Premium Only Content

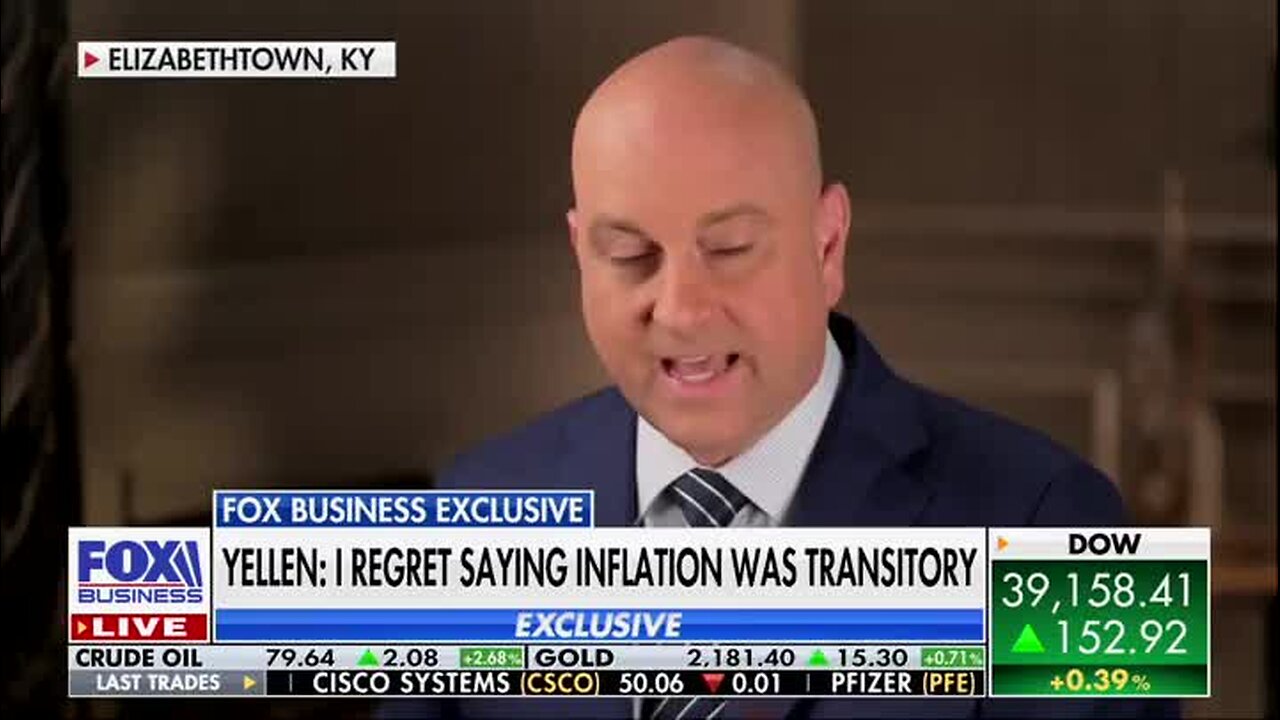

Yellen on Record Amounts of Credit Card Spending for Survival: ‘I See that as a Normalization than a Disturbing New Trend’

Lawrence: “Last year, many economists predicted a recession this year. We haven’t seen it. It looks like we may not see one this year. But consumer spending, record amounts of credit card in order to just survive for basic things, they can’t afford basic items, how long do you think this credit card debt accumulation can continue?”

Yellen: “Well, credit quality remains excellent, and charge-off rates, delinquencies have moved up slightly, but from historically low levels. Most households, even including the lowest income households, saw their overall financial position improve during the pandemic. Their average level of cash balances went up. Their overall finances improved. Now, over time, they have spent some of that buffer of savings, and particularly lower income households are borrowing again on credit cards. I see that as a normalization, rather than a disturbing new trend.”

Lawrence: “But it does seem like prices are higher than when President Biden came into office. What do you say to the family that’s having to use their credit card to pay for food or possibly could lose their home because of debt that they have accumulated with the higher prices?”

Yellen: “Well, I think the single most important metric to judge how households are doing is their spending power, their real wages or real earnings, namely their earnings adjusted for inflation. And the statistic that I think captures things best is, if we compare it where the median worker is now as compared to 2019, just before the pandemic, that worker can buy the same bundle of goods as before, with $1400 left over to save or spend, so wages have gone up considerably, and that’s more than offset, for the typical household, the impact of higher prices.”

-

0:06

0:06

Grabien

3 days agoDoug Emhoff: Kamala Did What Kamala Always Does, She Put Her Head Down and Went to Work

69 -

46:05

46:05

Candace Show Podcast

3 hours agoTrump Derangement Is Back And Better Than Ever! | Candace Ep 99

95.9K348 -

1:22:31

1:22:31

Dr. Drew

6 hours agoSalty Cracker: Trump Wins, The Left Immediately Makes Election Rigging Conspiracy Theories Great Again – Ask Dr. Drew

72.4K51 -

1:04:13

1:04:13

In The Litter Box w/ Jewels & Catturd

21 hours agoDumbfounded Democrats | In the Litter Box w/ Jewels & Catturd – Ep. 686 – 11/7/2024

85.5K42 -

1:25:15

1:25:15

FULL SEND PODCAST

5 hours agoBen Shapiro Predicts the 2024 Election Winner and Goes IN on Andrew Tate!

120K40 -

1:47:49

1:47:49

The Quartering

6 hours agoTrump Victory MELTDOWN Goes Nuclear!

145K43 -

1:40:49

1:40:49

SLS - Street League Skateboarding

10 days ago2024 SLS Sydney: Women’s Knockout Round

77.2K1 -

1:08:33

1:08:33

Savanah Hernandez

4 hours agoAmerica’s Golden Era Has Begun: Trump's Day 1 Policies

46.8K17 -

56:02

56:02

Uncommon Sense In Current Times

4 hours ago $1.63 earned"Are You a House Negro Or a Field Negro? A Faith Perspective on Freedom with Kevin McGary"

40.1K6 -

17:53

17:53

DeVory Darkins

7 hours agoThe View SELF-DESTRUCTS as Kamala CONCEDES Election

65.1K184