Premium Only Content

How to not having to answer to the tax authorities by way of notice

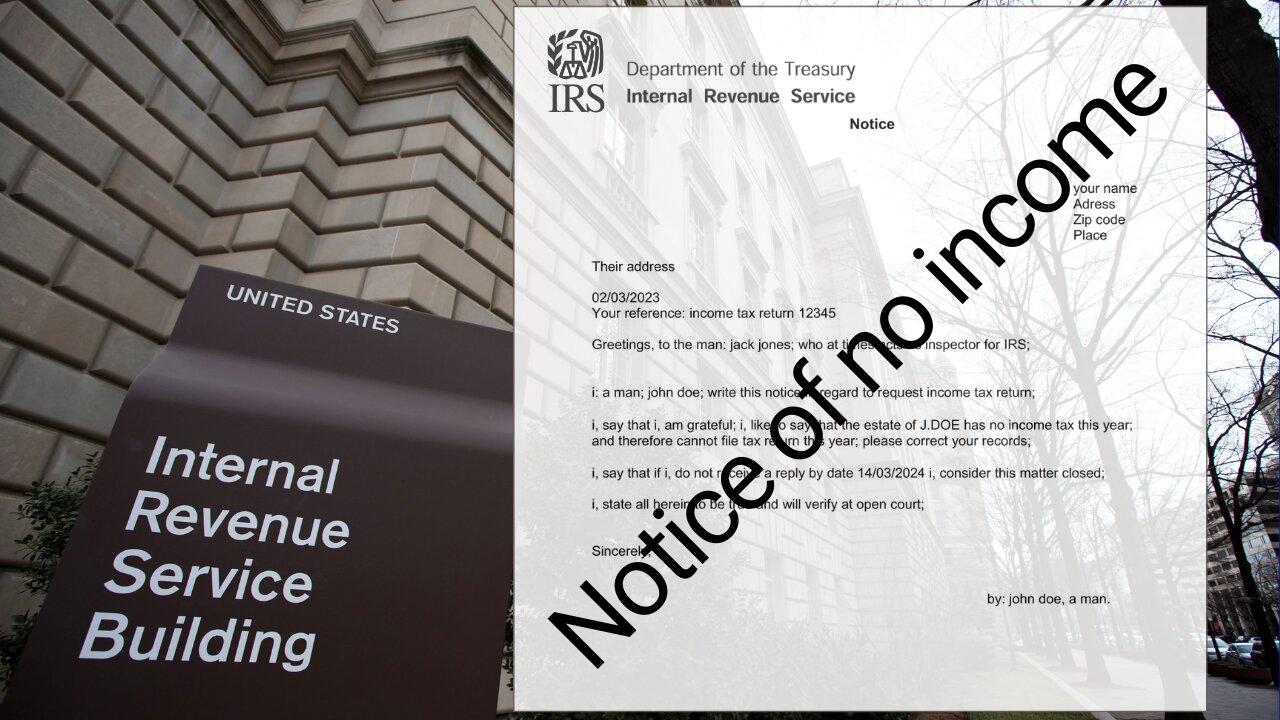

Part 5: Not having to answer to the tax authorities by way of notice

This is my last video of the 5 part video series. If you are working as a self-employed employee worker, this video can be really useful for you.

It is a different view on how to look towards the tax company.

"They don't tell you on what is created upon your birth. Being part of a society is largely seen as a privilege. However, if they were to fully disclose the concept of your personal token, your citizen token, and your estate (trust), people would start to perceive things differently.

Especially if people understood that if the ´estate´ established in (all caps your name) did not receive income, you can keep the money for yourself.In this video i will show you how to approach a notice of no income situation.

Disclaimer: To send such a notice, you need to operate fully in the private. This videoseries explains this concept.

If you wish to delve deeper into this knowledge and apply it in your life, you can connect with me through the website https://business-to-private.com/

By: Djordy Ritskes

-

4:33:40

4:33:40

FreshandFit

7 hours agoAfter Hours w/ Girls

219K94 -

2:33:36

2:33:36

Badlands Media

8 hours agoOnlyLands Ep. 21: From Trump’s VP Pick to Green Energy Grift

57.7K6 -

1:07:26

1:07:26

Inverted World Live

11 hours agoThe War Against Robots w/ Joe Allen

90.9K5 -

6:08:31

6:08:31

SpartakusLIVE

10 hours agoWARZONE NUKE IS BACK?! || Solo Challenge CHAMPION to start, duos w/ the Dawg later

92.1K1 -

1:00:18

1:00:18

Man in America

12 hours agoBig Pharma’s Empire of Lies Is COLLAPSING as People Turn to Natural Medicine

56K20 -

Drew Hernandez

14 hours agoGHISLAINE MAXWELL SAYS CLAIMS EPSTEIN WAS INTELLIGENCE ASSET ARE BULLSH*T?!

31.4K12 -

29:54

29:54

Afshin Rattansi's Going Underground

22 hours agoUkraine: Prof. Anatol Lieven SLAMS Europe’s ‘BLOODY STUPIDITY’ as Trump Negotiates with Putin

31K6 -

15:27

15:27

robbijan

1 day ago $2.45 earnedThe Emperor’s New Labubu & The Spiritual War Behind Everything

52.4K43 -

LIVE

LIVE

GritsGG

20 hours ago36 Hour Stream! Most Wins 3420+ 🧠

906 watching -

2:05:47

2:05:47

TimcastIRL

8 hours agoTrump FBI Raids John Bolton Amid Classified Docs Investigation | Timcast IRL

186K92