Premium Only Content

Make Money Forex Trading Using Zig Zag Indicator And 2 Moving Averages $300 In 1 Hour

Open Account: http://pocketoptioncapital.com Making profits in the forex markets is a multifaceted endeavor that demands a blend of discipline, knowledge, and strategy. At its core, forex trading involves the buying and selling of currencies with the aim of profiting from fluctuations in exchange rates. Traders employ various techniques, such as technical analysis, fundamental analysis, and sentiment analysis, to anticipate market movements and make informed trading decisions. While the potential for profit in forex trading is considerable, it is also accompanied by significant risks, requiring traders to approach the market with caution and implement robust risk management strategies.

Successful forex trading begins with a solid understanding of the factors that influence currency movements. Economic indicators, central bank policies, geopolitical events, and market sentiment all play a role in shaping exchange rates. By staying informed about these factors and conducting thorough analysis, traders can identify potential trading opportunities and mitigate risks. Moreover, having a clear trading plan and adhering to it diligently is crucial for long-term success in the forex markets. This includes setting realistic profit targets, establishing stop-loss orders to limit losses, and managing position sizes effectively to preserve capital.

Risk management is paramount in forex trading, as losses are an inevitable part of the process. Traders must be prepared to accept losses and learn from them, rather than allowing emotions to dictate their decisions. Implementing proper risk-reward ratios ensures that potential losses are limited while allowing for significant profits over time. Additionally, diversifying trading strategies and not putting all eggs in one basket can help spread risk and increase the chances of success. By approaching forex trading with discipline, patience, and a focus on risk management, traders can enhance their chances of making consistent profits in the dynamic and volatile forex markets.

Forex trading strategies are essential tools for traders in the foreign exchange market, helping them navigate the complex world of currency trading. These strategies are meticulously crafted plans that outline how traders will make decisions regarding when to buy, sell, or hold currencies to maximize profits or minimize losses. There are numerous forex trading strategies available, each with its unique approach and risk-reward profile.

One common forex trading strategy is the trend-following strategy. This approach involves analyzing historical price movements to identify prevailing trends in the currency pairs. Traders using this strategy aim to ride the momentum of the trend, buying when the market is in an uptrend and selling when it's in a downtrend. By following the trend, traders hope to capitalize on consistent price movements and minimize exposure to sudden market reversals.

Another popular strategy is the range-bound strategy. In this approach, traders look for currency pairs that are trading within a well-defined price range, bouncing between support and resistance levels. They aim to buy near the support level and sell near the resistance level, profiting from the predictable price movements within the range. This strategy is particularly useful when markets lack a clear trend and exhibit sideways movements.

Lastly, there's the breakout strategy, which involves identifying key support and resistance levels and waiting for the market to break out of these levels decisively. Traders using this strategy anticipate that a breakout will lead to a significant price movement in one direction. They position themselves to capitalize on this movement by buying or selling once the breakout occurs. Breakout trading can be highly profitable when executed correctly but carries the risk of false breakouts, which can lead to losses if not managed effectively.

In conclusion, forex trading strategies are vital tools for traders seeking success in the currency market. The choice of strategy depends on various factors, including market conditions, risk tolerance, and trading objectives. Whether one opts for trend-following, range-bound, or breakout strategies, it's crucial to combine them with thorough analysis, risk management, and discipline to navigate the dynamic and sometimes volatile world of forex trading successfully.

Open Account: http://pocketoptioncapital.com

-

7:44:50

7:44:50

SpartakusLIVE

9 hours agoThe Duke of Nuke CONQUERS Arc Raiders

163K2 -

1:05:26

1:05:26

Man in America

12 hours ago“Poseidon” Doomsday Sub, Microplastics & The War on Testosterone w/ Kim Bright

20.1K21 -

2:23:54

2:23:54

DLDAfterDark

8 hours ago $0.12 earnedGun Talk LIVE! Thursday At The Armory! Feat. Josh of BDG&G & DLD

24K4 -

2:50:16

2:50:16

TimcastIRL

8 hours agoSupreme Court May OVERTURN Gay Marriage, SCOTUS Hearing Set For TOMORROW | Timcast IRL

232K129 -

4:06:47

4:06:47

Barry Cunningham

9 hours agoBREAKING NEWS: PRESIDENT TRUMP HOSTS A STATE DINNER | FOX NATION PATRIOT AWARDS!

107K65 -

4:04:59

4:04:59

Alex Zedra

7 hours agoLIVE! New Game | The See Us

32.4K1 -

1:56:30

1:56:30

ThisIsDeLaCruz

7 hours ago $0.06 earnedOn The Road With Pantera

35.6K3 -

DVR

DVR

meleegames

7 hours agoMelee Madness Podcast #58 - They Changed What ‘It’ Was & It’ll Happen to You

24K5 -

2:32:46

2:32:46

megimu32

8 hours agoOn The Subject: Why K-Pop Demon Hunters Feels Like 90s Disney Again

34.5K9 -

1:38:28

1:38:28

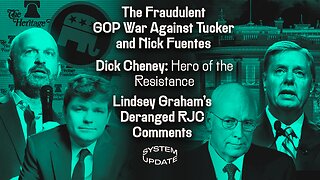

Glenn Greenwald

11 hours agoThe Fraudulent GOP War Against Tucker and Nick Fuentes; Dick Cheney: Hero of the Resistance; Lindsey Graham's Deranged RJC Comments | SYSTEM UPDATE #544

111K116