Premium Only Content

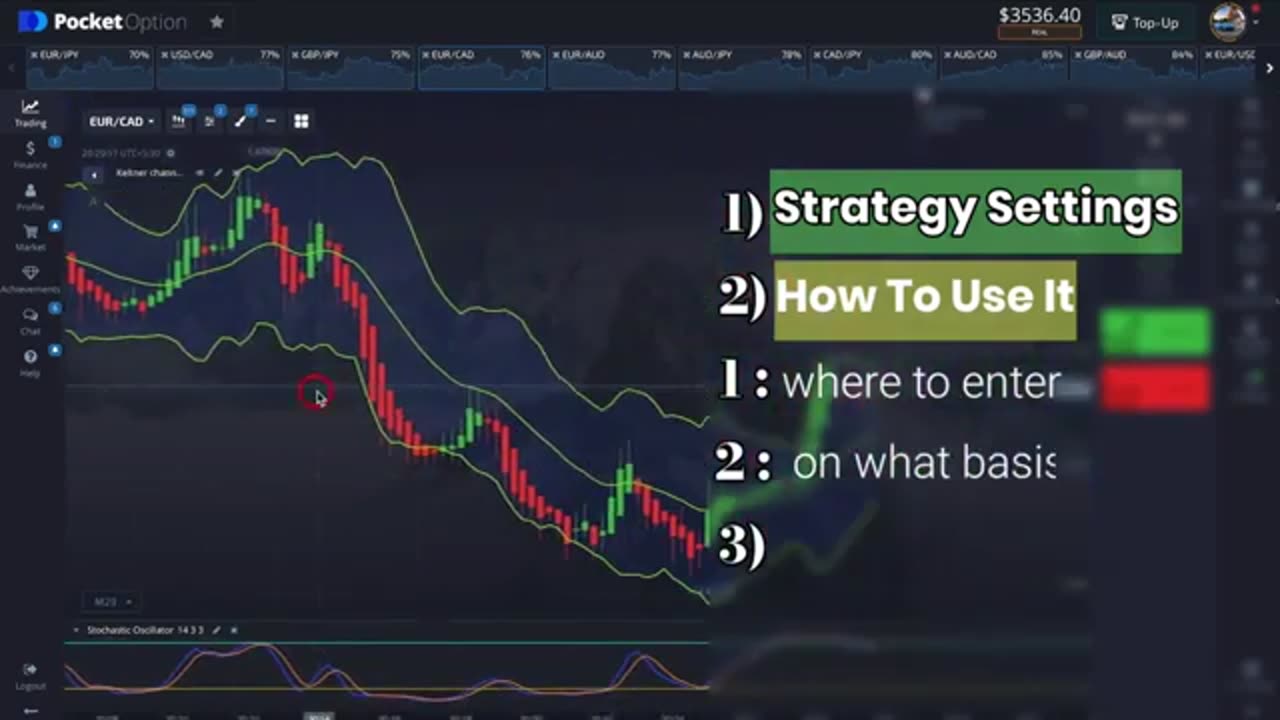

$1000/Day From Home Using This Simple 60 Second Scalp Trading Strategy

Open Account: http://pocketoptioncapital.com Making money trading from home is an increasingly popular option, thanks to advancements in technology and the accessibility of online trading platforms. One of the primary attractions is the flexibility it offers, allowing individuals to trade at their convenience, without the need for a traditional office setup. This means you can tailor your trading schedule around other commitments, making it a suitable option for those seeking a supplementary income or a full-time career. With markets such as forex, stocks, and cryptocurrencies being open at various times around the world, you can find trading opportunities at almost any time of the day or night.

Success in home trading requires a solid understanding of the markets and a well-defined trading strategy. It’s important to start with a clear plan, detailing your financial goals, risk tolerance, and preferred trading style—be it day trading, swing trading, or long-term investing. Education plays a crucial role; investing time in learning about market analysis techniques, such as technical and fundamental analysis, can significantly improve your trading decisions. Many resources, including online courses, webinars, and trading forums, are available to help build your knowledge and skills.

Risk management is a key component of profitable home trading. Since financial markets can be highly volatile, it’s essential to implement strategies that protect your capital. This includes setting stop-loss orders to limit potential losses, diversifying your trading portfolio to spread risk, and avoiding over-leveraging, which can lead to substantial losses. Consistently applying these risk management techniques can help mitigate the impact of unfavorable market movements and preserve your trading capital over the long term.

Another important aspect of making money trading from home is maintaining discipline and emotional control. The psychological aspect of trading can often be challenging, as market fluctuations can evoke strong emotional responses such as fear and greed. Developing a disciplined approach—sticking to your trading plan, avoiding impulsive decisions, and keeping emotions in check—can lead to more consistent and rational trading behavior. Additionally, utilizing tools such as trading journals to track your trades and reflect on your performance can help identify patterns and areas for improvement. By combining education, risk management, and emotional discipline, you can enhance your chances of making money trading from home.

Open Account: http://pocketoptioncapital.com

-

LIVE

LIVE

Tundra Tactical

4 hours ago $0.01 earnedDadlefield Game Night BF6 New Update Weapon Grind

198 watching -

15:39

15:39

Megyn Kelly

4 hours agoTucker Carlson on Why He Interviewed Nick Fuentes and What He Wanted to Convey To Him

39.1K52 -

1:14:10

1:14:10

Kim Iversen

3 hours agoZionists PANIC Over Muslim Mayor In NYC

70.8K109 -

1:50:40

1:50:40

Redacted News

4 hours agoBREAKING! Trump Makes HUGE Announcement Trying To Save MAGA, Cost of Living & Israel CRUSHED GOP

106K188 -

LIVE

LIVE

Dr Disrespect

9 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - QUEST MASTER

1,338 watching -

2:17:37

2:17:37

The Quartering

6 hours agoFooled Again! Mamdani Backtracks Everything & Today's Breaking News!

201K125 -

1:17:04

1:17:04

DeVory Darkins

7 hours agoPelosi SURRENDERS announces retirement and Bernie Sanders makes stunning admission

116K117 -

4:35:22

4:35:22

StoneMountain64

6 hours agoArc Raiders is actually INCREDIBLE

68K2 -

7:39:54

7:39:54

FusedAegisTV

8 hours agoFUSEDAEGIS PLAYS THE GREATEST JRPG EVER MADE ⌛► CHRONO TRIGGER (1995) Part 4

23.7K2 -

1:57:50

1:57:50

The Charlie Kirk Show

8 hours agoErika's Interview + Auburn Aftermath | Schlichter, Lomez | 11.6.2025

117K21