Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Lienholders Policies For Vehicle Title Asset Recovery

1 year ago

6

Automotive

Defaulted Loans

Repo Agencies

Wells Fargo

Automotive Loans

Repossession

Lien Release

Negotiation

Financial Advice

Loan Defaults

Vehicle Recovery

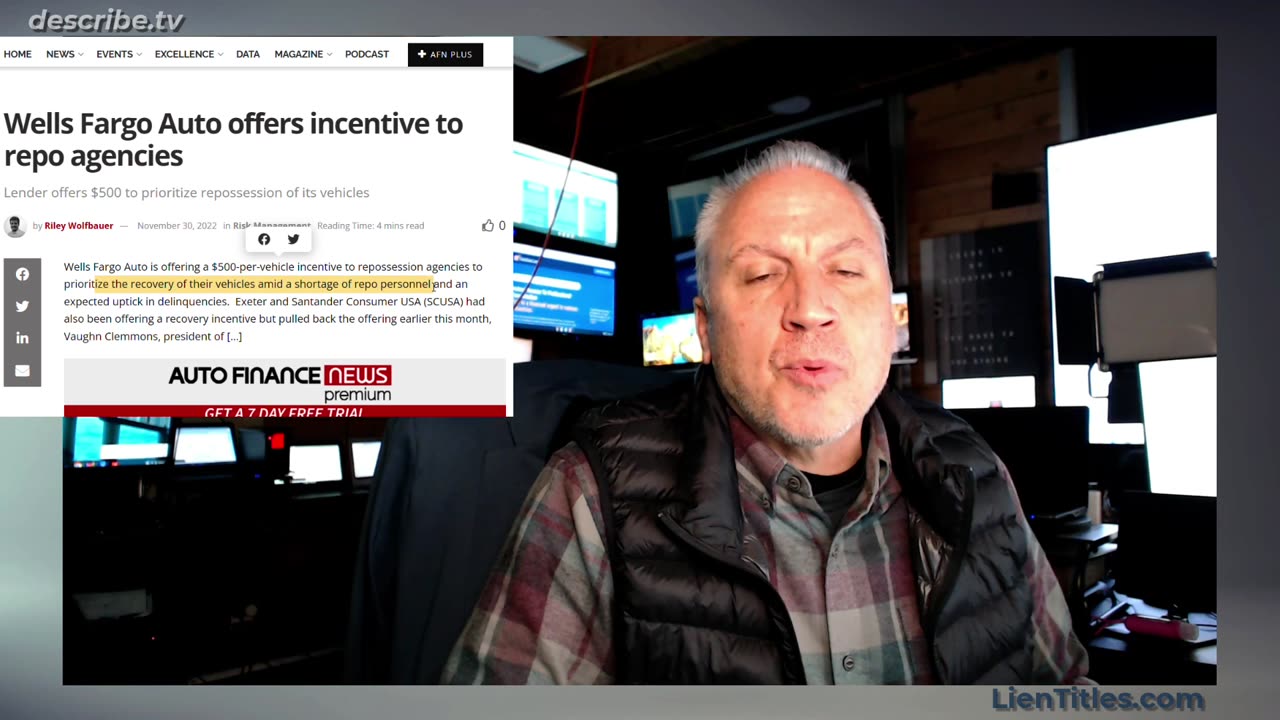

Be aware that if you're the primary borrower on a defaulted automotive loan, some lenders are ramping up their recovery tactics. For instance, Wells Fargo Automotive is incentivizing repo agencies with $500 per vehicle to prioritize repossession amid a shortage of repo personnel. This means banks are putting bounties on their vehicles to expedite recovery. If you're in this situation, negotiating with the lender could be advantageous—they prefer money over the hassle and cost of vehicle recovery.

Loading comments...

-

26:11

26:11

Upper Echelon Gamers

17 hours ago $3.06 earned"Her" Wasn't Fiction - Its Real

14.8K3 -

3:11

3:11

Canadian Crooner

2 years agoPat Coolen | It's Beginning to Look A Lot Like Christmas

72.8K17 -

5:22

5:22

DropItLikeItsScott

1 day ago $3.34 earnedThe GLOCK Killer? Shadow Systems XR920 / Would You Choose It?

19.9K9 -

2:06:15

2:06:15

BEK TV

1 day agoTrent Loos in the Morning - 12/01/2025

27.9K1 -

LIVE

LIVE

The Bubba Army

1 day agoDIDDY'S NEW DOC EXPOSED! - Bubba the Love Sponge® Show | 12/02/25

1,173 watching -

40:10

40:10

ZeeeMedia

15 hours agoFDA Memo: "Covid-19 Vaccines Have Killed American Children" | Daily Pulse Ep 153

34.3K39 -

LIVE

LIVE

Pickleball Now

7 hours agoLive: IPBL 2025 Day 2 | High-Intensity Matchups Continue in the Indian Pickleball League

119 watching -

15:11

15:11

itsSeanDaniel

1 day agoAngry Liberal Defends ILLEGALS, Then Gets CALLED OUT For It

59.7K29 -

10:32

10:32

Actual Justice Warrior

2 days agoColorado School FORCES Girl Into Bed With Trans

31.6K28 -

18:14

18:14

Nikko Ortiz

17 hours agoMost Painful Internet Clips...

82.8K12