Premium Only Content

Ian Carroll explains GameStop and the Global Derivatives Debt Crisis

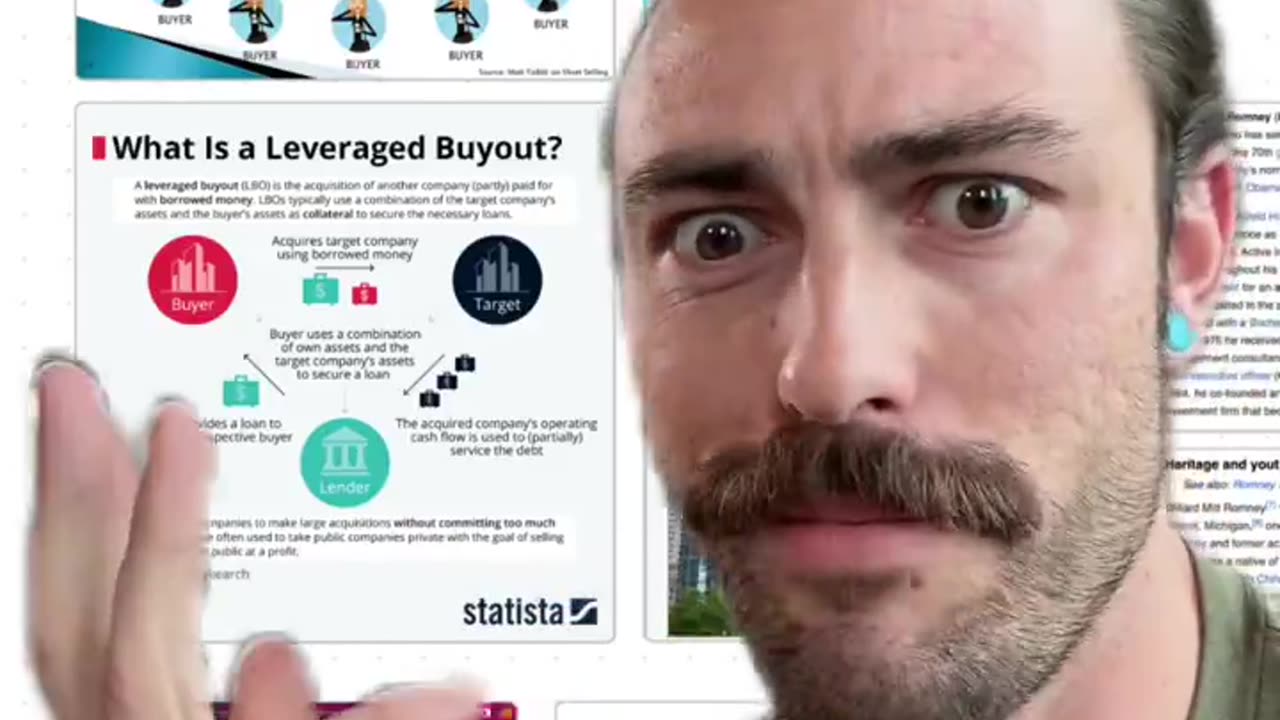

We have a colossal European and US debt crisis, a house of cards teetering on the verge of collapse and what can light the match? The meme stocks basket. Ian Carroll explains how this crack head's delight of global bankers and short hedge funds have been getting high sniffing on meme stocks to the detriment of all in the Western world. Global derivates debt could possibly exceed 4 quadrillion dollars! A debt no one can repay. [Who else benefits from all of these retail companies going bankrupt? AMAZON!!! Earlier in his career, Jeff Bezos worked at a Hedge Fund. "He then joined D. E. Shaw & Co, a newly created hedge fund with a strong emphasis on mathematical modelling from 1990 until 1994. Bezos became D. E. Shaw's fourth senior vice-president by age 30." -Wikipedia (follow the money)

-

1:31:12

1:31:12

"What Is Money?" Show

1 day agoBuy Bitcoin for Your Bloodline w/ Robert Breedlove (WiM589)

5.49K -

6:50

6:50

Dr. Nick Zyrowski

22 days agoApple Cider Vinegar Fasting Drink - Fasting Accelerator

5.77K2 -

1:07:48

1:07:48

Man in America

2 hours ago🚨 Plandemic 2.0: The July 4th Bioterror Plot & Palantir’s Master Plan w/ Dr. David Martin

16.7K12 -

1:43:07

1:43:07

Tucker Carlson

1 day agoBishop Barron on the New Pope, the Foolishness of Atheism, and Why Young Men Are Turning to Christ

190K199 -

3:24:07

3:24:07

Barry Cunningham

5 hours agoJD Vance And Marco Rubio Speak at American Compass Fifth Anniversary Gala | And More News!

50.1K25 -

2:52:45

2:52:45

TimcastIRL

4 hours agoTrump Admin ARRESTS Boulder Terrorists ENTIRE FAMILY, Preps Deportations | Timcast IRL

157K88 -

2:40:48

2:40:48

RiftTV/Slightly Offensive

6 hours agoBig, Beautiful SCAM? Elon FLIPS on Trump for WASTEFUL Bill | The Rift | Guests: Ed Szall + Matt Skow

42.8K12 -

LIVE

LIVE

SpartakusLIVE

5 hours agoSpecialist TOWER OF POWER || Duos w/ Rallied

559 watching -

3:24

3:24

Glenn Greenwald

5 hours agoPREVIEW: Sen. Rand Paul Interview Exclusively on Locals

84.8K51 -

VapinGamers

4 hours ago $0.05 earned⚔ 🔥 Blades of Fire - Game Review and Playthru - !game !rumbot #sponsored

30.6K4