Premium Only Content

Unlocking Homeownership: Leveraging Your Side Hustle Income for a Mortgage

Welcome to the inaugural episode of Mortgage Matters, where we uncover the secrets to using your extra income to make your homeownership dreams a reality. Today, we're diving into the world of mortgages and how your side hustle can be your ticket to owning a home.

Episode Highlights:

• The Rise of Side Hustles: In today's dynamic economic landscape, traditional 9-to-5 jobs are no longer the sole path to financial stability. With the gig economy flourishing, many individuals are exploring side hustles to supplement their income and achieve their financial goals.

• Unlocking Homeownership: Discover how side hustle income can play a pivotal role in qualifying for a mortgage and fulfilling your dream of homeownership. Despite the challenges of non-traditional income sources, leveraging your side hustle earnings can make homeownership increasingly attainable.

• Key Considerations for Mortgage Approval: Explore the factors lenders assess when evaluating side hustle income in mortgage applications. From consistency and documentation to scalability and transparency, learn how to present your side hustle income effectively to strengthen your mortgage application.

• Impact on Debt-to-Income Ratio (DTI): Understand how including side hustle income in your DTI calculation can enhance your mortgage approval chances. Lowering your DTI through supplementary earnings demonstrates financial stability and increases your attractiveness as a borrower.

• Strategies for Creditworthiness: Discover practical ways to leverage your side hustle income to improve your creditworthiness. From debt repayment and emergency savings to timely payments and diversification of income streams, learn how to enhance your financial profile and secure better mortgage terms.

• Choosing the Right Lender: Explore the importance of selecting a lender like First Nation Financial Corporation, which understands the unique financial circumstances of borrowers relying on side hustle income. Discover how the right lender can support you on your journey to homeownership.

Key Takeaways:

• Side Hustle Significance: Side hustle income is increasingly recognized as a valuable asset in mortgage applications, allowing individuals to qualify for homeownership despite non-traditional income sources.

• Presenting Side Hustle Income: Transparency, consistency, documentation, and scalability are crucial factors when presenting side hustle income to lenders. Building a compelling case for your supplementary earnings can strengthen your mortgage application and increase your chances of approval.

• Impact on DTI: Including side hustle income in your DTI calculation can lower your debt-to-income ratio, making you a more attractive candidate for mortgage approval. Understanding and optimizing your DTI with supplementary earnings is essential for securing financing for your dream home.

• Strategies for Credit Improvement: Leveraging your side hustle income to repay debt, build emergency savings, make timely payments, and diversify income streams can significantly enhance your creditworthiness. These strategies demonstrate financial responsibility and increase your eligibility for favorable mortgage terms.

Links: https://www.fnfloan.com

-

6:08

6:08

Mortgage Matters

4 months agoHow a Houston Veteran Family Bought a Home With Zero Down Using a VA Loan

31 -

LIVE

LIVE

Law&Crime

2 hours ago $1.06 earnedLIVE: Adelson Matriarch Murder Trial — FL v. Donna Adelson — Day 9

336 watching -

LIVE

LIVE

The Big Mig™

1 hour agoCartels Are On Borrowed Time, Here Comes The BOOM!

4,838 watching -

LIVE

LIVE

Matt Kohrs

12 hours agoMASSIVE Market Swings Incoming! || Top Futures & Options Trading Show

517 watching -

LIVE

LIVE

Wendy Bell Radio

6 hours agoIt's All About the Benjamins

6,904 watching -

LIVE

LIVE

JuicyJohns

3 hours ago $2.89 earned🟢#1 REBIRTH PLAYER 10.2+ KD🟢

80 watching -

3:18:50

3:18:50

Times Now World

5 hours agoLIVE: NATO Chief Demands 5% of GDP for War Chest! Mark’s Bold Plan for Allies at IISS Prague Defence

20.2K3 -

15:54

15:54

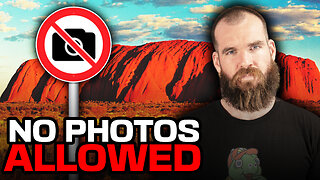

IsaacButterfield

6 hours ago $0.36 earnedAustralians BANNED from Taking Photos at Uluru

4.35K15 -

1:13:27

1:13:27

The Mike Schwartz Show

2 hours agoTHE MIKE SCHWARTZ SHOW with DR. MICHAEL J SCHWARTZ 09-04-2025

3.14K6 -

1:16:35

1:16:35

JULIE GREEN MINISTRIES

4 hours agoGOVERNMENTS AROUND THE WORLD ARE ABOUT TO COLLAPSE

81K158