Premium Only Content

Entity Structures That Safeguard MY Wealth

JOIN THE TAX-FREE WEALTH CHALLENGE NOW! AUGUST 5-9 2024!

https://join.taxalchemy.com/join-thec...

TAKING THE NEXT STEP:

Join The Tax Strategy Accelerator Community ▶ https://www.taxstrategyaccelerator.co...

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com/?utm_sou...

Book a Professional Tax Strategy Consultation ▶ https://www.taxalchemy.com/consultati...

Watch this FREE Webinar on How to Cut Your Tax Bill in Half as a Real Estate Investor ▶ https://join.taxalchemy.com/registrat...

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326...

Tax professionals such as enrolled agents help to structure entities for their clients on a regular basis. Proper entity structuring can result in a variety of benefits including enhanced liability protection, tax savings, and easier business management. Many business owners highly value all of these things.

However, even though tax pros commonly help their clients structure their entities, many of them do not publicly share the way that they structure their own entities. In this video, tax expert Karlton Dennis breaks down the full structure for all of the business entities that he owns.

This complete entity structuring explanation helps to provide insights into the way that he runs all of his businesses. Karlton walks you through his entire organizational structure for all of his business entities including his S Corps, LLCs, C Corps, and more. He also explains the reasons why he chose this particular overall structure.

Timecodes

0:00 The Trifecta

0:52 Using an S-Corp to Manage Multiple LLCs

1:45 How to Offset S-Corp's Income with C-Corp

2:39 Using a Private Family Foundation to Protect Assets and Save Taxes

4:00 Protecting Investments with Series LLC Structures

6:24 Inside and Outside Liability Protection Explained

7:48 Avoiding Probate with Step Up in Basis

8:24 Why Your Tax Plan Should Be Unique

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#TaxSecrets #TaxStrategies #SeriesLLC

-

56:55

56:55

The StoneZONE with Roger Stone

8 hours agoTrump Should Sue Billionaire Governor JB Pritzker for Calling Him a Rapist | The StoneZONE

63.1K10 -

59:21

59:21

Adam Does Movies

8 hours ago $1.91 earnedMore Reboots + A Good Netflix Movie + Disney Live-Action Rant - LIVE

40.4K1 -

36:28

36:28

TheTapeLibrary

17 hours ago $10.89 earnedThe Disturbing True Horror of the Hexham Heads

67.1K6 -

6:08:00

6:08:00

JdaDelete

1 day ago $5.13 earnedHalo MCC with the Rumble Spartans 💥

46.6K7 -

3:52:22

3:52:22

Edge of Wonder

11 hours agoChristmas Mandela Effects, UFO Drone Updates & Holiday Government Shake-Ups

40.5K15 -

1:37:36

1:37:36

Mally_Mouse

10 hours agoLet's Play!! -- Friends Friday!

44.4K1 -

57:45

57:45

LFA TV

1 day agoObama’s Fake World Comes Crashing Down | Trumpet Daily 12.20.24 7PM EST

40.3K17 -

1:27:17

1:27:17

2 MIKES LIVE

9 hours ago2 MIKES LIVE #158 Government Shutdown Looms and Games!

34.8K10 -

1:07:34

1:07:34

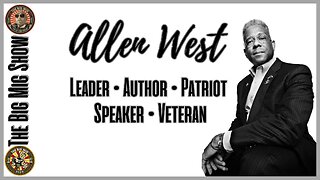

The Big Mig™

13 hours agoVeteran, Patriot, Leader, Author Allen West joins The Big Mig Show

32.2K8 -

1:06:47

1:06:47

The Amber May Show

1 day ago $1.33 earnedBloated CR Failed | What Did The View Say Now? | Who Kept Their Job At ABC| Isaac Hayes

19.5K3