Premium Only Content

Bank of America Advantage Plus Banking review 2023: fees, rates and requirements.

In the fast-paced world of banking, finding the right account to suit your needs can be a daunting task. Enter the Bank of America Advantage Plus Banking account—a comprehensive solution designed to streamline your financial management while offering competitive features. Let's delve into the details of this account to see if it's the right fit for you.

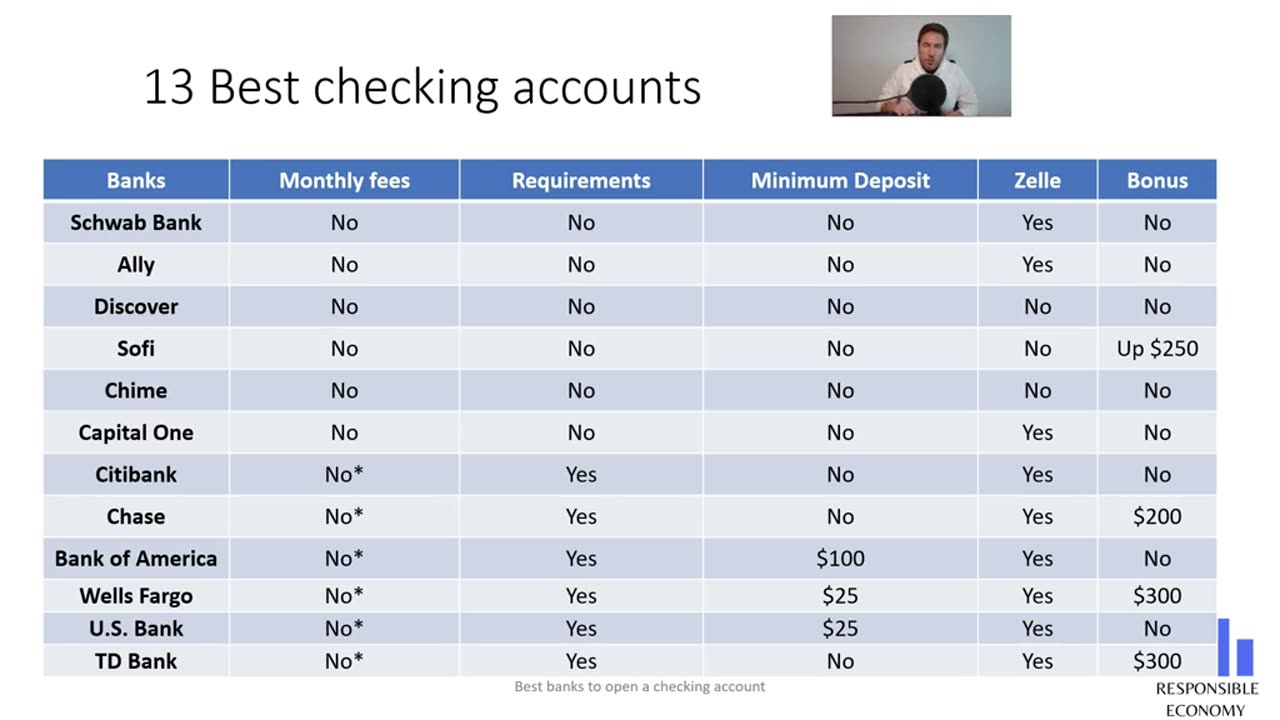

Fees: One of the key considerations for any banking account is its fee structure. With the Bank of America Advantage Plus Banking account, you'll find a transparent fee system aimed at minimizing unnecessary costs. While specific fees may vary depending on your location and account activity, you can typically expect a monthly maintenance fee. However, this fee can often be waived by meeting certain requirements, such as maintaining a minimum balance or setting up direct deposit.

Rates: When it comes to rates, the Bank of America Advantage Plus Banking account strives to offer competitive returns on your deposits. While interest rates may fluctuate over time, you can generally expect a modest return on your balances, helping your money work harder for you.

Requirements: To open a Bank of America Advantage Plus Banking account, you'll need to meet certain requirements set forth by the bank. These requirements may include providing personal identification, such as a driver's license or passport, as well as proof of address. Additionally, you may need to meet minimum age requirements and have a Social Security number or Taxpayer Identification Number.

Overall, the Bank of America Advantage Plus Banking account presents a compelling option for individuals seeking a reliable and feature-rich banking solution. With its transparent fee structure, competitive rates, and straightforward requirements, it's worth considering for those looking to streamline their financial management and maximize their banking experience.

-

2:21:40

2:21:40

FreshandFit

4 hours agoOF Bimbo Gets TRIGGERED Over Systemic Racism! HEATED DEBATE

63.4K51 -

2:03:03

2:03:03

Inverted World Live

9 hours agoPregnant Robots | Ep. 93

109K21 -

LIVE

LIVE

Akademiks

4 hours agoDrake vs Roc Nation! Tory Lanez argues for new Trial! Bloodhound Q50 dodged 60 shots.

2,125 watching -

1:58:16

1:58:16

Badlands Media

20 hours agoBaseless Conspiracies Ep. 146: GART Deadwood Highlights

72.8K20 -

4:55:43

4:55:43

Drew Hernandez

12 hours agoTRUMP SECURES SETTING MEET BETWEEN PUTIN & ZELENSKYY

19.8K9 -

5:06:26

5:06:26

SpartakusLIVE

8 hours agoSpartan HERO here to MOTIVATE the MASSES

53.2K2 -

1:27:19

1:27:19

Badlands Media

20 hours agoCulture of Change Ep. 117: DARPA, Downloads & the Roots of the Narrative

59.8K6 -

LIVE

LIVE

BubbaSZN

16 hours ago🔴 LIVE - MAFIATHON (COMPLETING THE MAFIA SERIES WITHOUT ENDING STREAM)

303 watching -

2:50:02

2:50:02

TimcastIRL

7 hours agoTrump Calls Putin During Zelenskyy White House Visit, European Leaders Praise Trump | Timcast IRL

188K62 -

1:54:34

1:54:34

FreshandFit

11 hours agoBrandon Carter Returns

51.2K6