Premium Only Content

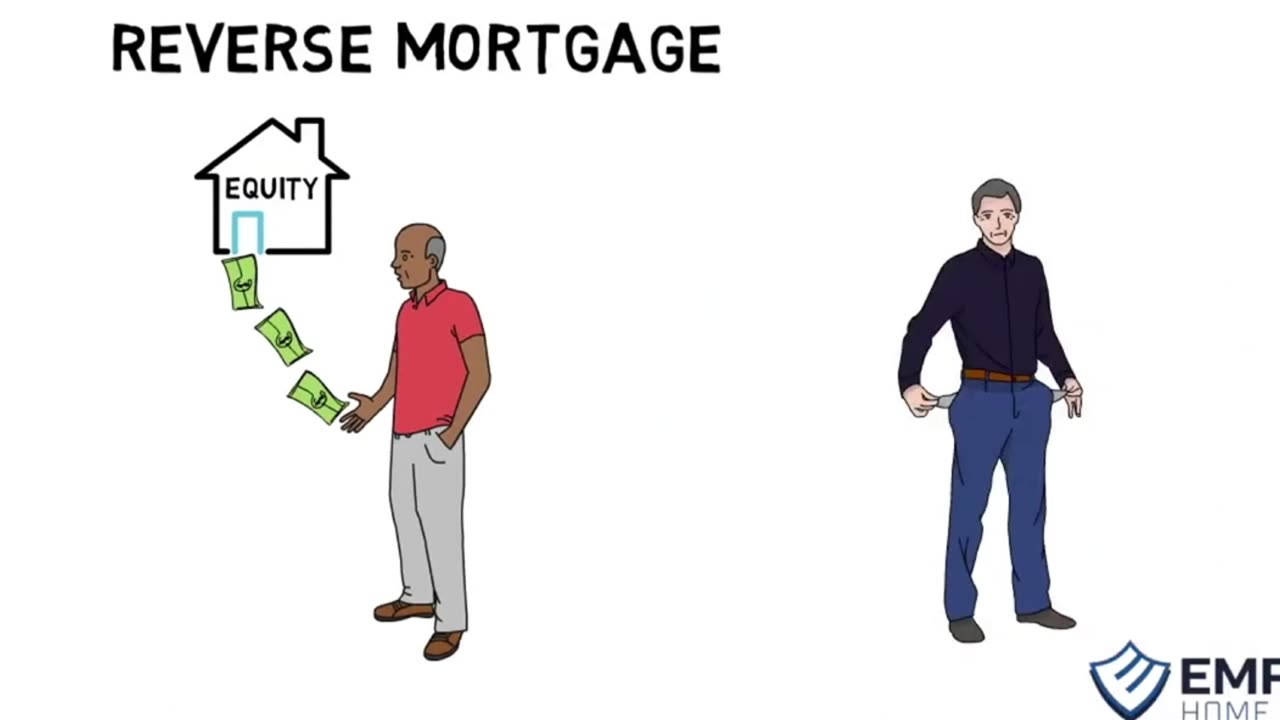

Facts and Fiction About Reverse Mortgages

Hey seniors, let’ss talk about reverse mortgages, a financial option tailored for folks aged 62 and older (55+ in California) who want to access the equity in their homes while still living there. But before making any important financial decisions, it's crucial to clear up some common misconceptions and understand the facts.

Fact: With reverse mortgages, homeowners can tap into their home equity and receive cash through various means, like a lump sum, monthly payments, or a line of credit.

Fiction: Some folks worry that taking out a reverse mortgage means giving up ownership of their home. But in reality, as long as they keep up with property taxes, homeowners insurance, and property maintenance, they retain ownership.

Fact: Unlike traditional mortgages, reverse mortgages don't require monthly payments. Instead, the loan balance grows over time and is typically repaid when the homeowner moves out, sells the home, or passes away.

Fiction: While there have been cases of abuse in the past, today's reverse mortgages are regulated by the government and have strict eligibility requirements. They're not scams or predatory loans.

Fact: Reverse mortgages can be a lifeline for retirees needing extra income or wanting to supplement their savings. The funds can cover various expenses, from paying off debt to home improvements.

Fiction: Some folks think reverse mortgages are only for those in financial trouble, but they can benefit financially stable homeowners looking to enhance their retirement lifestyle.

Fact: Keep in mind that reverse mortgages come with costs, like origination fees and closing costs. It's essential to understand these fees and how they affect the overall loan balance.

Fiction: Concerns about leaving a burden for heirs are common, but reverse mortgages are non-recourse loans. That means if the loan balance exceeds the home's value, the homeowner's estate isn't responsible for the difference.

In conclusion, reverse mortgages can be a valuable tool for eligible homeowners, but it's crucial to understand the facts and dispel any myths. By doing so, seniors can make informed decisions about whether a reverse mortgage fits their financial needs and goals.

-

0:47

0:47

Mortgage Broker Videos

9 days agoMoving Out Of State? Use This Road Map

8 -

5:16:01

5:16:01

MattMorseTV

7 hours ago $7.26 earned🔴CHILLING + TALKING🔴

87.1K3 -

2:04:23

2:04:23

The Charlie Kirk Show

4 hours agoTHOUGHTCRIME Ep. 99 — THOUGHTCRIME IRL

109K38 -

1:11:34

1:11:34

Flyover Conservatives

12 hours agoSilver Shortage ALERT: London Vaults Running Dry in 4 Months- Dr. Kirk Elliott; 3 Tips to Transform Your Business - Clay Clark | FOC Show

34.2K3 -

1:10:18

1:10:18

Glenn Greenwald

7 hours agoIsrael Pays Influencers $7,000 Per Post in Desperate Propaganda Push: With Journalist Nick Cleveland-Stout; How to "Drink Your Way Sober" With Author Katie Herzog | SYSTEM UPDATE #525

112K109 -

38:54

38:54

Donald Trump Jr.

10 hours agoDems' Meme Meltdown, Plus why California Fire Victims should be more Outraged than Ever | TRIGGERED Ep.279

127K94 -

2:15:18

2:15:18

megimu32

4 hours agoOn The Subject: Meg’s Birthday Bash! 🎂🎶

25.8K14 -

23:47

23:47

Jasmin Laine

8 hours agoALL HELL BREAKS LOOSE—Eby MELTS DOWN While Poilievre CORNERS Carney

20K16 -

LIVE

LIVE

SpartakusLIVE

6 hours agoNEW Black Ops 7 BETA || WZ too! And PUBG later?

176 watching -

1:00:02

1:00:02

BonginoReport

8 hours agoTerror Strikes Manchester Again - Nightly Scroll w/ Hayley Caronia (Ep.147)

89.5K56