Premium Only Content

Unlocking Success: Mastering Trade Compliance for Seamless International Trade

ISF Filer || isf@isffiler.com || 858-280-9374 || www.isffiler.com

In conclusion, achieving trade compliance excellence in customs brokerage requires a multi-faceted approach. It starts with understanding the importance of customs bonds and ensuring their proper utilization to provide financial guarantees to customs authorities. Staying abreast of global trade regulations and working with experienced customs brokers is essential to navigate complex trade environments effectively. The implementation of comprehensive internal compliance programs, including regular audits and proper documentation practices, demonstrates due diligence and reduces the risk of non-compliance. Understanding and managing the Importer Security Filing process, as well as being prepared for customs inspections, further contribute to trade compliance excellence. By prioritizing trade compliance, importers can ensure smooth and efficient international trade operations while avoiding penalties and delays.

#usimportbond #isfcustomsbroker #uscustomsclearing #isfentry

Video Disclaimer Here: This video is intended for educational purposes and has no affiliation with US government entities.

00:24 - Importance of Customs Bonds: Customs bonds act as a financial guarantee for importers, ensuring that customs duties and fees are paid, thereby fostering trust between importers and customs authorities.

00:53 - Understanding Trade Regulations: Staying updated on global trade regulations is essential for compliance. Customs brokers provide expertise in navigating the complexities of customs procedures, tariff classifications, and documentation requirements.

01:23 - Managing Importer Security Filing (ISF): Compliance with ISF requirements is critical for ocean cargo entering the U.S. This involves submitting specific shipment information to enhance supply chain security and mitigate risks.

01:54 - Implementing Internal Compliance Programs: Establishing robust internal compliance measures, such as regular audits and record-keeping, helps demonstrate due diligence and prepares importers for customs inspections, reducing the risk of non-compliance.

-

1:09:59

1:09:59

Geeks + Gamers

6 hours agoSonic 3 DESTROYS Mufasa And Disney, Naughty Dog Actress SLAMS Gamers Over Intergalactic

60.1K9 -

51:59

51:59

The Dan Bongino Show

7 hours agoDemocrat Donor Admits The Scary Truth (Ep. 2393) - 12/23/2024

692K2.06K -

2:32:15

2:32:15

Matt Kohrs

18 hours agoRumble CEO Chris Pavlovski Talks $775M Tether Partnership || The MK Show

104K29 -

28:23

28:23

Dave Portnoy

18 hours agoDavey Day Trader Presented by Kraken - December 23, 2024

138K37 -

59:29

59:29

BonginoReport

9 hours agoTrump, Murder Plots, and the Christmas Miracle: Evita + Jack Posobiec (Ep.110) - 12/23/2024

148K126 -

2:59:14

2:59:14

Wendy Bell Radio

12 hours agoNothing To See Here

120K70 -

2:12:18

2:12:18

TheDozenPodcast

1 day agoIslam vs Christianity: Bob of Speakers' Corner

108K26 -

14:36

14:36

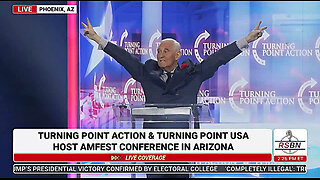

The StoneZONE with Roger Stone

1 day agoRoger Stone Delivers Riveting Speech at Turning Point’s AMFEST 2024 | FULL SPEECH

129K31 -

18:59

18:59

Fit'n Fire

18 hours ago $8.46 earnedZenith ZF5 The Best MP5 Clone available

89.2K4 -

58:34

58:34

Rethinking the Dollar

1 day agoTrump Faces 'Big Mess' Ahead | RTD News Update

63.8K6