Premium Only Content

Demystifying ISF 10 How Customs HTS Codes Impact Importer Security Filings!

ISF Solution | (800-2

In this video, we deep dive into the concept of ISF 10+2 and its relationship with Customs HTS codes. ISF 10+2, also known as Importer Security Filing, is a requirement by US Customs and Border Protection (CBP) to enhance security in the global supply chain. It involves electronic filings of specific data elements for sea shipments. Customs HTS codes are internationally recognized codes that classify products for import and export, providing a standardized way to identify and categorize goods. The Importer Security Filing includes HTS codes for each item in the shipment. Accurate HTS codes are crucial as they determine duties, taxes, and fees and ensure compliance with CBP regulations. Working with a customs broker can help navigate this complex process and ensure compliance with ISF 10+2 requirements.

#usimportbond #isfcustomsbroker #uscustomsclearing #isfentry video explores the relationship between Importer Security Filing (ISF) and Customs HTS codes in the context of customs brokerage and international trade. Importer Security Filing is a program that requires importers to provide information about their shipments before they arrive in the United States, enhancing cargo security and facilitating risk assessment. Customs HTS codes are standardized classification codes used to identify and classify traded products, helping customs authorities determine appropriate tariffs and regulations. The video explains how the two concepts are interconnected, with importers needing to provide HTS codes in their ISF filings to ensure compliance with customs regulations and proper assessment of duties. The expertise of customs brokers in determining HTS codes accurately is discussed, along with the importance of a valid customs bond in the ISF process. The video concludes by emphasizing the significance of accurate ISF filings, customs broker assistance, and a valid customs bond in ensuring smooth import processes and compliance with customs regulations.

[email protected] | www.isfsolution.com

In today's episode, we will be exploring the concept of bonded warehouses and their significance in the world of customs brokerage. A bonded warehouse is a secure facility where imported goods can be stored without payment of customs duties and taxes until they are released for domestic consumption or re-exported. These warehouses are regulated and supervised by customs authorities to ensure compliance with import regulations and safeguard national revenue.

The primary advantage of utilizing a bonded warehouse is the postponement of customs duties and taxes. Importers can defer the payment of duties until the goods are actually released for consumption. This can help improve cash flow and provide financial flexibility for businesses.

Additionally, bonded warehouses offer storage and inventory management services, allowing importers to efficiently manage their supply chain. Goods can be stored for extended periods of time, giving importers the flexibility to strategize their distribution and sales.

Another benefit of bonded warehouses is the ability to manipulate and process goods within the facility. Importers can perform value-added activities, such as sorting, packaging, labeling, and assembly, without paying duties or taxes on the intermediate products. This can help streamline operations and reduce logistics costs.

Furthermore, bonded warehouses provide enhanced security for stored goods. These facilities are subject to strict security measures to prevent theft, damage, or unauthorized access. Importers can have peace of mind knowing that their goods are being stored in a controlled and secure environment.

Overall, bonded warehouses play a crucial role in the customs brokerage process by providing importers with a range of benefits, including duty deferment, supply chain management, value-added activities, and enhanced security. Working with a knowledgeable customs broker can help importers navigate the complexities of utilizing bonded warehouses and optimize their customs procedures.

Video Disclaimer Here: For educational purposes - No affiliation with US government sectors.

-

LIVE

LIVE

Grant Cardone

4 hours agoHow to Find Your First $1million Profit In Real Estate

1,918 watching -

LIVE

LIVE

This is the Ray Gaming

47 minutes agoNew Shirt SaturRAY | Rumble Premium Creator

57 watching -

LIVE

LIVE

PenguinSteve

22 minutes agoLIVE! The Return of the Battlefield 6!

85 watching -

54:54

54:54

iCkEdMeL

2 hours ago $46.80 earned🔴 BREAKING: Gunman Opens Fire at Tim Pool’s Home

71K31 -

LIVE

LIVE

GamingWithHemp

2 hours agoPlaying Metroid Prime 4 episode 1 A new beginning

89 watching -

2:30:55

2:30:55

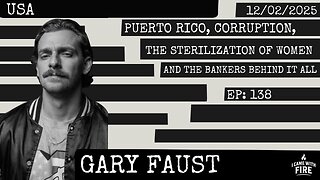

I_Came_With_Fire_Podcast

12 hours agoPuerto Rico, Corruption, Ther Sterilization of Women, and the Bankers Behind it All

19.9K15 -

![Mr & Mrs X - [DS] Pushing Division, Traitors Will Be Exposed, Hold The Line - EP 18](https://1a-1791.com/video/fwe2/96/s8/1/w/U/W/F/wUWFz.0kob-small-Mr-and-Mrs-X-DS-Pushing-Div.jpg) 54:40

54:40

X22 Report

6 hours agoMr & Mrs X - [DS] Pushing Division, Traitors Will Be Exposed, Hold The Line - EP 18

106K28 -

3:14:03

3:14:03

ttvglamourx

3 hours ago $2.66 earnedHAPPY SATURDAY !DISCORD

26.3K3 -

18:53

18:53

Wrestling Flashback

23 days ago $9.83 earned10 WWE Wrestlers Who Ruined Their Bodies Wrestling Too Long

36.5K4 -

LIVE

LIVE

Amarok_X

4 hours ago🟢LIVE WARZONE | LETS SQUAD UP | PREMIUM CREATOR | VETERAN GAMER

148 watching