Premium Only Content

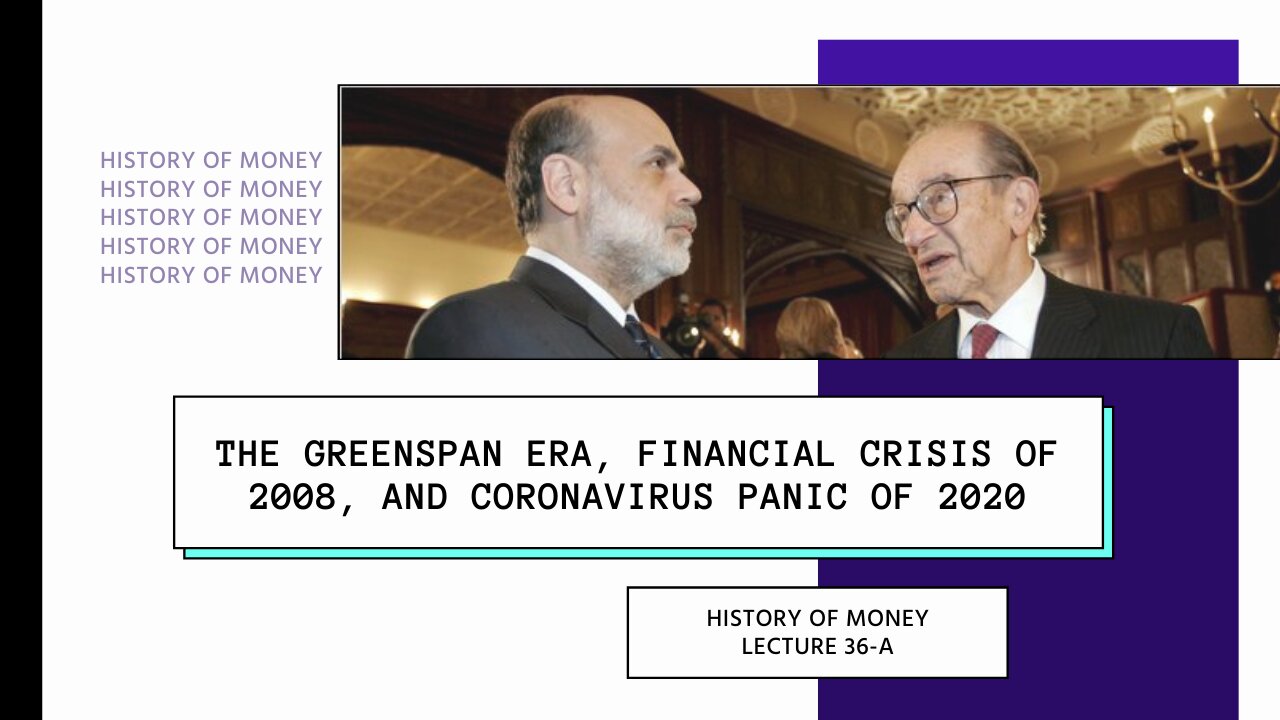

The Greenspan Era, Financial Crisis of 2008, and Coronavirus Panic of 2020 (HOM 36-B)

[Originally recorded and posted on YT in Dec. 2020]

History of Money, Lecture 36, Pt. B: overview of the Federal Reserve and monetary policy from the 1990s to the present day, including Alan Greenspan, the dot-com bubble, the repeal of Glass-Steagall, the housing bubble, Ben Bernanke, Janet Yellen, Jerome Powell, and the Fed's response to covid.

Timecodes

0:00 - Intro

0:16 - Alan Greenspan

8:59 - Dot-com Bubble

13:18 - Housing Bubble

16:56 - Ben Bernanke

18:58 - Financial Crisis of 2008

21:41 - TARP bailout

29:00 - Bernanke 2009-2014

35:22 - The Fed in 2014-2019

40:01 - Coronavirus Panic of 2020

_______________________________________

If enjoy this channel and would like to support:

https://patreon.com/professorbarth

Follow me on X:

https://twitter.com/Professor_Barth

Buy my book! The Currency of Empire: Money and Power in English America, released June 2021 with Cornell University Press. Order your copy now.

https://www.amazon.com/Currency-Empire-Seventeenth-Century-English-America/dp/1501755773/ref=tmm_pap_swatch_0?_encoding=UTF8&qid=1611158577&sr=8-1

_______________________________________

Dr. Jonathan Barth received his PhD in history from George Mason University in 2014. He specializes in the history of money and banking in the early modern period, with corollary interests in early modern politics, empire, culture, and ideas. Barth is Associate Professor of History at Arizona State University and Associate Director of the Center for American Institutions at Arizona State University.

_______________________________________

Visit my website https://www.professorbarth.com/

_______________________________________

Disclaimer: The views and opinions expressed on this channel are my own and do not reflect the views of Arizona State University, nor are any of the views endorsed by Arizona State University.

-

28:35

28:35

Professor Barth

4 months agoMy thoughts on the Trump tariffs

41 -

![[Ep 731] Trump Leading the World | Islam NOT Compatible with West | Guest Sam Anthony [your[NEWS](https://1a-1791.com/video/fww1/93/s8/1/c/n/K/a/cnKaz.0kob-small-Ep-731-Trump-Leading-the-Wo.jpg) LIVE

LIVE

The Nunn Report - w/ Dan Nunn

1 hour ago[Ep 731] Trump Leading the World | Islam NOT Compatible with West | Guest Sam Anthony [your[NEWS

151 watching -

2:05:30

2:05:30

Side Scrollers Podcast

5 hours agoEveryone Hates MrBeast + FBI Spends $140k on Pokemon + All Todays News | Side Scrollers Live

74.4K2 -

46:56

46:56

The White House

5 hours agoPress Secretary Karoline Leavitt Briefs Members of the Media, Aug. 19, 2025

43.5K56 -

1:11:36

1:11:36

Sean Unpaved

4 hours agoFootball Flashpoint: Bengals' D in Distress, Colts' Bet on Jones, & Micah's Trade Talks

34.5K2 -

LIVE

LIVE

The Robert Scott Bell Show

1 hour agoVaccine Lawsuits & Legal Fights, Autism–ADHD Link to Tylenol, MAHA Action, Caitlin Sinclair, Fat Jabs for Pets - The RSB Show 8-19-25

66 watching -

2:57:22

2:57:22

Right Side Broadcasting Network

7 hours agoLIVE REPLAY: White House Press Secretary Karoline Leavitt Holds a Press Briefing - 8/19/25

90.1K47 -

1:03:48

1:03:48

Timcast

4 hours agoGavin Newsom SURGES In Polls, COPIES Trump's Style

142K119 -

4:37

4:37

Michael Heaver

10 hours agoBusted France Faces UPRISING

23.9K5 -

10:45

10:45

Dr. Nick Zyrowski

1 day agoDoctors Got It Wrong! This Causes of Obesity - NOT Sugar

28.6K13