Premium Only Content

Mastering Tariff Code Selection: Key Tips for ISF Filing and Customs Clearance

ISF Filer || [email protected] || 858-280-9374 || www.isffiler.com

This video discusses the importance of tariff code selection in Importer Security Filing (ISF) filing. Tariff codes are numeric codes used to classify products and determine the applicable duties and regulations. Accurate tariff code selection is crucial for compliance with customs regulations and to avoid penalties and delays. To ensure accurate tariff code selection, it is important to gather detailed information about the products, consult an official tariff code database, and cross-reference product specifications with the descriptions in the database. Seeking assistance from customs experts or licensed customs brokers is recommended for complex tariff codes. Double-checking the selected tariff codes and accurately including them in the ISF filing is essential for smooth customs clearance.

#usimportbond

#isfcustomsbroker

#uscustomsclearing

#isfentry

Video Disclaimer Here: This video is intended for educational purposes and has no affiliation with US government entities.

0:14 - Tariff code selection is crucial for ISF filing success

0:25 - Tariff codes determine duties, taxes, and regulations for imported goods

0:46 - Accurate tariff code selection ensures compliance with customs regulations

-

7:44:50

7:44:50

SpartakusLIVE

10 hours agoThe Duke of Nuke CONQUERS Arc Raiders

168K4 -

1:05:26

1:05:26

Man in America

12 hours ago“Poseidon” Doomsday Sub, Microplastics & The War on Testosterone w/ Kim Bright

23.5K21 -

2:23:54

2:23:54

DLDAfterDark

8 hours ago $0.16 earnedGun Talk LIVE! Thursday At The Armory! Feat. Josh of BDG&G & DLD

26.6K4 -

2:50:16

2:50:16

TimcastIRL

8 hours agoSupreme Court May OVERTURN Gay Marriage, SCOTUS Hearing Set For TOMORROW | Timcast IRL

232K129 -

4:06:47

4:06:47

Barry Cunningham

10 hours agoBREAKING NEWS: PRESIDENT TRUMP HOSTS A STATE DINNER | FOX NATION PATRIOT AWARDS!

109K66 -

4:04:59

4:04:59

Alex Zedra

7 hours agoLIVE! New Game | The See Us

33.6K1 -

1:56:30

1:56:30

ThisIsDeLaCruz

7 hours ago $0.08 earnedOn The Road With Pantera

36.8K3 -

meleegames

7 hours agoMelee Madness Podcast #58 - They Changed What ‘It’ Was & It’ll Happen to You

24.9K5 -

2:32:46

2:32:46

megimu32

8 hours agoOn The Subject: Why K-Pop Demon Hunters Feels Like 90s Disney Again

35.5K9 -

1:38:28

1:38:28

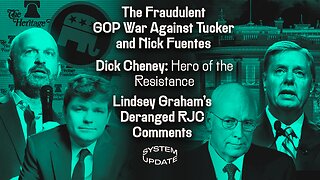

Glenn Greenwald

11 hours agoThe Fraudulent GOP War Against Tucker and Nick Fuentes; Dick Cheney: Hero of the Resistance; Lindsey Graham's Deranged RJC Comments | SYSTEM UPDATE #544

112K117