Premium Only Content

NO TAX for Sovereigns? Unpacking Ancient Tax Systems

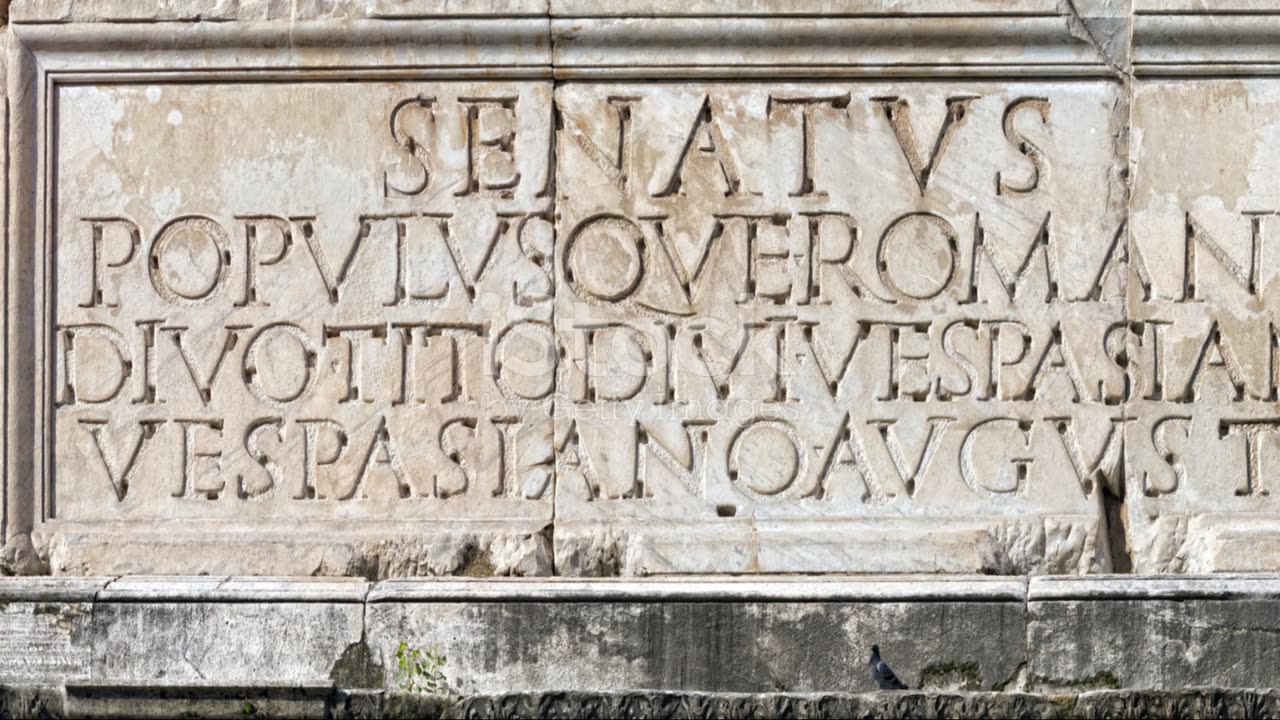

THE HISTORICAL ROOTS OF ‘NO TAX’: FROM SOVEREIGNS TO SUBJECTS.

SOVEREIGN PEOPLE OR COLONISED TAXABLE PEOPLE ?

‘Even though it was not a military conquest but a mere political agreement, what characterised the subjection to Rome was precisely the payment of taxes, from which Roman citizens, i.e. all Italians, were exempt, so taxation did not apply to citizens but only to the colonised, who thus supported the Italians’ standard of living. There was therefore a kind of incompatibility between the status of citizen and the payment of taxes, while taxation defined the status of the colonised, i.e. of a person subject to the empire.’

- from: ‘Currency: Anglo-Saxon vs. Latin Culture’, by Davide Storelli, Paguro editions, 2024.

The quote provides a historical analysis of the roots of the relationship between sovereigns and subjects in relation to taxes. In particular, it emphasises how in ancient Rome the payment of taxes was a distinctive feature of subjugation, with Roman citizens exempt from payment while the colonised were required to bear the costs. This underlines how taxation was seen as a sign of subjugation, while exemption from payment was reserved for citizens, who enjoyed specific rights and privileges.

This historical scenario highlights a divide between the two groups: Roman citizens, seen as members of the community and thus not subject to taxation, and the colonised, seen as subject to imperial authority and thus obliged to pay taxes. This distinction reflects an idea of ‘sovereign people’ and ‘colonised people’, where the former enjoy rights and privileges that the latter do not.

This concept can be interpreted in relation to broader issues of social justice and equity, as it highlights how taxation and the distribution of rights and privileges were used to define and reinforce social and political hierarchies.

-

53:29

53:29

Candace Show Podcast

2 hours agoEXCLUSIVE! Brigitte Macron's Lawyer Has A Dark Past. Dan Bongino Speaks Out. | Candace Ep 220

23.1K66 -

1:18:11

1:18:11

Redacted News

2 hours agoScotland is being DESTROYED and Neil Oliver is trying to save it

14.8K37 -

LIVE

LIVE

Exploring With Nug

8 hours agoMissing Tennessee Man Found Crashed in Ravine — Could He Have Been Saved!

108 watching -

36:36

36:36

Kimberly Guilfoyle

3 hours agoTrump Trade Wins, Live with Daniel Turner & Jarrett Stepman | Ep241

82.6K16 -

13:16

13:16

Michael Button

8 hours agoWhat If We’re NOT the First Smart Humans?

5.69K4 -

LIVE

LIVE

The Amber May Show

2 hours agoShattering the Narrative: Trump, Media Collapse & The Rising Chaos

132 watching -

LIVE

LIVE

LFA TV

22 hours agoLFA TV ALL DAY STREAM - MONDAY 7/28/25

895 watching -

LIVE

LIVE

freecastle

7 hours agoTAKE UP YOUR CROSS- STOP the Hate From State to State!

188 watching -

1:11:04

1:11:04

vivafrei

4 hours agoWhat Did Bongino See? The Epstein "Privilege"! Canada Has Become a Dangerous JOKE & MORE!

90.8K75 -

2:07:48

2:07:48

The Quartering

5 hours agoToday's Breaking News With Josie The Red Headed Libertarian, Hannah Claire & Luke Rodkowski

124K32