Premium Only Content

May 16, 2024

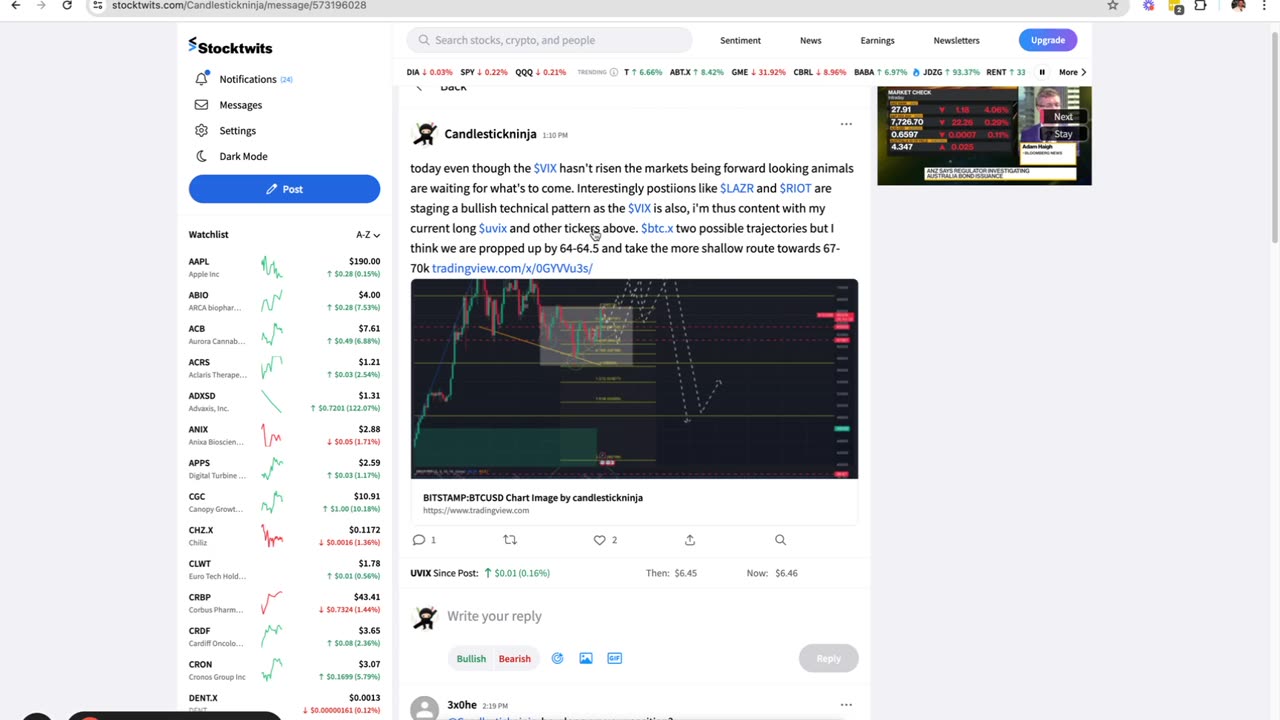

In this comprehensive update, we delve into the Bitcoin (BTCUSD) daily and weekly timeframes and show some key Fibonacci ratios and levels, support and resistance levels, bullish diamond formations, and the continuous story they speak over time. Candlestick Ninja stresses the importance of avoiding biases, recency biases, and ignoring higher-level timeframes and price action to avoid whipsaw as the next and last short-term leg up is within a very inflated Bitcoin, S&P500, and ultimately any global “risk on” or at-risk investment that’s directly correlated to stock indices.

The goal of this video is to look at three of the most important barometers in any trader’s utility belt: the S&P500 Index, its implied counterpart the VIX (Fear Index), and Bitcoin, which we consider the S&P500 of all things crypto. It’s crucial for any trader to know where we are in the overall higher-order wave patterns, because if you don’t know where you are, you definitely don’t know where you are going, and in turn, where your trading account or investments are headed.

This comprehensive analysis serves the dual purposes of showing you our carefully thought out trend bias and trading plan and also provides a tactical trade idea on ticker RIOT towards the end.

📈 Key Insights:

Bitcoin rallied towards $67,000 very quickly after our last prediction when we were below $62k.

We are now retracing and will most likely bounce at $63,000.

Our prediction: Bitcoin will rise towards $67,500, then $70,000 psychological level within 5 to 7 days.

Thus, we are neutral now and bullish at $63k on BTC, which probably happens by early morning or late night tonight!

📬 Disclaimer: For informational purposes only. Not financial advice. Trade at your own risk.

Handles:🥷

📈 TradingView: CandlestickNinja

🎥 TikTok: @candlestickninja

📘 Facebook: CandlestickNinja

🔗 Rumble: CandlestickNinjaTV

📬 Stocktwits: Candlestickninja

▶️ YouTube: CandlestickNinjaTV

💼 LinkedIn: CandlestickNinja (Coming Soon!)

#BitcoinAnalysis, #BTCUSD, #BitcoinOutlook, #CryptoAnalysis, #TechnicalAnalysis, #TA, #ShortTermTrends, #MarketAnalysis, #TradingPsychology, #RiskManagement #ta #iotstocks #riotgames #ewp #elliottwavetheory #cryptoanalysis #cryptonomics

-

8:07

8:07

WhaddoYouMeme

1 day ago $0.02 earnedBut His Response Left Them Speechless!

2.01K2 -

21:24

21:24

marcushouse

12 hours ago $0.17 earnedStarship Launches Won’t Be the Same After This! 🔥

4.69K9 -

9:20

9:20

SKAP ATTACK

1 day agoNikola Jokic Needs to GET OUT of Denver

2.35K6 -

12:56

12:56

Tactical Advisor

1 day agoTop 5 AR15 Upgrades You Didn't Know You Needed

7675 -

![Nintendo Switch It UP Saturdays with The Fellas: LIVE - Episode #14 [Mario Party Superstars]](https://1a-1791.com/video/fww1/e3/s8/1/f/D/x/B/fDxBy.0kob-small-Nintendo-Switch-It-UP-Satur.jpg) LIVE

LIVE

MoFio23!

9 hours agoNintendo Switch It UP Saturdays with The Fellas: LIVE - Episode #14 [Mario Party Superstars]

31 watching -

1:10:24

1:10:24

Keepslidin

4 hours ago30K START | UFC 314 | ROAD TO 100K | Mother.land

32 -

DVR

DVR

Spartan (Pro Halo esports Player)

4 hours agoPro Halo Scrims vs SSG!

381 -

LIVE

LIVE

blockysplashy

1 hour agoROAD TO HERESY ACT 1, 2 & 3 COMPLETION!+XUR IS HERE!😃

46 watching -

3:00:01

3:00:01

Barry Cunningham

7 hours agoPRESIDENT TRUMP FINISHES STRONG! THE WEEK IN REVIEW AND MORE NEWS

22.1K23 -

24:09

24:09

MYLUNCHBREAK CHANNEL PAGE

1 day agoDams Destroyed Egypt

37K54