Premium Only Content

China isn't dumping dollars. They're dumping banks

Video: China isn't dumping dollars. They're dumping banks, and setting up a new financial system. 中國沒有拋售美元。他們正在拋棄銀行,建立新的金融體系.

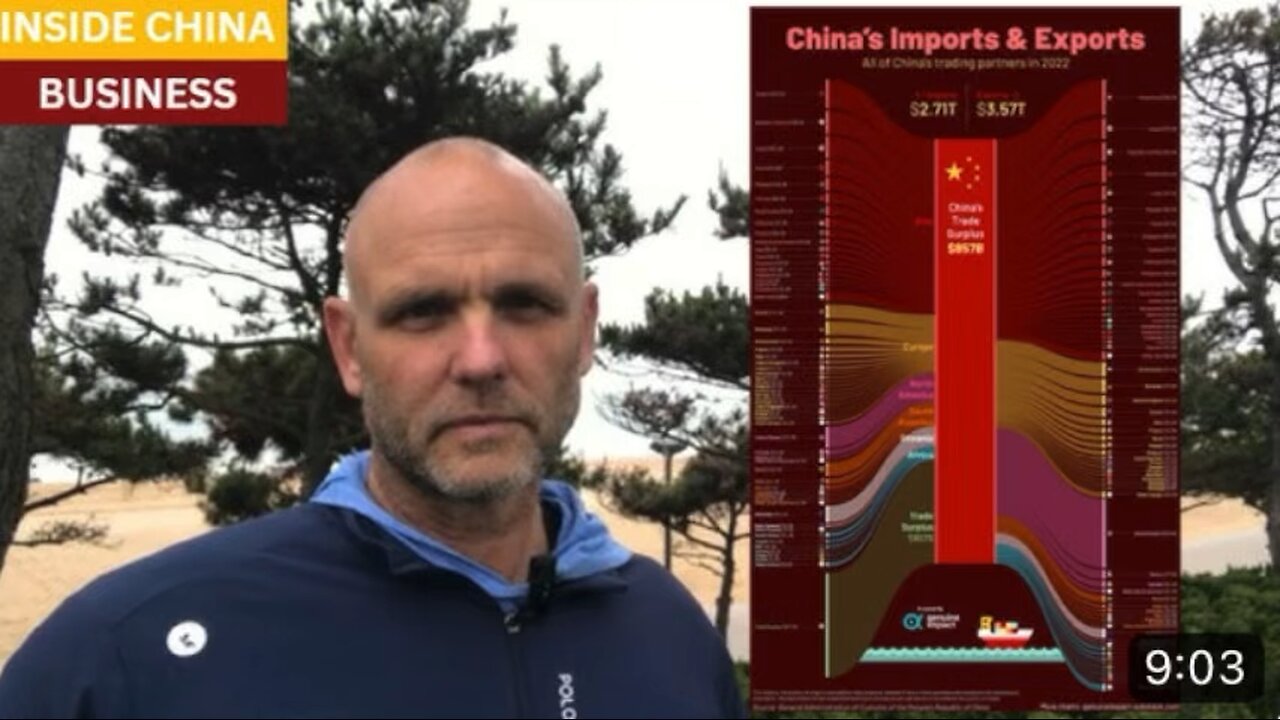

China runs massive trade surpluses with North America and Europe. Those markets pay in US Dollars or in Euro. Every day China earns about $2.7 billion USD and about 500 million Euro in surplus trade from those areas.

Typically a country will re-invest those trading surpluses into investments into those same countries. In economics this is called Balance of Payments. China, however, is not doing so. They are instead bringing these surplus USD and euro out of Western banks, to capitalize a new banking system.

China directed its Belgian custodian to liquidate $53 billion in US government notes and agency paper in the first quarter, and these moves almost certainly resulted in large trading losses. Interest rates are far higher today than when China bought the bonds, so any sales in the secondary market would reflect higher yields and lower market prices. That they were willing to accept steep losses on such a huge portfolio on bonds demonstrates a strong urgency to move the assets away from Europe as quickly as possible, and out of bonded debt as quickly as possible and into more liquid instruments.

Many countries are anxious to establish and use a new financial system, a network of banks that is completely outside of SWIFT and of Western government oversight and sanctions risk. To capitalize such a system, large pools of USD and euro will be required to make markets and fund trade settlements.

What's more, the USD and Euro that are now in Chinese banks, in China, can be used to collateralized new loans in any currency, and create new economic growth elsewhere.

中國與北美和歐洲存在巨額貿易順差。這些市場以美元或歐元支付。中國每天從這些地區獲得約27億美元和約5億歐元的順差貿易收入。

通常,一個國家會將這些貿易盈餘重新投資到這些國家。在經濟學中,這稱為國際收支平衡。然而中國並沒有這麼做。相反,他們將這些盈餘美元和歐元從西方銀行撤出,以資本化新的銀行體系。

中國指示其比利時託管機構在第一季清算 530 億美元的美國政府票據和機構票據,這些措施幾乎肯定會導致巨額交易損失。現今的利率遠高於中國購買債券時的水平,因此二級市場上的任何銷售都將反映出更高的收益率和更低的市場價格。他們願意接受如此龐大的債券投資組合的巨額損失,這表明迫切需要盡快將資產從歐洲轉移出來,並儘快擺脫債券債務並轉向更具流動性的工具。

許多國家急於建立和使用新的金融體系,即一個完全不受 SWIFT 影響、不受西方政府監管和製裁風險影響的銀行網絡。為了利用這樣一個系統,需要大量的美元和歐元來建立市場並為貿易結算提供資金。

更重要的是,現在存在於中國銀行的美元和歐元可以用來抵押任何貨幣的新貸款,並在其他地方創造新的經濟成長.

-

37:09

37:09

The Mel K Show

6 hours agoMel K & Dr. Kirk Moore | A Doctor’s Oath: Doing What is Right No Matter the Cost | 7-26-25

14.4K5 -

36:44

36:44

NordicVentures

5 days ago $0.71 earnedWINTER Bushcraft 2 Nights: Building ALONE a Survival Shelter

6.52K4 -

LIVE

LIVE

JakRazGaming

3 hours ago $0.09 earnedPlaying Minecraft with GameQuest1552, Rexmon, and JuicyKinnKandy! Stream 9

67 watching -

LIVE

LIVE

GoA_Malgus

2 hours agoGoA Malgus - The Legend Has Returned!!! - Live domination on Black Ops 6

51 watching -

7:12

7:12

nospeedlimitgermany

2 days ago $0.97 earnedAudi TT 1.8 T Roadster | 180 PS | Top Speed Drive German Autobahn No Speed Limit POV

9.93K1 -

LIVE

LIVE

CharleyHornsePlays

1 hour agoCHP DESTINY 2 | Big noob | WEEKLY DONOR GIVEAWAYS

53 watching -

4:15:37

4:15:37

FrizzleMcDizzle

4 hours ago"She Who Plays with Wonder" AXON BOSS?! - Clair Obscure: Expedition 33

2.71K -

LIVE

LIVE

Damysus Gaming

1 hour agoDune: Awakening - The Grind Continues - Pushing to Complete More Story Night 4!!!

23 watching -

2:51:17

2:51:17

Donut Operator

4 hours agoREADY OR NOT WITH BRANDON HERRERA AND MA SON

171K8 -

LIVE

LIVE

Amish Zaku

8 hours agoRumble Spartans July Event- Classic Halo Multiplayer

74 watching