Premium Only Content

Navigating Trade Wars: Impact on ISF Compliance

ISF Template | 562-453-7357 | isf@isftemplate.com | www.isftemplate.com

This video explores the impact of trade wars on compliance requirements, specifically focusing on Importer Security Filing (ISF) in the field of customs brokerage. Trade wars have caused disruptions and uncertainties in global trade, leading to more complex and stringent customs regulations. ISF is a mandatory filing requirement implemented by US Customs and Border Protection (CBP) for all ocean shipments entering the United States. It is crucial for enhancing supply chain security by allowing CBP to assess potential risks associated with cargo before it arrives at US ports. However, trade wars have directly affected compliance requirements for ISF, resulting in challenges for importers in determining the correct classification of goods and calculating proper valuation for Customs duties. Customs brokers play a vital role in helping importers navigate these complexities and ensure accurate ISF filings, as non-compliance can lead to severe consequences such as penalties and cargo delays. Importers must stay informed about trade developments, maintain proper documentation, and work closely with their customs broker to ensure compliance with ISF requirements.

#usimportbond #isfcustomsbroker #uscustomsclearing #isfentry

Video Disclaimer Here: This video is designed for education and is unaffiliated with US government bodies.

0:24 - Trade wars have caused disruptions in global trade, leading to more complex and stringent customs regulations and compliance requirements.

0:48 - Importer Security Filing (ISF) is a mandatory requirement by U.S. Customs and Border Protection for all ocean shipments entering the United States to ensure security and safety of goods.

1:20 - Trade wars have directly impacted ISF compliance requirements, making it challenging for importers to determine the correct classification of goods and calculate proper valuations for Customs duties.

-

LIVE

LIVE

cosmicvandenim

5 hours agoWARZONE - Kenetik Energy Announcement - Discord Spy Bots

57 watching -

1:05:51

1:05:51

Jeff Ahern

2 hours ago $13.79 earnedThe Saturday Show with Jeff Ahern

82.9K10 -

LIVE

LIVE

Misfit Electronic Gaming

37 minutes ago"LIVE" RUMBLE HALO Spartans "Halo MCC" 23 Followers to go till we hit !000 RUMBLE TAKEOVER

19 watching -

1:57:13

1:57:13

Film Threat

4 hours agoLIVE FROM SAN DIEGO COMIC-CON! (Saturday) | Film Threat Live

7.69K -

31:40

31:40

Tactical Advisor

3 hours agoEveryone Talks About This AR15 Being The Best? | Vault Room Live Stream 034

53.1K3 -

1:08:53

1:08:53

Michael Franzese

17 hours agoHollywood Deaths & Political Secrets: A Nation at a Crossroads?

147K93 -

9:27

9:27

MattMorseTV

1 day ago $14.95 earnedHe just lost EVERYTHING.

56.1K75 -

1:40:30

1:40:30

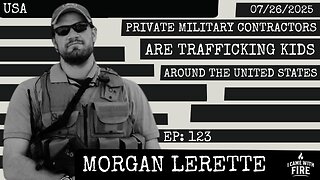

I_Came_With_Fire_Podcast

15 hours agoPrivate Military Contractors Are TRAFFICKING KIDS Around The United States

34.8K24 -

LIVE

LIVE

JdaDelete

17 hours ago $3.74 earnedFinal Fantasy VII Rebirth | Jdub's Journey Part 8 - Corel Prison

175 watching -

2:39:09

2:39:09

LFA TV

21 hours agoTHE ARK ENCOUNTER LIVE EVENT! 7.26.25 9AM EST-12PM EST

213K31