Premium Only Content

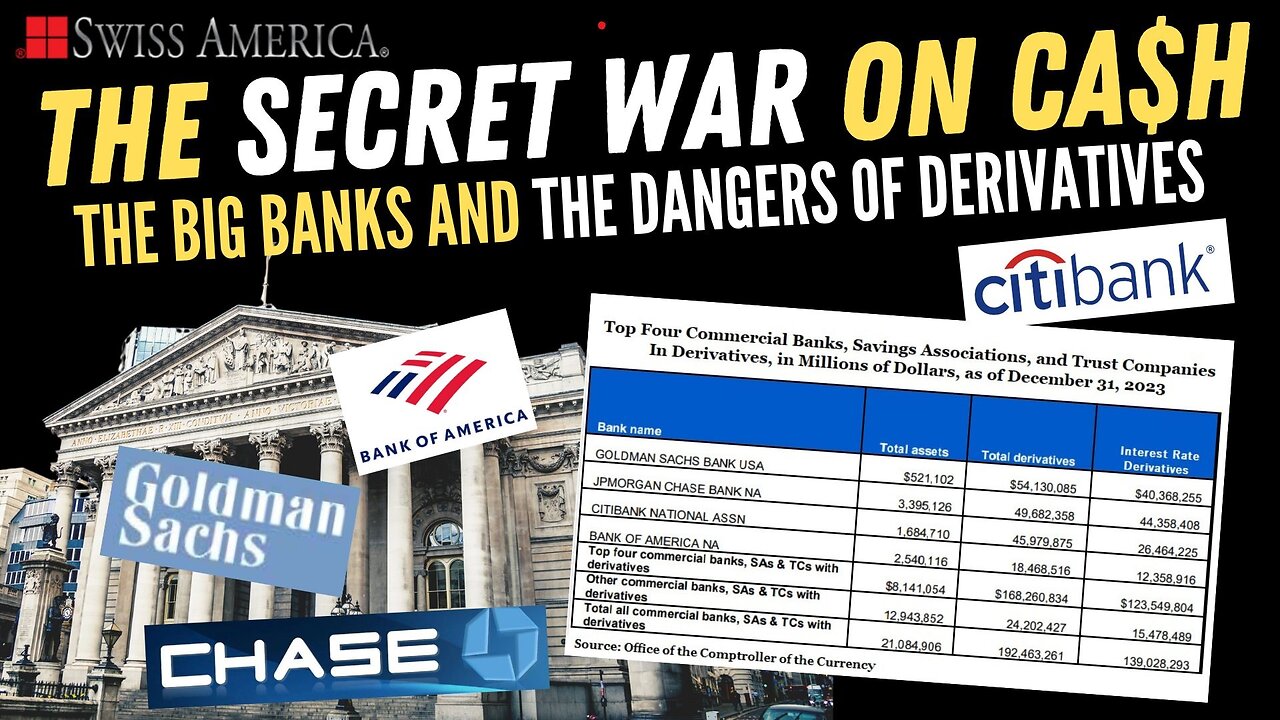

The Big Banks and the Dangers of Derivatives

Remember the 2007 Credit Crunch and the subsequent 2008 Crash? That stemmed from a change in home loan policies in the mid-1990s - resulting in several delinquent and expensive loans - which led to the constant sale and resale of derivatives.

Now, we see several banks - especially the big ones - going deep into derivatives once again. Not only that, the top four 'large banks' wind-down plans from their derivatives have been given failing grades by both the Federal Reserve and the FDIC. In fact, Goldman Sachs’ Bank Derivatives Have Grown from $40 Trillion to $54 Trillion.

How dangerous could this be for our economy, your credit, your savings and your investments? Swiss America CEO Dean Heskin and Chris Agelastos break down the situation and what it could mean on The Secret War on Cash.

Call for your FREE copy of The Secret War on Cash newsletter: (800) 289-2646 or

Visit our website for more information: https://www.swissamerica.com/rumble

Call for your FREE copy of How the Coming Global Crash Will Create a Historic Gold Rush: (480) 548-2975

Follow us on Facebook: https://www.facebook.com/swissamerica/

Follow us on X (Twitter): @Swiss_America

Follow us on LinkedIn: https://www.linkedin.com/company/1023049

Articles referred to in this podcast:

The Fed and FDIC Wake Up Suddenly to the Threat of Derivatives, Flunking the Four Largest Derivative Banks on their Wind-Down Plans (wallstreetonparade.com)

Goldman Sachs’ Bank Derivatives Have Grown from $40 Trillion to $54 Trillion in Five Years; So How Did Its Credit Exposure Improve by 200 Percent? (wallstreetonparade.com)

-

10:11

10:11

Worldview Financial TV

18 hours agoBRICS to Expand Ranks in 2025; Gold to Reach $3200?

12 -

3:07:17

3:07:17

Alex Zedra

8 hours agoLIVE! New Game | Exorcism!??

23.6K2 -

6:00:06

6:00:06

SpartakusLIVE

11 hours agoThe Conqueror of Corona || Delta Force LATER

60.3K1 -

2:17:30

2:17:30

barstoolsports

14 hours ago$250k Winner Revealed With Final Votes And Reunion | Surviving Barstool S4 Finale

125K9 -

2:05:49

2:05:49

Kim Iversen

12 hours agoTikTok Ban BACKFIRES: Millions Flee To New App Showing The REAL China

114K152 -

1:35:12

1:35:12

Glenn Greenwald

14 hours agoCNN And Jake Tapper In Deep Trouble In Defamation Lawsuit: With Jonathan Turley; TikTok Ban, Trump's China Policy, And More With Arnaud Bertrand | SYSTEM UPDATE SHOW #390

103K72 -

12:24

12:24

Dan Bongino Show Clips

14 hours agoPresident Trump Full Interview - 01/16/25

130K300 -

1:27:39

1:27:39

Man in America

14 hours agoBig Pharma's Deadliest Lie is Being EXPOSED to the Masses w/ Jonathan Otto

93.2K38 -

1:40:08

1:40:08

Precision Rifle Network

1 day agoS4E2 Guns & Grub - Training Vs. Competition

46.7K1 -

58:27

58:27

Flyover Conservatives

1 day agoGarrett Ziegler Breaks Down Special Councilor’s Report on Hunter Biden. Insights for Trump’s Top Picks. | FOC Show

71.5K6