Premium Only Content

Nvidia already in trouble, swamped by China's "all the above" strategy for chips

Investor alert video: Nvidia already in trouble, swamped by China's "all the above" strategy for chips 投資者警報:英偉達已經陷入困境,被中國「上述所有」晶片策略所淹沒

https://merics.org/en/report/huawei-quietly-dominating-chinas-semiconductor-supply-chain

https://www.morningstar.com/news/dow-jones/202405271617/china-unveils-48-billion-fund-to-bolster-chip-industry

https://www.barrons.com/articles/deere-stock-51644767351

https://fortune.com/asia/2024/07/05/china-poised-take-over-legacy-chips-mature-nodes-us-semiconductor-export-controls/

https://fasterplease.substack.com/p/fewer-and-faster-global-fertility

https://www.barrons.com/articles/companies-solving-world-food-shortage-stocks-51659046305

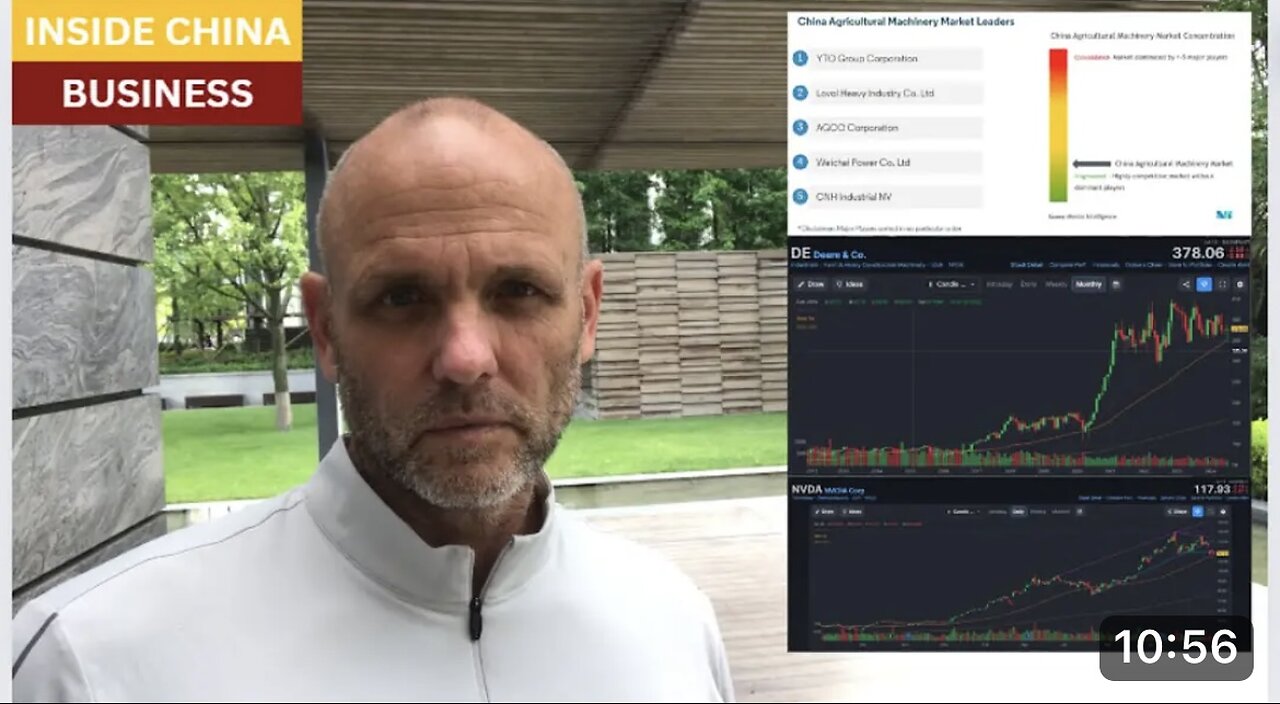

In 2022, investors raced into John Deere (DE) and Case New Holland (CNH), encouraged by the trendy investment theme of food scarcity, made much worse by the war in Ukraine and droughts in the US and Africa. The world would need huge volumes of new farm equipment to get us through the coming decades.

The fatal flaw of that thesis was that China had already developed a vast industrial sector that built low-cost, high quality farm equipment that would soon lead to soaring global food production and falling prices. As a result, Deere and CNH are now only competitive in the North American and European markets, where trade barriers have been erected to deny China's manufacturers access. Since those recommendations from sell-side Wall Street investment banks, Deere stock is back to where it was before the Ukraine war, and CNH shares are below prices of 2014.

The high-end semiconductor industry is attracting even greater interest from investors, who have made Nvidia a $3 trillion company. Here, too, China's massive capital investments and manpower advantages are already causing severe competitive problems for Nvidia. Huawei's chips are faster, more reliable, and are even priced more expensively than Nvidia's, while yet being less expensive to manufacture. Huawei, then, is enjoying far high profit margins than Nvidia in head-to-head sales.

However, Huawei and other Chinese tech companies are not allowed to sell high-end chips in the US market. Just as in the case of cars and agriculture equipment, Nvidia seems headed for a future similar to John Deere's present: competitive only in markets where Chinese have been closed off, and out of business everywhere else.

2022 年,受糧食短缺這一流行投資主題的鼓舞,投資者紛紛湧入約翰迪爾 (DE) 和凱斯紐荷蘭 (CNH),而烏克蘭戰爭以及美國和非洲的干旱則使情況雪上加霜。 世界將需要大量新的農業設備來支撐我們度過未來幾十年。

該論文的致命缺陷是,中國已經發展了一個龐大的工業部門,生產低成本、高品質的農業設備,這將很快導致全球糧食產量飆升和價格下跌。 結果,迪爾和CNH現在只在北美和歐洲市場具有競爭力,而這些市場已經設立了貿易壁壘,拒絕中國製造商進入。 由於賣方華爾街投資銀行的建議,迪爾股票已回到烏克蘭戰爭前的水平,而 CNH 股票則低於 2014 年的價格。

高端半導體產業正在吸引投資者更大的興趣,他們使英偉達成為一家價值 3 兆美元的公司。 在這方面,中國大量的資本投資和人力優勢也為英偉達帶來了嚴重的競爭問題。 華為的晶片速度更快、更可靠,甚至價格比英偉達的還要貴,但製造成本卻更低。 因此,在正面銷售中,華為的利潤率遠高於英偉達。

然而,華為和其他中國科技公司不被允許在美國市場銷售高階晶片。 正如汽車和農業設備領域一樣,英偉達的未來似乎與約翰迪爾的現狀相似:只在中國被封鎖的市場上具有競爭力,而在其他地方則失去業務.

-

59:24

59:24

The Dan Bongino Show

4 hours agoCoping Hollywood Actress Says Trump Supporters Are "Uneducated" (Ep. 2379) - 11/27/2024

455K1.23K -

DVR

DVR

Benny Johnson

2 hours agoKamala Campaign EXPOSED as Scam To DEFRAUD Democrats | Spiraling Drunk Kamala Posts Slurring RANT 🤣

44.2K70 -

6:49

6:49

Colion Noir

3 hours agoFood Vendor With Concealed Handgun License Shoots Robber Dead in Chicago

1.94K9 -

1:35:35

1:35:35

Graham Allen

5 hours agoDid Trump Just Bring Peace In Israel?! Biden Sending $24 BILLION To Ukraine! + Kamala Is Back???

107K200 -

1:56:47

1:56:47

Matt Kohrs

15 hours agoIt's Payday Friday!!! || The MK Show

44.7K7 -

35:31

35:31

BonginoReport

6 hours agoTackling Trump Derangement This Thanksgiving: Evita + Michael Knowles (Ep.94) - 11/27/24

91K140 -

2:06:14

2:06:14

LFA TV

16 hours agoTRUMP BROKE KAMALA! | LIVE FROM AMERICA 11.27.24 11am EST

63.3K22 -

1:50:22

1:50:22

Jeff Ahern

5 hours ago $8.11 earnedNever Woke Wednesday. The Thanksgiving show!

41K3 -

1:34:07

1:34:07

Game On!

17 hours ago $12.72 earnedThis is BAD! Things are getting so much worse for Conor McGregor!

62K6 -

33:38

33:38

Brewzle

1 day agoI Created My First Whiskey Blend!

85.5K11