Premium Only Content

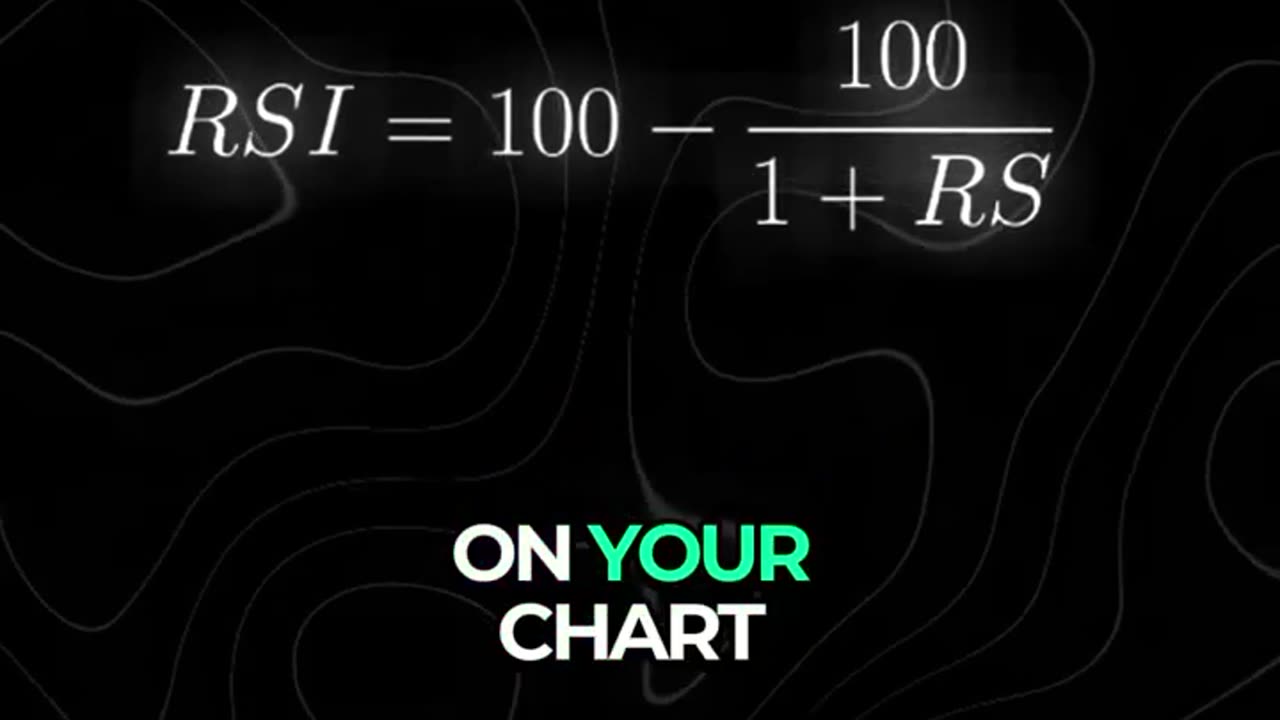

RSI Indicator - OOOOO

Reversal Patterns

A price pattern that signals a change in the prevailing trend is known as a reversal pattern. These patterns signify periods where the bulls or the bears have run out of steam. The established trend will pause, then head in a new direction as new energy emerges from the other side (bull or bear).

3

For example, an uptrend supported by enthusiasm from the bulls can pause, signifying even pressure from both the bulls and bears, then eventually give way to the bears. This results in a change in trend to the downside.

Reversals that occur at market tops are known as distribution patterns, where the trading instrument becomes more enthusiastically sold than bought. Conversely, reversals that occur at market bottoms are known as accumulation patterns, where the trading instrument becomes more actively bought than sold.

The longer the pattern takes to develop and the larger the price movement within the pattern, the larger the expected move once the price breaks out.

When a price reverses after a pause, the price pattern is known as a reversal pattern. Examples of common reversal patterns include:

Head and Shoulders, signaling two smaller price movements surrounding one larger movement

Double Tops, representing a short-term swing high, followed by a subsequent failed attempt to break above the same resistance level

Double Bottoms, showing a short-term swing low, followed by another failed attempt to break below the same support level

Pennants

Pennants are continuation patterns drawn with two trendlines that eventually converge. A key characteristic of pennants is that the trendlines move in two directions—one will be a down trendline and the other an up trendline. The figure below shows an example of a pennant. Often, the volume will decrease during the formation of the pennant, followed by an increase when the price eventually breaks out.

A bullish pennant is a pattern that indicates an upward trending price—the flagpole is on the left of the pennant.

Bullish pennant trading indicator

Image by Sabrina Jiang © Investopedia 2020

A bearish pennant is a pattern that indicates a downward trend in prices. In a bearish pattern, volume is falling, and a flagpole forms on the right side of the pennant.

Flags

Flags are continuation patterns constructed using two parallel trendlines that can slope up, down, or sideways (horizontal). Generally, a flag with an upward slope (bullish) appears as a pause in a down trending market; a flag with a downward bias (bearish) shows a break during an up trending market. Typically, the flag's formation is accompanied by declining volume, which recovers as price breaks out of the flag formation.

-

LIVE

LIVE

Badlands Media

21 hours agoDevolution Power Hour Ep. 401

6,225 watching -

LIVE

LIVE

MattMorseTV

3 hours ago $83.89 earned🔴Antifa action INBOUND.🔴

8,837 watching -

LIVE

LIVE

Tundra Tactical

6 hours agoTundra Nation Live - Tundra's Guns?? We Finally See What Tundra Shoots

316 watching -

LIVE

LIVE

BlackDiamondGunsandGear

5 hours agoAFTER HOURS ARMORY / Whiskey & Windage

51 watching -

23:56

23:56

marcushouse

14 hours ago $1.48 earnedStarship Began the Demolition!? 🔥

3773 -

17:59

17:59

JohnXSantos

1 day agoI Gave AI 14 Days to Build NEW $5K/MONTH Clothing Brand

10 -

LIVE

LIVE

DLDAfterDark

4 hours agoGun Talk - Whiskey & Windage - The "Long Range" Jouney - After Hours Armory

65 watching -

9:37

9:37

Film Threat

6 hours agoSHELBY OAKS REVIEW | Film Threat

2275 -

35:40

35:40

The Mel K Show

1 hour agoMel K & Dr. Mary Talley Bowden MD | Heroes of the Plandemic: Doing What is Right No Matter the Cost | 10-25-25

2.03K3 -

3:06:20

3:06:20

FreshandFit

6 hours agoMILF date at ComplexCon with DJ Akademiks

178K22