 month agoTed Cruz: 12 Highlights From the "Big Beautiful Bill"

51 -

LIVE

LIVE

Nerdrotic

3 hours ago $4.62 earnedLet's TACO-bout Take Us North, Hollywood COPE! Cracker Barrel CRACKED! | Friday Night Tights 369

1,644 watching -

LIVE

LIVE

StoneMountain64

3 hours ago#1 Battlefield Mastery Session with the BOYS

199 watching -

1:23:45

1:23:45

Roseanne Barr

4 hours agoDeclassifying Presidential Sex Slavery W/ Cathy O’Brien | The Roseanne Barr Podcast #113

93.5K30 -

LIVE

LIVE

FusedAegisTV

18 hours agoHollow Knight Silksong Waiting Room ~~ pt. I

80 watching -

8:37

8:37

Warren Smith - Secret Scholar Society

7 hours agoJesse Lee Peterson EXPOSES How Stupid David Pakman Really Is

19.3K11 -

44:44

44:44

Scammer Payback

9 hours agoCrazy Confrontation with Hacked Scammer Group

14.5K2 -

1:09:00

1:09:00

vivafrei

4 hours agoKamala Harris Security Being "Pulled"? Kilmar Wants Trump Admin GAGGED! Fake News GALORE & MORE!

70.5K34 -

1:33:32

1:33:32

The Quartering

6 hours agoContest Winners Picked, More Trans Attacks, SNL Collapsing, Raja Jackson STILL Not Arrested!

207K171 -

1:19:44

1:19:44

Mark Kaye

6 hours ago🔴 Kamala FURIOUS Over Trump's Latest Move!

33.7K13