Premium Only Content

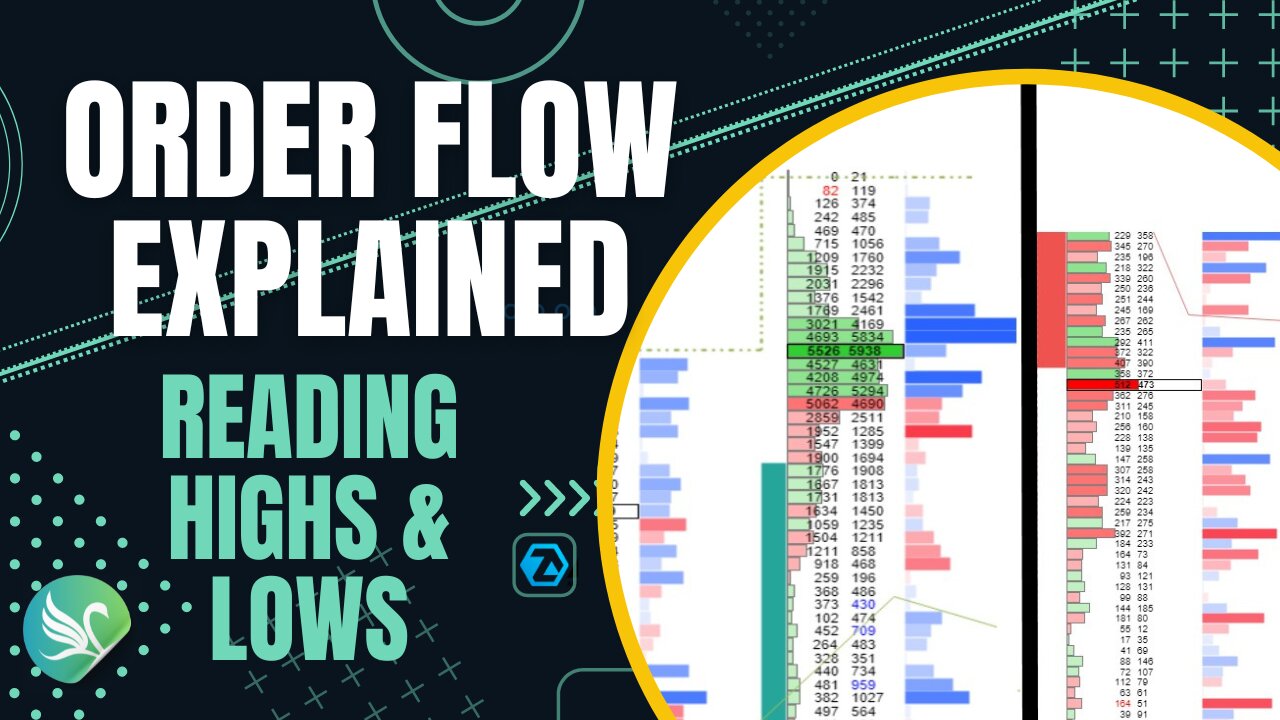

Mastering Order Flow: Reading Highs and Lows

Welcome to White Swan Finance!

In this episode of Matering Order Flow, we check out how to read highs and lows. Not strictly as a trade entry, although it can also be used as one. Use this video to help you read, interpret and apply a structured approach to your own order flow trading. This is lesson three in the series and we are now starting to cross cover parts that we have already learnt and use them simultaniously in our analysis. By the end of this video, you'll have more of an understanding on reading highs and lows and can apply this to youor own charts to help you read and scalp the market.

🔔 Subscribe to the channel to stay updated with valuable tips, strategies, and insights on trading. Don't miss out!📈 What you'll learn:

Understanding Order Flow

Utilizing Footprint Charts

Essential Trading Tips

Strategies to Become Profitable

Hit that subscribe button and join our community of traders! Follow for more updates!

__________________________________________________________________________________

00:00 | Intro

00:23 | ATAS Link

00:31 | Key Points

02:04 | 4 Key Factors Overview

03:08 | Finished Auction

04:09 | Imbalance

04:28 | Volume Tapering

05:05 | Delta and Volume Profile

06:00 | Low example

07:29 | How To Trade A High Or Low

10:16 | IMPORTANT NOTES

10:56 | Your Turn Example 1

11:04 | Your Turn Example 2

11:10 | Your Turn Example 3

11:24 | Example 1 Explained

12:40 | Example 2 Explained

13:59 | Example 3 Explained

15:36 | Summary & Helpful Notes

_______________________________________________________________________________________________________________

Software I use to trade is ATAS. You can check them out on the link below:

https://tinyurl.com/whiteswanfinance

Plus use this code for 5% off during August of 2024:

6EFSCLVTFU

_______________________________________________________________________________________________________________

Disclaimer: The information provided in this video is for educational purposes only and does not constitute financial advice. Trading involves risk, and you should conduct your own research and consult with a licensed financial advisor before making any trading decisions. White Swan Finance is not responsible for any losses incurred.

#trading #footprintchart #orderflow #tradingtips #becomeprofitable #trading #banknifty #futures #futurestrading #nqfutures #esfutures #whiteswanfinance #tradeorderflow #tradingorderflow #crypto #bitcoin #footprintchartstrategy #volumetrading #technicalanalysis #tradingpsychology #ATAS #ATASPlatform

-

20:22

20:22

The Pascal Show

1 day ago $2.61 earnedARE THEY IGNORING HER?! Is The White House & FBI Ignoring Candace Owens' A**assination Claims?!

25.1K15 -

1:00:45

1:00:45

TruthStream with Joe and Scott

1 day agoMondays with Matt Geiger from Verity Metals: Gold, Silver, The Housing Market and more. Live 12/1 6pm pacific #519

4.11K -

2:17:46

2:17:46

The Connect: With Johnny Mitchell

3 days ago $14.70 earnedA Sitdown With The Real Walter White: How An Honest Citizen Became A Synthetic Drug Kingpin

76.9K1 -

2:40:08

2:40:08

PandaSub2000

9 hours agoDEATH BET | Solo Episode 01 (Edited Replay)

1.65K -

LIVE

LIVE

Lofi Girl

3 years agolofi hip hop radio 📚 - beats to relax/study to

856 watching -

2:03:38

2:03:38

Inverted World Live

7 hours agoSatanic Pedophile Network in Australia | Ep. 149

230K55 -

3:34:45

3:34:45

TimcastIRL

8 hours agoCandace Owens Implies TPUSA KILLED Charlie Kirk, Claims Failed Bibi Deal Cost MILLIONS | Timcast IRL

227K162 -

6:38:10

6:38:10

SpartakusLIVE

9 hours agoTrios w/ The BOYS on WZ and then we're teaching Jean ARC RAIDERS

82.1K7 -

2:55:52

2:55:52

SOLTEKGG

7 hours agoLIVE - NOT LOSING A MATCH - NEW PC - !pc

39.8K2 -

2:55:16

2:55:16

ThatStarWarsGirl

7 hours agoTSWG LIVE: Stargate Is BACK! EFAPing Michael Shanks Interview with GUEST!!!

35.5K5