Premium Only Content

Jonathan Williams: Iowa's Tax Triumphs

On this episode of ITR Live, we are joined by Jonathan Williams, ALEC’s Chief Economist and SVP of Policy. Jonathan is involved in educating state legislators on the principles of limited government, free markets, and federalism, and works with them to highlight conservative priorities that resonate with the public. Jonathan has been a key figure in promoting ideas for states to become more economically competitive.

Jonathan understands very well why Iowa's approach to tax policy has been touted as the "gold standard" not only for its strategic tax cuts but also for its comprehensive tax reforms. The trajectory that began with tax reductions has transitioned into a model of sustainable and equitable tax structures, propelling the state forward both in terms of economic health and investment attractiveness. Even beyond fiscal policy, Iowa has made strides in advancing educational initiatives, thus securing its position as a leader in conservative reform.

Iowa's competitive edge is sharpened by the ongoing contest not only among its peers in the Midwest but also on the wider national level. This competition drives states like Iowa to continuously refine and innovate their policies to stay ahead, a testament to the dynamic nature of America's federal system. Known as the "laboratories of democracy," states like Iowa lead by example, showing that lower tax rates, minimal government intervention, and free-market principles lead to significant socioeconomic benefits.

This state competition is core to driving policies that champion growth, ensuring that states remain attractive to business and talent alike. Iowa, through its series of successful reforms, has showcased that the race for economic excellence is an ongoing one, requiring constant vigilance and a willingness to embrace change.

Iowa's consideration of two taxpayer protection amendments marks another evolutionary step in how the state approaches fiscal governance. One proposal would require a two-thirds majority in both legislative houses for any increase in taxes, adding a layer of protection against sudden or poorly considered tax hikes. The other aims to constitutionally protect the state's move to a flat tax system, solidifying a long-term commitment to a policy that has demonstrated success in creating a thriving, stable economy.

Taxpayer protection legislation such as this reflects a broader movement within conservative circles to establish bulwarks against erratic fiscal policies that could disrupt economic growth and citizen well-being. These kinds of rigorous standards incentivize lawmakers to prioritize funding for essential services and to carefully evaluate the long-term ramifications of their budgetary decisions.

As the effects of the Tax Cuts and Jobs Act and current federal budget proposals continue to unfold, there exists an ongoing debate regarding the permanence and extension of various tax policies. The assumption that individual tax cuts will sunset as stipulated by the Senate can lead to substantial tax increases if no action is taken. This further underscores the need for vigilance and proactive measures at both the state and federal levels to maintain a tax environment conducive to growth and the well-being of citizens.

The principle of federalism underpins America's political system, dividing powers between national and state governments. Each state's autonomy to craft its own fiscal and regulatory strategies is a cornerstone of federalism that allows diversity and innovation in policy-making to thrive. This becomes particularly relevant when states defy blanket federal policies in favor of more localized solutions aimed at addressing specific regional challenges.

-

1:08:49

1:08:49

Kim Iversen

4 hours agoEpstein Island: What's With The Creepy Medical Chair and Masks?

41.2K33 -

23:54

23:54

Jasmin Laine

5 hours agoCarney’s WORST Day EVER—BOOED, Fact-Checked, and Forced to FLEE the House

24.6K17 -

1:59:47

1:59:47

Redacted News

5 hours agoDeep State Coup Coming for Trump? New JFK Files Released and NATO Preparing Attack on Russia

163K105 -

7:31:43

7:31:43

Dr Disrespect

10 hours ago🔴LIVE - DR DISRESPECT'S TRIPLE THREAT CHALLENGE - ARC RAIDERS • BF6 • FORTNITE

102K7 -

1:00:57

1:00:57

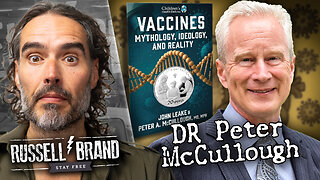

Russell Brand

7 hours agoThe Vaccine Ideology Unmasked | Dr Peter McCullough - SF658

128K39 -

1:11:25

1:11:25

vivafrei

6 hours agoKash Patel's Jacket-Gate! Pfizer Whistleblower Qui Tam on Appeal! Meanwhile in Canada! AND MORE!

70.4K45 -

16:30

16:30

Clintonjaws

10 hours ago $8.57 earnedEntire Room Speechless as Pete Hegseth Snaps Destroying All Media To Their Face

43.3K20 -

22:12

22:12

Dad Saves America

6 hours ago $1.04 earnedHow Greek Philosophers Created Western Civilization: The Death of Debate - Pt 2

22.5K3 -

LIVE

LIVE

LFA TV

22 hours agoLIVE & BREAKING NEWS! | WEDNESDAY 12/03/25

616 watching -

1:05:46

1:05:46

The Quartering

7 hours agoNew Epstein Video Drops! The US Economy Has SCARY Numbers Released & More

134K37