Premium Only Content

NO TAX for Sovereigns? Unpacking Ancient Tax Systems

THE HISTORICAL ROOTS OF ‘NO TAX’: FROM SOVEREIGNS TO SUBJECTS.

SOVEREIGN PEOPLE OR COLONISED TAXABLE PEOPLE ?

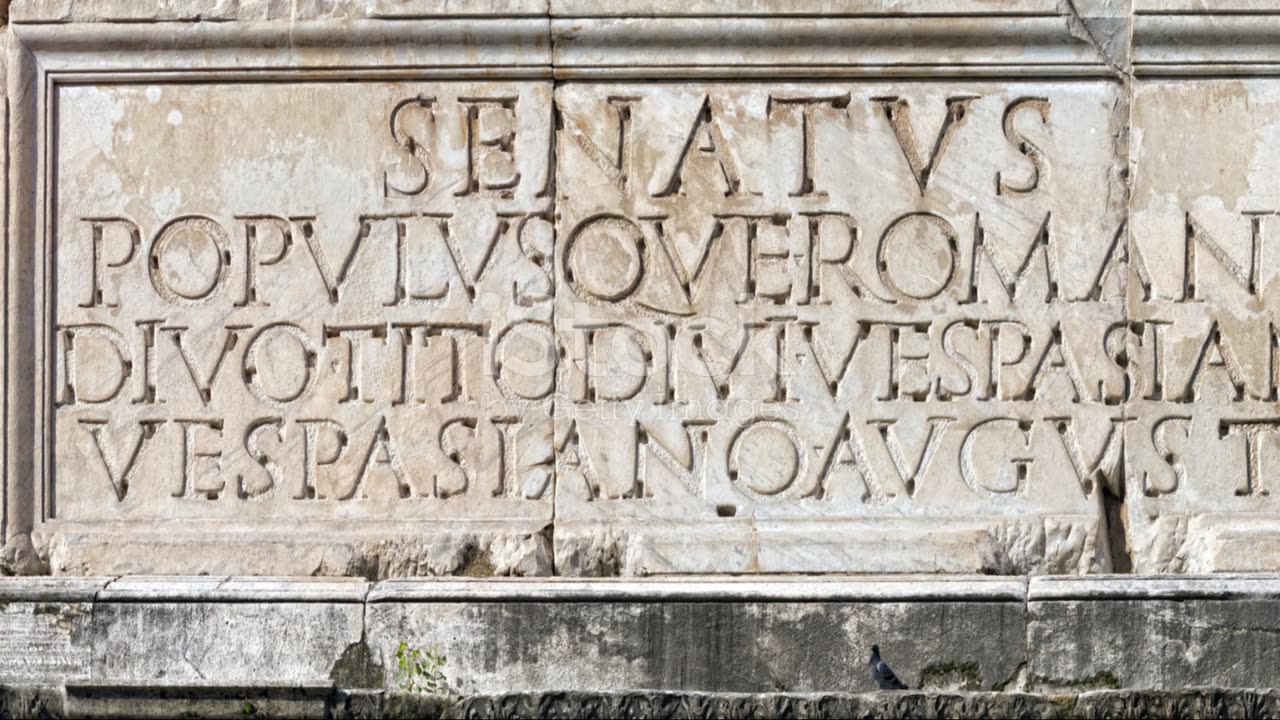

‘Even though it was not a military conquest but a mere political agreement, what characterised the subjection to Rome was precisely the payment of taxes, from which Roman citizens, i.e. all Italians, were exempt, so taxation did not apply to citizens but only to the colonised, who thus supported the Italians’ standard of living. There was therefore a kind of incompatibility between the status of citizen and the payment of taxes, while taxation defined the status of the colonised, i.e. of a person subject to the empire.’

- from: ‘Currency: Anglo-Saxon vs. Latin Culture’, by Davide Storelli, Paguro editions, 2024.

The quote provides a historical analysis of the roots of the relationship between sovereigns and subjects in relation to taxes. In particular, it emphasises how in ancient Rome the payment of taxes was a distinctive feature of subjugation, with Roman citizens exempt from payment while the colonised were required to bear the costs. This underlines how taxation was seen as a sign of subjugation, while exemption from payment was reserved for citizens, who enjoyed specific rights and privileges.

This historical scenario highlights a divide between the two groups: Roman citizens, seen as members of the community and thus not subject to taxation, and the colonised, seen as subject to imperial authority and thus obliged to pay taxes. This distinction reflects an idea of ‘sovereign people’ and ‘colonised people’, where the former enjoy rights and privileges that the latter do not.

This concept can be interpreted in relation to broader issues of social justice and equity, as it highlights how taxation and the distribution of rights and privileges were used to define and reinforce social and political hierarchies.

-

1:22:31

1:22:31

Dr. Drew

4 hours agoSalty Cracker: Trump Wins, The Left Immediately Makes Election Rigging Conspiracy Theories Great Again – Ask Dr. Drew

38.6K31 -

1:04:13

1:04:13

In The Litter Box w/ Jewels & Catturd

20 hours agoDumbfounded Democrats | In the Litter Box w/ Jewels & Catturd – Ep. 686 – 11/7/2024

49.9K15 -

1:25:15

1:25:15

FULL SEND PODCAST

3 hours agoBen Shapiro Predicts the 2024 Election Winner and Goes IN on Andrew Tate!

62.6K27 -

1:47:49

1:47:49

The Quartering

5 hours agoTrump Victory MELTDOWN Goes Nuclear!

104K36 -

1:40:49

1:40:49

SLS - Street League Skateboarding

10 days ago2024 SLS Sydney: Women’s Knockout Round

52.1K1 -

1:08:33

1:08:33

Savanah Hernandez

2 hours agoAmerica’s Golden Era Has Begun: Trump's Day 1 Policies

22.3K4 -

56:02

56:02

Uncommon Sense In Current Times

3 hours ago $1.02 earned"Are You a House Negro Or a Field Negro? A Faith Perspective on Freedom with Kevin McGary"

21.2K3 -

17:53

17:53

DeVory Darkins

6 hours agoThe View SELF-DESTRUCTS as Kamala CONCEDES Election

48.1K157 -

1:59:12

1:59:12

vivafrei

7 hours agoLive with the Gad Saad! Talking "Suicidal Empathy" and the Post-Election Liberal Meltdown! Viva Frei

76.8K46 -

1:02:41

1:02:41

Josh Pate's College Football Show

5 hours ago $3.88 earnedWeek 11 Upset Alerts | Florida Keeping Billy Napier | The Playoff Bubble | Cole Cubelic

42.7K